Dear Happy Investor, Investing in Exchange Traded Fund (ETF) is the best choice for the average investor. It's a hard truth that not everyone wants to hear. Perhaps you think you can present better than the market average in the long run by investing in individual stocks. And in principle, you're right. But for the average retail investor who understands less about financial and strategic business analysis, it makes more sense to invest in the best ETFs.

For example, the best ETFs of 2022 delivered average annual returns above 20%. For the long term, this may be as high as 10 to 12% at the latest.

What will the next ten years bring us? No one knows for sure. Below are my personal views on these best Exchange Traded Funds for 2022 and long term. Please note the long-term investing of ideally > 15 years.

Let money work for you!

10x Best ETFs for 2022 and long term (summary)

The best Exchange Traded Funds for 2022 listed:

- WisdomTree Cloud Computing UCITS ETF

- ARK's two best ETFs (high risk).

- WisdomTree Battery Solutions UCITS ETF

- VanEck Vectors Video Gaming and eSports UCITS ETF

- Best Technology ETFs: QQQ vs. VGT vs. BST (+30.6% return p.y.)

- S&P 500 (Dividend) Exchange Traded Fund

- CHIQ vs. IEMG

- Vanguard Total Stock Market Index vs. Vanguard FTSE All-World UCITS ETF

- Schwab U.S. Dividend Equity ETF

- Crypto Tracker? (very high risk)

Below we look at the details for each tracker. They are very different investments in terms of risk. Read carefully to make the right choice. Some are also vey suitable for young investing.

Tip: Specifically for 2022, it is smart to choose value and dividends. I am very enamored with Schwab U.S. Dividend Equity ETF. See #9 for full details, this is one of the best dividend trackers for Value + Dividend. This ETF (and more) can be bought commission-free via eToro. Click here to create an account for free.

Update January 2022: as to be expected, high-risk ETFs with growth stocks are dropping. Think WisdomTree Cloud Computing, QQQ and the extreme ARK ETFs. Is this a good entry point? Personally, I'm holding off on buying and continuing to allocate my money in Value + Dividend for now

Read on to find out why these are the best Exchange Traded Funds of 2022. Please note that this is not a buy recommendation nor personal investment advice. Please consult an investment advisor for this.

Tip: always read the essential investor information of ETFs before investing in them. This describes what and how high the risks are. After all, investing involves risk and money loss. Be wise, and choose optimal diversification.

Best ETF 2022 #1: WisdomTree Cloud Computing UCITS ETF

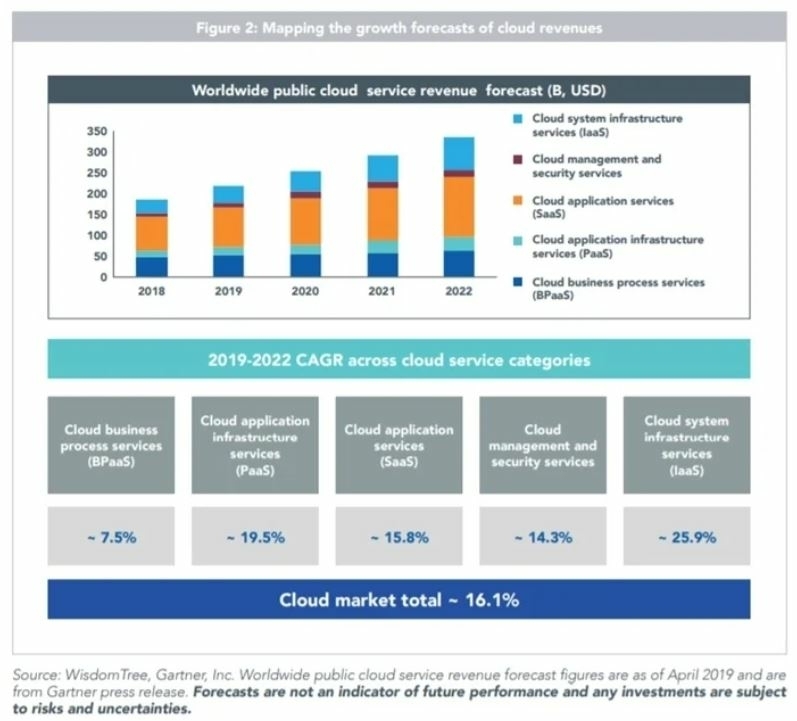

The Cloud Computing industry is booming! More and more companies are moving to the cloud. It is estimated that 50% of all companies will be working in the cloud by 2025. And by 2030, it will be as high as 80%. The growth potential of this industry is truly gigantic. For example, Figure 2 from WisdomTree's Cloud Computing article shows that this market is growing at about 16% annually. This may be the best ETFs for the long term. Not so much because it is expected to realize huge growth in the short term. But mainly because the WisdomTree Cloud Computing is a good long-term investment.

Before 2022, this ETF may temporarily underperform. The stocks are heavily valued. That is why they are falling hard right now, as seen with Asana, Docusign and many other cloud stocks. But let this just give the opportunity for buy the dip. The tip: let this best ETF still fall in 2022, and wait for the momentum to improve.

One of my favorite stocks within the Cloud industry is Adobe. Adobe is characteristic of the unique advantages that earning model brings in the Cloud business. For example, profitability in terms of margin (%) is very high. The revenue model is usually based on membership. Customers do not pay a large sum of money. Instead, they can purchase a subscription at a lower, monthly rate. This revenue model leads to companies becoming more profitable, as each new customer brings in more money (the longer they stay a member, the more money they bring in). Besides Adobe, you also have well-known cloud companies such as IBM, Amazon Web Services, Microsoft Azure, et cetera.

The WisdomTree Cloud Computing ETF contains over 54 growth stocks within the Cloud industry.

Update January 2022: the ETF is now falling very hard because of the correction of growth stocks. The top 10 has changed, see fact sheet. Investing now with a monthly fee can be interesting for the long term. Do not go all-in, take into account further price decline.

Best ETFs #2. ARK's two best trackers high risk/yield

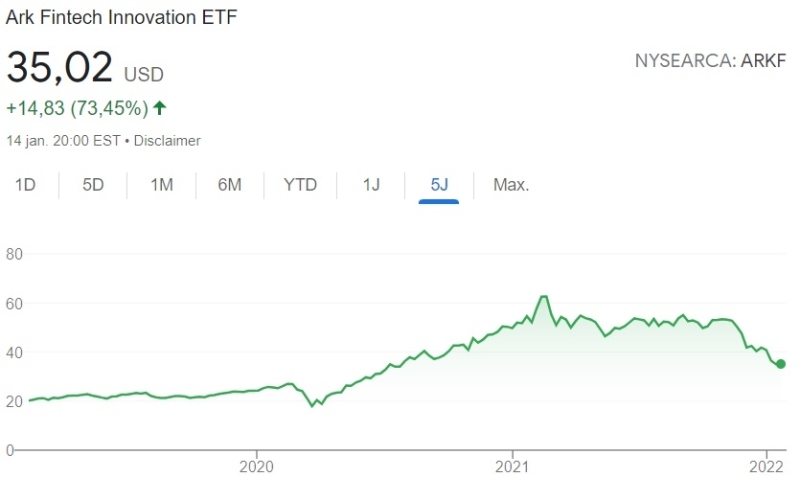

As an investor in technology stocks, you will no doubt have heard of ARK. Cathie Wood is the founder of ARK and has been hailed as a visionary in recent years. She owes this to investing early in unique companies, including Tesla when it was down 50%. Contemporary, ARK's best ETFs do carry considerable risk, as the companies in the trackers are significantly overvalued. For example, the tracker ARKW has a P/E ratio of 118 (and that is bizarrely high).

Whether these trackers will also be successful in the long run depends on Cathie Wood and her team. Right now, the P/E ratio is so high that a 30% correction is plausible. On the other hand, as in recent years, she may be right and ETFs will give high returns. After all, beat the market is done by trading against market expectations.

My personal (subjective) opinion is that the downside risk is currently higher than the upside potential. Patience can be a virtue, and if a correction occurs buy the dip could provide an above average return.

Update Jan. 2022: the ARK trackers have performed very poorly in 2021. Currently, the trackers are falling hard. This is according to the estimate above. In my opinion, this decline may continue even now, but the entry point becomes more attractive. Yes, there are reasons for concern with ARK ETFs, such as high valuations, inflation and negative impact if interest rates increase. On the other hand, a decline means we can get in lower when the market is anxious. Be cautious, limit the deposit to e.g. max 5% per tracker, and position yourself for potentially higher returns.

The ETFs of ARK can not be purchased commission-free at eToro. Click here to create an account for free.

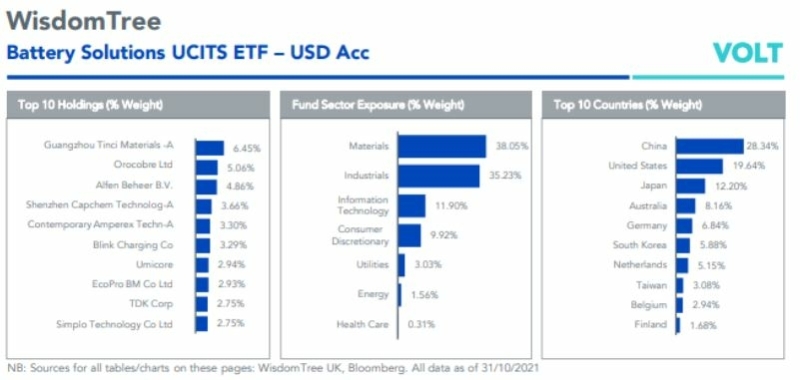

Best ETF #3: WisdomTree Battery Solutions UCITS ETF

Among the best long-term ETFs is another ETF from WisdomTree. This is the WisdomTree Battery Solutions UCITS ETF. The name says it all; this ETF has a focus on battery. The demand for battery is increasing more and more. The world is moving more and more to electricity. This is, for now, the strongest transition when it comes to a more sustainable world. By transition, I mean the transition from fossil fuels to renewable energy (electricity) generated by wind and solar power. Now there are ETFs like the iShares Global Clean Energy (ICLN) and the Invesco Solar (TAN). These ETFs include companies focused on renewable energy. At the time of writing, these could be interesting stocks for additional diversification.

However, I believe that the best ETF for renewable energy is WisdomTree Battery Solutions. It is not that these are very sustainable companies. It is mainly a company that is focused on growth within the battery sector. The battery is necessary for storing electricity, and Wisdomtree's Exchange Traded Fund plays into that. In total, this best ETF of 2022 contains more than 94 stocks. Learn more about this ETF in the fact sheet.

Best ETF #4: VanEck Vectors Video Gaming and eSports UCITS ETF

The video gaming and esports industry has been growing for years. Especially in Asian countries, there are large events where more than 60,000 people come to watch a gaming tournament. Perhaps you can't imagine this. Why watch other people gaming? Apparently there is a huge demand for this relatively new market. This is also the case in Western countries, for example with the video-gaming platform Twitch. Whether or not you have an affinity with this, it should not matter to an investor. An investor should look objectively at where the money is flowing. Investing in the best ETFs means looking at increasing demand that leads to higher sales and usually higher profits for that industry.

VanEck Vectors Video Gaming and eSports UCITS ETF definitely belongs to the list of best ETFs. This ETF focuses entirely on the growing gaming industry. Note that this is a risky ETF that has a narrow focus. If the video gaming industry collapses, this ETF will also collapse. Therefore, always read the essential investor information before investing in ETFs. In addition, there are only 25 stocks in it, which is relatively few for an ETF. However, there are also many advantages to this Exchange Traded Fund. After all, it allows you to invest directly in the growing gaming industry with a single purchase. There are also major companies in the ETF, such as Nvidia, Tencent and Sea ltd. Nvidia in particular is a unique growth stock that focuses on artificial intelligence through chips and the like in addition to the gaming industry.

Tip: The relatively new VanEck Vectors Semiconductor ETF is also interesting for long-term investors. Note that this tracker is still relatively small and contains only 25 positions. High potential returns, but also higher risk.

Best Technology ETFs #5: QQQ vs. VGT vs. BST

Perhaps the most popular and the best ETF for innovative stocks, is the Invesco QQQ Trust Series 1 ETF. By now, this fund contains over 140 billion (!) in market capitalization. Thanks to this ETF, you can simply and easily invest in the 100 largest non-financial companies that have a high degree of innovation. Also, this best ETF has been voted by Lipper as the top 1% best performing ETFs for 15 years in a row. Thus, since its inception, this ETF has achieved an average annual return of approximately 8.8%. Over the past 10 years (2010 - 2020), it has averaged +22%. And over the past 5 years (2015 - 2020), this was even +25%. That is really ridiculously high!

+25% return per year, and yet QQQ is not the best technology ETF of 2022.

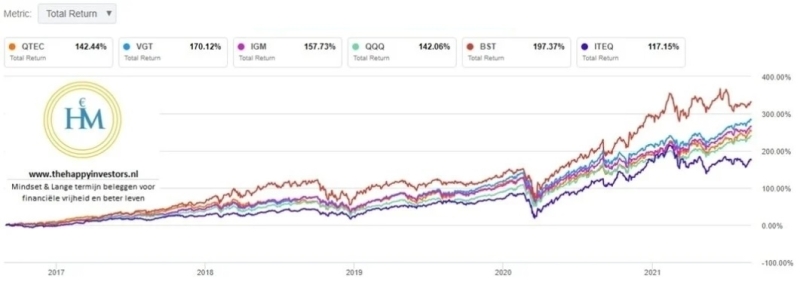

Two better technology ETFs are Vanguard Information Technology (VGT) and BlackRock Science and Technology Trust (BST) (this is a CEF). The chart shows this:

Source: Happy Investors research with a tool from SeekingAlpha

The VGT has delivered an average annual return of 30.6% (!) over the past 5 years. Since inception 2004, the average has been 13.57%. It is possible that with such an ETF we can expect returns of around 10 - 12% over the next 20 years. You can buy the VGT for free through this broker.

The BST is doing even better. I'm cheating here, though. It is not an ETF, but a CEF. This stands for Closed End Fund. This is a type of mutual fund, where management is more active in buying and selling shares within the CEF. So this is slightly different from an ETF, where only the price is followed (tracker).

In terms of returns, BST is dominant over the past five years: 32.87%. And you should know that this CEF also pays a high dividend of about 4.5%. That brings the total return in 5 years to 314%! I have no crystal ball, but the BST can be a very excellent investment. Possibly better than QQQ and VGT.

Note that QQQ and VGT have a disproportionately heavy distribution over the top 10 (more than 50%). This implies higher risk. BST has a more proportionate distribution.

Best ETFs #6: S&P 500 Dividend Exchange Traded Fund

As a result of the covid-19 health care crisis, non-technology companies have fallen dramatically in valuation. This category includes some large dividend-paying companies. One of the best ETFs for 2022 will be those in dividends. Indeed, these large companies with strong brand names will start to recover in both the short and long term. I am talking about companies like Coca Cola, Walt Disney Company, et cetera. Currently, the market value of such traditional companies is still relatively low. This means that the chance for a price increase is greater than a price decrease. After all, cheap companies can sometimes be more attractive than expensive ones (the market is not always rational unfortunately 😉 ).

Among the best 2022 ETFs for S&P 500 dividends are:

- iShares Core S&P 500 UCITS ETF

- Vanguard S&P 500 UCITS ETF

- SPDR Portfolio S&P 500 High Dividend ETF

A major benefit of dividends is that they can act as income. Many therefore refer to dividend stocks as a source of passive income . Not only because dividend stocks are relatively less volatile, but especially because they pay dividends every quarter. This means that every quarter you get a fixed amount of money paid into your investment account. Many people attach more value to this than a mere price increase. That is why Exchange Traded Funds that pay dividends can be a nice addition to your investment portfolio.

Best ETFs 2022 #7: Global X MSCI China Consumer Discretionary ETF (CHIQ)

The 5 ETFs above are primarily concentrated on United States stocks. As a matter of diversification, it is wise to invest outside of the United States as well. While it is true that many of these stocks operate globally, it does create geographic risk. To reduce this risk, you can opt for a bit more geographic diversification. You can do this by investing in both European and Asian companies. In Europe, you have ETFs like the Euro Stoxx 50 and Euro Stoxx 600, which hold the 50 and 600 largest publicly traded companies from Europe, respectively.

One of the best ETFs could be the Global X MSCI China Consumer Discretionary ETF (CHIQ). This Exchange Traded Fund allows you to invest directly in over 70 Chinese listed companies.

Be aware of the momentum, though. The Chinese tracker is now falling very sharply, partly because of panic in the market and concerns about Chinese politics. This can be a great opportunity, but it is usually smarter to wait until the momentum is better. In other words: follow the big money.

Also, the iShares Core MSCI Emerging Markets (IEMG) could be one of the best long-term ETFs to complement. This tracker has given a total return of 92% over the past five years. The spread covers 2676 stocks in Emerging Markets. And the annual dividend is about 1.77%.

The IEMG offers more diversification and therefore lower risk than the CHIQ.

Best ETFs 2022 #8: Vanguard Total Stock Market Index vs. Vanguard FTSE All-World UCITS ETF

The best ETF with wide diversification is the Vanguard Total World Stock Index (VTI). In terms of returns, it has performed the best over the past ten years. The VTI contains 3900 (!) positions in companies around the world. The return over the past five years was 104.55%. This is 35% higher than the popular VWRL. VTI is therefore the best choice based on actual performance. Given its composition, it seems likely that it will also outperform in the long term (although I have no crystal ball...).

In other words: higher return and lower risk.

An alternative is the Vanguard Total World Stock (VT). This tracker holds more than 9000 (!) companies around the world. The annual dividend is 1.65% and the VT ETF has given a total return of 106% in 5 years. In my opinion, you would be better off choosing the VTI because you also have such a thing as "too much spread" (yes really...)

Another excellent global ETF is the iShares MSCI ACWI ETF (ACWI). This tracker also gave a 106% return over the past 5 years, only it offers less diversification (2375 positions).

Want to buy the best global ETF? Then go for the VT. You can buy this commission-free at eToro. Click here to create an account for free.

VWRL as the best ETF for long-term investors as an alternative to VT

If you want the maximum spread within the stock market, there's the Vanguard FTSE All-World UCITS ETF (VWLR). When buying this ETF, your money is immediately spread over more than 3,400 stocks worldwide. There is maximum diversification here, with 55% being US stocks and 45% being non-US stocks. In other words, you are investing in the global stock market. Consequently, this can be considered one of the better 2022 ETFs for passive investors. The average annual return of VWLR over the past 5 years is 8%. The total return was 70.55%, which is 35% lower than the Vanguard Total Stock Market Index.

The advantage of the VWLR is that you have maximum diversification within the stock market. As a result, you run the least risk of all the ETFs in this list of the best Exchange Traded Funds. In exchange for this risk spread, you do have to take into account a lower potential return. Although you never know for sure. After all, the Invesco QQQ ETF could perform magisterially next year, only to generate negative returns for the remaining five years. Anything is possible, you can never be completely sure when investing.

I do believe that certain industries such as artificial intelligence, the Cloud and Video gaming are going to rise for the next few years. By investing some of your money in them, you could benefit from additional high returns.

If you want less risk, choose the Vanguard Total World Stock ETF or the Vanguard FTSE All-World UCITS ETF and supplement with alternative investments such as real estate, commodities, crowdfunding and P2P Lending.

Best ETF long term #9. Schwab U.S. Dividend Equity ETF (SCHD)

An addition for 2022 to the list of best long-term ETFs is the Schwab U.S. Dividend Equity ETF (SCHD). From new and extensive research, I am coming to the conclusion that I have overlooked this tracker.

Its total return over the past five years was 119%, while also paying an annual dividend of almost 3% (!). This is a high yield for a dividend ETF that are normally less volatile. We also see this in the risk analysis below, where the SCHD still ranks well in terms of relatively lower risk:

In total, the SCHD contains about 103 positions. There are two drawbacks if you ask me. The first is that the top 10 holdings account for about 40% of the total weighting (see figure). Secondly, the risk spread is lower than global ETFs and it only covers stocks from U.S. exchanges.

On the other hand, it still offers a relatively good risk spread with a very attractive total return and dividend. Moreover, the expense ratio is only 0.06%! This makes it a very cheap ETF for dividend investors.

The SCHD is an excellent dividend ETF. We believe it is part of the best dividend ETF’s.

Best High Risk ETF #10. Crypto Portfolio Tracker

The world is changing. We need to move with the times. Now I don't know if crypto coins are a good long-term investment. I have my experiences since 2017 in this market. In the short term it can give spectacular gains as well as losses. How this is in the long term I do not know.

Anyway: we should not ignore extraordinary results. There are Crypto Portfolio Trackers that realize exceptionally high returns. There are some crypto ETFs for next 2022, but they only track one crypto currency such as Bitcoin or Ethereum. However, a Crypto Portfolio tracks dozens of coins.

The Crypto ETF called "DeFiPortfolio" has realized +1407% return in three years!

That is truly bizarre. However, beware: this investment is extremely risky and only suitable for advanced investors. Therefore, only invest with small amounts that you can lose 100%. Crypto is and remains for the time being an asymmetrical investment. The tip is to speculate with up to 3% of your total investment capital. Assume that you will lose the money.

Want to invest in crypto portfolios in addition to other ETFs like the SCHD? Click here to create an account for free.