Dear Happy Investor, in this article you will find inspiration to the best low risk bond ETFs. Risk, in this form, manifests itself in lower price volatility. However, that is not to say that bond ETFs can realize a substantial price loss. At the time of writing, many of the best bond ETFs below stand at a price loss of -10 to -15% from its previous peak.

What do you mean safe?

Not without risk, in other words. But for the long term, getting in at lower price levels can be interesting. And so it is time to research the best bond ETFs with a lot of spread or high coupon rate.

On to sustainable (financial) success!

What is an (Corporate) Bond ETF?

A bond ETF is an investment vehicle that allows you to invest in bonds without having to buy individual bonds. Instead, you buy shares of the ETF, which represent a basket of bonds.

Bonds are debt obligations issued by corporations or governments. They are often used as a form of financing because they can be traded on secondary markets like stocks and they pay interest over time. Bond ETFs allow investors to diversify their portfolios by investing in a variety of different bonds at once, rather than having to do so individually.

Bond ETFs exist in a variety of flavours, but they are generally classified into four types: sovereign, corporate, municipal, and broad market.

Bond ETF risk and returns

Bond ETFs have low risk, but are not without risk.

For instance, the interest rate on bonds can change over time. This can affect the return of bond ETFs. As interest rates rise, the value of bonds fall and their performance decreases. This is because investors will be paying less for a bond whose coupon is higher than the current market rate.

The other major risk associated with bond ETFs is that they may not be able to find buyers when they want to sell their holdings. If there aren't enough buyers for a particular bond ETF's holdings, it may need to sell them at below-market prices in order to find a buyer—which means you could lose money if you invest in one of these funds.

They offer lower returns than other investment types, but they also have a lower risk of default. Bond ETFs also tend to be less volatile than other types of investments, which makes them a good choice for investors who cannot afford to lose money.

Overall, the benefits of holding a bond ETF outweigh these risks because they offer investors a low-risk way to gain exposure to different types of bonds without having to actively manage their investments.

However, it is true that in the long run, equities (ETFs) can offer higher returns. So the choice for bonds is not always obvious as far as we are concerned. Long-term investors who can withstand price volatility may be better off in the long run with a spread in higher-risk assets.

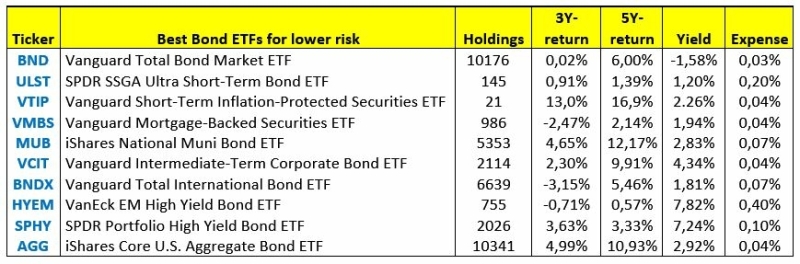

10x Best Bond ETFs for lower risk

We built this list of 10x best bond ETFs by looking at and comparing a few factors, including the expense ratio, P/E ratio, as well as the fund’s historical returns, and yield. The historical return says nothing about future returns, but it can provide an indication of price volatility.

the 3- and 5-year return are based on cumulative returns according the factsheets of the ETF in 2022

the 3- and 5-year return are based on cumulative returns according the factsheets of the ETF in 2022

This list of 10x best bond ETFs includes several funds. You can select based on holdings. Basically, a higher number of holdings indicates lower risk or at least less price volatility. On the other hand, it can sometimes be smarter to choose bond ETFs with fewer holdings, because with the right diversification, a higher yield or return can be realized.

Yield is the coupon rate. The annual percentage rate that is paid out. Usually in quarters or per month. The higher the yield, the more attractive it is for passive income. Although one should always take into account potential price drops. In such cases, it can be interesting to "buy the dip" as long as one maintains a long-term investment horizon.

The best bond ETFs with high coupon rates usually deliver little to no price return. And any alternative or complement to this could be a good dividend ETF.

Vanguard Total Bond Market ETF

The Vanguard Total Bond Market ETF is a good choice for investors looking to diversify their portfolios with fixed-income securities. It has a low expense ratio, at only 0.03%, which means that it's less expensive than other funds in its category. It also offers an average duration of 5 years, which makes it a relatively stable portfolio asset.

The Vanguard Total Bond Market ETF may not be the best option for investors who are looking for more aggressive growth and capital gains potential in their portfolios. The fund invests in a broad range of fixed income securities—including Treasuries, corporate bonds, and municipal bonds—which means that it won't offer much of an opportunity to gain from interest rate fluctuations or other market fluctuations that could impact individual bond prices over time.

The Vanguard Total Bond Market ETF don’t offer a competitive yield and has not performed well than its peers during both bull and bear markets over the past 3 years.

This tracker is among the best eToro ETFs.

SPDR SSGA Ultra Short-Term Bond ETF

The fund invests only in short-term bonds, which means that it doesn't have to worry about interest rates going up or down. This makes it a good choice for investors who want to protect their assets from rising interest rates, but don't want to take on the risk associated with long-term bonds.

The fund has performed well over the past five years, with an average annual return in positive. It has also outperformed its benchmark over this period, which shows that it has been able to outperform other similar funds as well as its benchmark index.

Because it invests only in short-term bonds, this fund can be volatile during periods when interest rates rise unexpectedly (for example, if there's an economic crisis). But because it also has low risk relative to other bond funds, this volatility can be more manageable than volatility in other types of investments like stocks or real estate.

VanEck EM High Yield Bond ETF

The VanEck EM High Yield Bond ETF offers investors a way to gain exposure to emerging market debt without having to buy individual bonds. The fund also provides diversification because it holds a variety of bonds from different issuers in different countries. The focus of this tracker provides inherently higher risk.

This product may be suitable for investors who are looking for a higher return than what they can get from bonds issued by developed countries, but without taking on the excessive risk associated with direct investment in equities or other riskier assets such as commodity futures or derivative contracts.

One drawback to this potentially best bond ETF is its high expense ratio of 0.4% per year. This is quite high for a bond ETF. On the other hand, it does make sense given the specific focus on high coupon rates. A strategy on high yield requires more effort. And in that perspective, the 0.4% is a small compensation, especially compared to investment companies that manage the assets for you. With this product, you can do the same thing. And quite a bit cheaper.

iShares Core U.S. Aggregate Bond ETF

The iShares Core U.S. Aggregate Bond ETF is a low-cost fund that provides exposure to a broad range of fixed income securities in the US. The iShares Core U.S. Aggregate Bond ETF is an investment in a basket of short- and long-term US government, corporate, and mortgage-backed bonds that has a low expense ratio.

It is an ideal investment for investors who want to diversify their portfolios with a single security, rather than multiple securities.

The iShares Core U.S. Aggregate Bond ETF has a low expense ratio of 0.04% per year, which makes it one of the lowest-priced options on the market today.

The iShares Core U.S. Aggregate Bond ETF has very low volatility, making it a good choice for investors who are looking for low risk but still want exposure to fixed income markets.

The fund only invests in US bonds, so if you want to invest in international bonds, this isn't a good option for you.

Vanguard Short-Term Inflation-Protected Securities ETF

The Vanguard Short-Term Inflation-Protected Securities ETF is a well-known investment option for investors. The purpose of the ETF is to provide investors with a way to protect their investments from rising inflation while still receiving interest income. If you are looking for a way to protect your portfolio from inflation without sacrificing return, this may be an interesting consideration.

The Vanguard Short-Term Inflation-Protected Securities ETF has a low expense ratio of 0.04% per year, making it one of the more affordable options on the market today. But this potentially best bond ETF has relatively high volatility. Keep in mind larger ups and downs in the fund's price over time.

Another aspect is that sector diversification is not as good. The potentially best bond ETFs above offer more risk diversification in that perspective. Nevertheless, this tracker goes for a certain focus.

Where to buy ETFs?

It is important to choose the best investment platforms. They offer a wide range of ETFs so that you can build a good portfolio. They also have low transaction costs. Some even offer commission-free investing. In the long run, this saves a lot of costs.

![10x Best Bond ETFs voor Low Risk Investing [2022]](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/best-bond-etfs-2560x1100.png)