Dear Happy Investor, the best energy ETFs have performed particularly strongly in recent years. First, there was a huge boom in clean energy stocks. This momentum weakened and then energy ETFs focused on oil & gas exploded. Interesting developments driven by macroeconomic conditions. In this review, I aim to provide an overview of the best energy trackers. This is a mix of clean energy and investment funds focused on oil & gas. There are also different tactics available, for both the short- and long-term investor.

On to sustainable (financial) success!

Table of Contents

The Best Energy ETFs: Oil & Gas vs. Clean Energy

In researching the best energy ETFs for short- and long-term returns, there is a clear distinction between oil & gas vs. clean energy. In recent years, clean energy ETFs have performed the best. But after the covid-19 crisis, oil & gas energy ETFs are performing phenomenally.

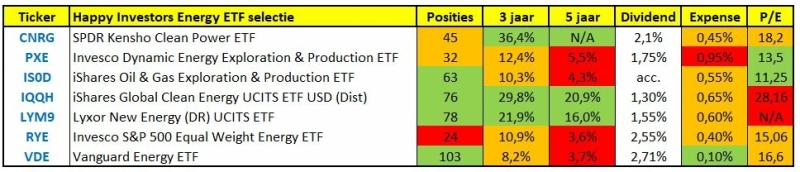

Here's an overview of the best energy ETFs:

Source: Happy Investors

Source: Happy Investors

Looking at the annual performance of 2021 and 2022, it is to be expected that oil & gas are among the best energy ETFs. This sector has strong momentum. Therefore, it stands at number 1 among the Zacks ranking for best sector on EPS revision. Moreover, oil & gas companies are also expected to see a sharp increase in earnings in 2022.

For the short term, I expect PXE and IS0D to be the best energy ETFs. They are expected to give the highest returns in 2022 because the current financial valuation is favorable and the market is counting on strong earnings growth.

However, in the long term, I do not believe they are a sustainable investment. Oil and gas are desperately needed right now. And probably still will be in 3 years. But if we really want to be forward-looking investors, my personal preference would be for the best clean energy ETFs.

All mentioned ETFs are available through brokers such as Freedom24

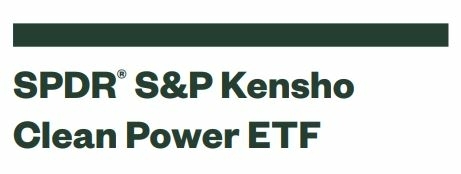

Best Energy ETF: SPDR Kensho Clean Power

The SPDR Kensho Clean Power ETF (CNRG) is among the potentially best energy ETF for the long term. It is a relatively new fund. Unfortunately, it is not available through DEGIRO/BUX/eToro. However, it is available through Mexem, Freedom24 or Interactive Brokers.

The tracker focuses on innovative companies that enable clean energy. In its TOP 10 holdings there are not only the standard companies. This makes the fund more unique, which can lead to higher than average returns. Also, it tracks only 45 positions, which is a risk, but on the other hand it can lead to higher returns.

![]()

Source: iShares CNRG factsheet

The TOP 10 holdings contain about 30% of the total. This is beneficial as it gives a more proportionate spread across all positions. In terms of geographic distribution, 75% is U.S.-listed. Then another 9% in Canada and 9% in China.

The annualized return for the past 3 years was 36.4% (!) on average. However, the 2021 return was about -17%. And if we look at weighted averages such as financial valuation, it seems that CNRG can achieve attractive returns in both the short and long term.

Source: iShares CNRG factsheet

Best Energy ETF: Invesco Dynamic Energy Exploration & Production

Invesco Dynamic Energy Exploration & Production ETF may be the best energy ETF for 2022. The fund is exploding. In 2021, the return was a whopping 90%! Bizarre. And in 2022, the return is already at 34% YTD.

However, PXE is a risky fund. The number of positions is limited to ±30 companies. Moreover, there is no geographic spread, as 97% U.S. is publicly traded. Also, the fund is expensive with 0.95% annual expenses (expense ratio).

![]()

Source: Invesco PXE factsheet

PXE as an investment fund is focused on oil & gas. Given its characteristics and focus on fossil fuels, this energy tracker seems only suitable as a short-term investment. Despite the recent price explosion, early 2022 still seems to be an acceptable entry point. The current financial valuation (weighted average) is on the cheap side. And given the strong price increases in oil and gas, earnings growth is likely to continue in 2022.

Both best energy ETF PXE and CNRG can be purchased through larger brokers such as Freedom24.

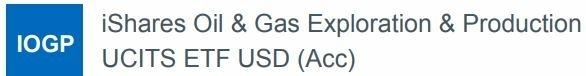

Best Energy ETF: iShares Oil & Gas Exploration & Production

The iShares Oil & Gas Exploration & Production ETF, under ticker IS0D and IOGP at DEGIRO, is currently among the best energy ETFs for oil. Note, however, that this is a short-term event. After all, the fund is still at -7% since inception (2011). In the covid-19 crash, it was even -74%. Therefore, think carefully about what kind of investment funds you invest in. Ideally, you should choose themes with great future potential.

Anyhow, in the short term IS0D/IOGP performs extremely well. Besides the lack of long-term perspective, there is also a risk in terms of the number of positions. The tracker follows about 60 companies. The TOP 10 holdings have a weighting of 65%. The spread is therefore disproportionate. There is also little geographic diversification, with 66% and 20% stocks from the U.S. and Canada, respectively.

![]()

Source: iShares IOGP fact sheet

Best Energy ETF: Invesco S&P 500 Equal Weight Energy

![]()

The Invesco S&P 500 Equal Weight Energy ETF (RYE) focuses purely on energy companies within the S&P 500. And, as the name implies, the tracker assigns a proportional distribution across all positions. There are only ±20 of these, by the way. One advantage to investing in the S&P 500, is that these companies must meet some guidelines to be included in the S&P 500. One is that they must be profitable for consecutive quarters. This somewhat lowers the risk.

RYE is among the best energy ETFs based on returns. But in my opinion, it is not the best choice as a tracker of energy companies. For example, its TOP 10 holdings are almost identical to the PXE (see above). However, the PXE performs better on returns and offers a bit more risk diversification in terms of number of positions. It is also true that PXE seems to have a more favorable financial valuation (weighted average of (future) P/E and P/B ratio).

On the other hand, RYE has a lower expense ratio of 0.4%. Other than the lower cost, I see no reason to choose this tracker.

![]()

Source: Invesco RYE fact sheet

Best Energy ETF: Vanguard Energy ETF

The last of the best energy ETFs is the Vanguard Energy ETF (VDE). One advantage to all Vanguard Exchange-Traded funds is that they have a low expense ratio. In the case of VDE, this is only 0.1%. In the long run, this leads to a significantly higher net return, even when it may perform (slightly) less well than comparable yet expensive investment funds.

Another advantage to Vanguard trackers is that they usually offer a lot of risk diversification. After all, this was the philosophy of John Bogle, the founder of Vanguard. He believed that the average investor would not be able to beat the market. That's why he focused on keeping costs as low as possible.

The VDE is among the best energy ETFs because of its diversification and low cost. In terms of returns, the VDE does not seem to be an interesting long-term investment, as the current positions are mainly focused on oil companies. It is striking that, despite the many positions, the TOP 10 holdings have a total weight of 66.7%. As much as 37% (!) is allocated to the two largest positions. It is true, however, that these companies are likely to rise sharply in the near term because of the momentum of oil.

There are significantly better Vanguard ETFs than the VDE (for long-term investors).

![]() source: vanguard factsheet VDE

source: vanguard factsheet VDE

How can I best invest in energy investment funds?

Energy is a sector. Energy investment funds, therefore, belong to theme ETFs. I also consider energy to be a form of commodities/raw materials. Oil and gas are good examples.

In general, theme ETFs tend to be short- to medium-term investments. This is not always the case, by the way, as with technology ETFs. But in the case of energy, this is more the case. And especially in the case of oil & gas concentrated investment funds. After all, commodities have a cyclical movement. Now oil was somewhat consistent, but for natural gas it is not. So an energy ETF for natural gas can fall for years, only to double or even triple in a year.

Cyclical movement is one of the most important characteristics of investing in commodities.

Another important feature is the low correlation with other types of stocks. For example, we have recently seen technology stocks fall hard, while oil & gas stocks explode (figuratively...). In short, investing in the best energy ETFs is a diversified addition to your portfolio, but cyclical movements must be taken into account. Also, oil & gas have a less attractive long-term outlook. For clean energy ETFs, that's a different story.

So: how best to invest in these energy investment funds?

For energy ETFs focused on oil & gas in particular, short-term trading would be my preference. Right now, for the time being, it looks like it could be a good entry point. Hold for 6 to 24 months, and sell based on the financial valuation. Does the future financial valuation (P/E, P/B, Growth, Earnings, etc.) become less favorable? Then sell in time.

For the best energy ETFs focused on clean energy, long-term trading is my preference. The strategy to do so depends on your preference. You can choose to invest 100% now, or go for a more metered tactic.

Questions or comments for the best energy ETFs? Ask them in the comments below.

![Best Energy ETF: 7 Energy Investment Funds [2022]](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/best-energy-etf-2560x1100.png)

![8x Best ETFs eToro to Buy [2022] Higher Yield, Lower Risk](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/responsive/5981219/best-etf-etoro-2560x1100_734_315.png)

![What is the best thing to invest in? Stocks to Crypto [2022]](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/responsive/5849118/what-is-the-best-thing-to-invest-in-2560x1100_614_264.png)