Dear Happy Investor, what are the 10 best dividend ETFs for dividend (and value) investing? Based on several criteria, such as risk and dividend, we have compared many dividend ETFs. After a lot of research, we came up with a top 10. We'll also look at how to build a dividend investment portfolio, where to buy the best dividend ETFs, and analysis on risk and opportunity per tracker.

On to the best dividend ETF!

PS: Did you find this article valuable? Sharing is greatly appreciated to help others make better investments

Table of Contents

[[show index]]

The Best Dividend ETFs: TOP 10 for long-term dividend investing

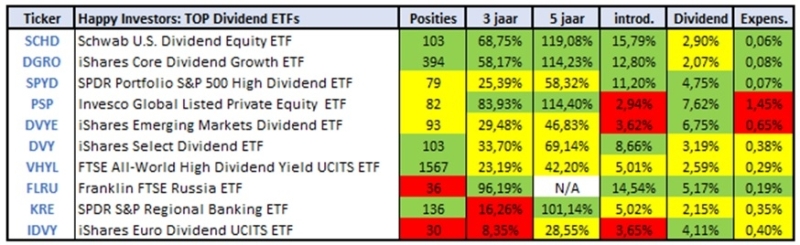

Source: Happy Investors research

Source: Happy Investors research

The table represents the TOP 10 best dividend ETFs. This is based on comparison and ranking criteria. The criteria of (1) positions, (2) dividend and (3) expense ratio weigh the most, as the focus here is on (stable) dividend investing. Also dividend growth is an important criterion (see analysis in this article).

Based on colors you can see which dividend ETFs score relatively best. Red = below average, yellow = average and green = above average.

I don't rule out that there are better dividend ETFs than this table. However, I am confident in this selection. As for the "emerging markets" and "Europe" dividend ETFs, there may be better equity funds out there. Nevertheless, I have good arguments for arriving at this selection. For example, the IDVY. This fund doesn't seem to be doing very well (except for dividends), but this fund scores very well on low P/E and P/B ratios. This means potential undervaluation and therefore higher upside in the future.

Below is a brief analysis by dividend ETF for explanation.

First, let's look at crucial tips for constructing a dividend ETF portfolio. I also indicate where to buy which dividend ETF.

Let Money Work for You! Starting on the best investment platforms is half the battle

Are you still working hard for your money? Why don’t you consider letting the money work for you! Create passive income and attain financial freedom. Starting on the best investment platforms is half the battle. Do you want to know what the very best investment platforms are? Then click on the blue link to compare the best investment platforms now. Here you can read my independent comparison of the best online brokers for stocks, crypto, and P2P. Save money and choose the best investment platform!

Building a Dividend Portfolio with the Best Long-Term Dividend ETFs

The combination of global diversification + long-term holding + dividend reinvestment leads to exponential long-term capital growth. In particular, diversification is important for those seeking stability.

The TOP 3 best Dividend ETFs are focused on U.S. stocks (see table). This has led to higher price returns in the past, but is no guarantee for the future. Especially given the risk of relatively high valuation (P/E ratio). You therefore do not want to invest exclusively in this type of dividend tracker.

The solution: put together a diversified investment portfolio for more risk diversification, both in geography and industry.

For example, you can combine the SCHD with the DVYE and IDVY. The latter focus on emerging markets and Europe, respectively. (Note: you also have IDV for slightly more international diversification). You would want to make such a composition with the goal of a higher dividend or total return.

For passive investors, there is an easier way: the VHYL. This best dividend ETF offers global diversification in 1500+ companies that pay relatively higher dividends. This is not the best performing fund on both dividends and ETF, but it is an easy way to relatively diversify risk. In addition to the VHYL, you also have the popular VWRL ETF. This fund offers even more diversification with a slightly lower dividend.

Besides a selection of (dividend) ETFs, it is also necessary to invest in other investment markets. For example, with the best real estate funds you get a diversified investment in real estate. This gives about 7 - 8.5% dividend per year. You can also look at various assets, including bond (ETFs), commodity (ETFs), P2P Lending, Crowdfunding, et cetera.

Where can I buy the best dividend ETFs?

Below are my recommendations for investment apps that I use myself to buy the best dividend ETFs:

You can buy the dividend trackers SCHD, DGRO, SPYD, DVY, and KRE commission-free at eToro

The dividend trackers SPYD, VHYL, and IDVY (or IDV) can be bought through DEGIRO

The dividend trackers PSP, DVYE and FLRU can be bought via Financial Freedom

Analysis of the best long-term dividend Exchange Traded Funds

Below is a brief analysis of these best dividend ETFs:

- - iShares Core Dividend Growth ETF (DGRO)

- - Invesco Global Listed Private Equity ETF (PSP)

- - iShares Emerging Markets Dividend ETF (DVYE)

- - FTSE All-World High Dividend Yield UCITS ETF (VHYL)

- - SPDR S&P Regional Banking ETF (KRE)

- - iShares Europe Dividend UCITS ETF (IDVY)

I have examined what I consider to be the best dividend ETF Schwab U.S. Dividend Equity (SCHD) in a separate, more comprehensive analysis.

The dividend ETFs SPDR Portfolio S&P 500 High Dividend and the iShares Select Dividend have overlap with other trackers in this list. They are both fine equity funds, but we will not analyze them separately.

We are also not going to analyze the Franklin FTSE Russia ETF. This is an interesting investment, but also presents relatively higher risk. It is a theme fund that focuses on Russian dividend-paying companies. The dividend, yield and expense ratio are excellent, but typically such a theme fund is not suitable for passive or risk-averse dividend investors. If you do want to take on more risk, it is worth investigating.

Tip: always read the fact sheet before buying a dividend ETF.

Commission-free Crypto, Stocks and FOREX Trading with NAGA

Do you want to trade Bitcoin, Crypto, Stocks, and Forex? NAGA is one of the biggest all-in-one crypto brokers where you can buy crypto 100% commission-free. You can also use the AutoCopy to copy the Top Traders of NAGA. In fact, you can even become a Top Trader yourself and earn up to 10.000 dollars a month if you are really good at it. Anyway, this broker is perfect for anyone who wants to trade crypto 100% commission-free. You can set up an account for free and try it out.

Want to know more? Click for more information

Best dividend fund analysis: iShares Core Dividend Growth ETF (DGRO)

After analyzing iShares Core Dividend Growth ETF, I obtain the following relevant data:

- - Strategy: low-cost dividend tracker for U.S. stocks with dividend growth from various industries

- - Positions: about 400

- - Dividend yield: 2.07%

- - Dividend Growth 5 Years: 10.28%

- - Top 10 stocks weighting: 25.62%

- - Expense ratio: 0.08%

- - P/E ratio: 25.52

- - P/B ratio: 3.74

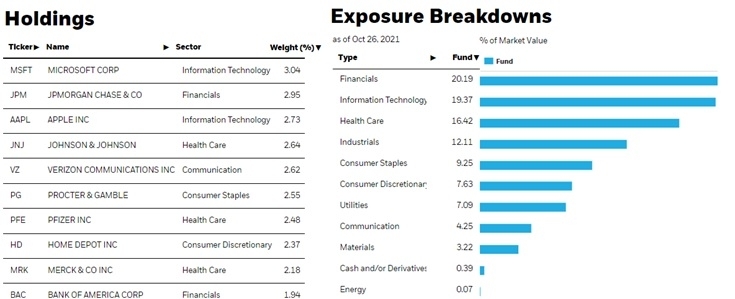

In my opinion, the DGRO is among the best dividend ETFs for U.S. stocks. With about 400 positions, you get a relatively large amount of diversification, just as you would with an S&P 500 dividend ETF. The DGRO focuses on a combination of Value and Growth, with the companies having a track record of consistent dividend growth. This is reflected in the 5-year dividend growth rate of 10.28%.

The top 10 stocks make up 25.62% of the total. This is neither high nor low. These are a diverse mix of companies, such as Microsoft to Home Depot. The risk of this dividend fund is in its higher financial valuation and limited geographic spread. A weighted average P/E ratio of 25 is (historically) high. This means that these companies need to grow significantly in earnings over the next few years. If this does not happen, the DGRO will pay out a lower yield compared to recent years.

This dividend fund has a very low management fee of 0.08%. This is beneficial for higher net returns in the long term. You can buy the iShares Core Dividend Growth ETF commission-free at eToro

Source: iShares.com, 28 October 2021

Source: iShares.com, 28 October 2021

Analysis best dividend fund: Invesco Global Listed Private Equity ETF (PSP)

After analysing Invesco Global Listed Private Equity ETF, I obtain the following relevant data:

- - Strategy: global focus on stocks of companies that invest and/or lend money in/to unlisted companies (private equity)

- - Positions: approximately 80

- - Dividend Rate: 7.69

- - Dividend Growth 5 Years: 25.78%

- - Top 10 shares weighting: 44.10%

- - Expense ratio: 1.45%

- - P/E ratio: 19.27

- - P/B ratio: 2.24

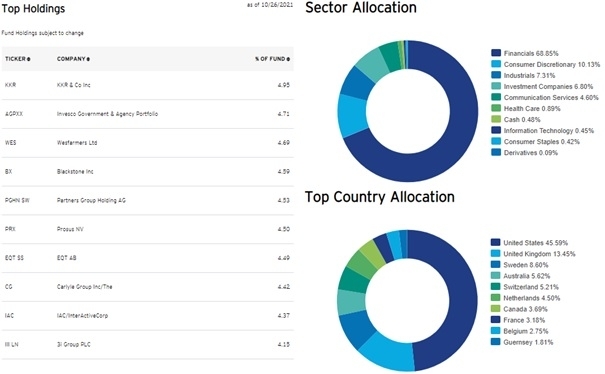

As the best dividend ETF, the PSP focuses entirely on private equity investment companies and capital providers. This includes companies such as KKR & Co, Blackstone and the "Dutch" investment firm Prosus N.V..

The Invesco Global Listed Private Equity ETF is not for risk-averse dividend investors. The fund has a limited sector focus and the top 10 stocks are 44% of the total (which is high). Another major drawback is the very high management fee of 1.45%.

So why is the PSP still among the best dividend funds? Because it has excellent scores on both dividends and annual dividend growth. The latter is particularly high at 25.78%. Also, the P/E and P/B ratios are acceptable in terms of level. Although the fund indicates that the forward P/E ratio is rising to 23, which is on the high side.

You can buy the this tracker at low commission at Financial Freedom. This platform is one of the largest providers with 1400+ ETFs.

Source: Invesco.com, October 28, 2021

Source: Invesco.com, October 28, 2021

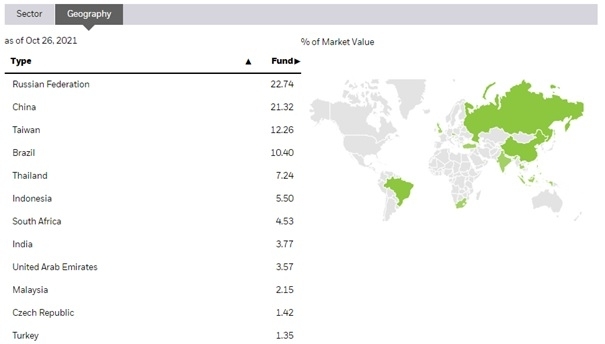

Analysis best dividend fund: iShares Emerging Markets Dividend ETF (DVYE)

After analyzing iShares Emerging Markets Dividend ETF, I obtain the following relevant data:

- - Strategy: broad diversification across established emerging markets dividend-paying companies

- - Positions: about 100

- - Dividend: 6.75%

- - Dividend Growth 5 Years: 10.26%

- - Top 10 shares weighting: 19.82%

- - Expense ratio: 0.49

- - P/E ratio: 8.62

- - P/B ratio: 1.09

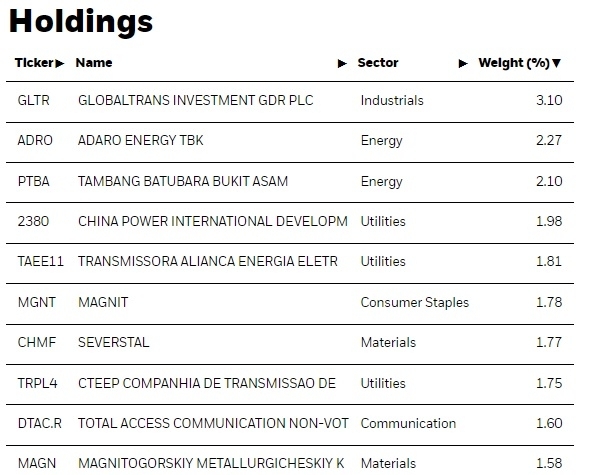

The DVYE is a good dividend ETF for more risk-averse investors who want to diversify within emerging markets. The tracker offers a lot of diversification across geography and sectors. The number of positions is fine, with the top 10 stocks making up 19.82% of the total. But most importantly, the relatively inexpensive valuation: a P/E ratio of 8.62 is very low. It may be that this best dividend ETF is undervalued.

DVYE offers a relatively lower price yield, but a high dividend. The annual dividend growth rate is okay. Combined with the low P/E ratio, this could well be a very good investment with high total return. Within that context, a management fee of 0.49% is acceptable.

Source: iShares.com, 28 October 2021

Source: iShares.com, 28 October 2021

Source: iShares.com, 28 October 2021

Source: iShares.com, 28 October 2021

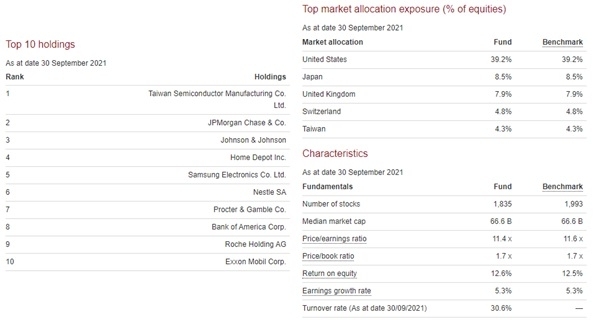

Analysis best dividend tracker: FTSE All-World High Dividend Yield UCITS ETF (VHYL)

After analyzing FTSE All-World High Dividend Yield UCITS ETF, I obtain the following relevant data:

- - Strategy: The Index consists of stocks of large and mid-cap companies, excluding real estate trusts, in developed and emerging markets that pay dividends that are generally higher than average

- - Positions: about 1500 - 1800

- - Dividend: 2.59%

- - Dividend Growth 5 Years: N/A

- - Top 10 shares weighting: 13.6%

- - Expense ratio: 0.29

- - P/E ratio: 11.4

- - P/B ratio: 1.7

The FTSE All-World High Yield UCITS ETF is the best choice for risk-averse investors who want to invest passively. The fund offers global diversification in 1500+ dividend-paying companies. The tracker does not track real estate investment trusts (REITs). Therefore, investing in REITs would be a good complement to the VHYL.

The dividend and yield is not shockingly high. That is not possible with such a large (risk) spread. However, you can see this tracker as a more secure investment with lower price volatility. This does not mean that VHYL cannot fall 30%, but the chance of that is smaller. Especially given the current P/E ratio of 11.4, which indicates a relatively lower downside potential.

VHYL is also part of the DEGIRO core selection, which means you can buy the ETF commission-free.

Source: vanguardinvestments.dk, October 28, 2021

Source: vanguardinvestments.dk, October 28, 2021

Analysis best dividend tracker: SPDR S&P Regional Banking ETF (KRE)

After analyzing SPDR S&P Regional Banking ETF, I obtain the following relevant data:

- - Strategy: tracker for shares of regional banks

- - Positions: approximately 130

- - Dividend Rate: 2.15%

- - Dividend Growth 5 Years: 11.82%

- - Top 10 shares weighting: 20.78%

- - Expense ratio: 0.35%

- - P/E ratio: 12.01

- - P/B ratio: 1.38

SPDR S&P Regional Banking is a theme dividend ETF that focuses on (regional) banks. The complete focus on this type of stock makes it a riskier asset. Nonetheless, the dividend and historical price yield are attractive. At the moment the financial world seems to be fairly stable. The fund itself expects a 3 - 5 Annual EPS Growth of 13.7%. That's good considering the relatively lower P/E valuation of 12.01.

You would want to invest in this best dividend ETF if you believe in a stable, growing banking world for years to come. In my opinion, this sector does present risks around innovation. The increasing online banking and DeFi (crypto) are serious threats to regional banks. On the other hand, banks currently manage a good balance sheet and have a relatively low financial valuation. Therefore, for the medium term of 1 - 5 years it may still be interesting, but for the long term I see more uncertainty.

Although: the KRE also contains positions in innovation banks such as Silvergate Bank, which is a bank for crypto currencies.

Note that this fund has a very high short interest of ±40%!

You can buy this dividend fund commission-free through eToro.

![]() Source: ssga.com, October 28, 2021

Source: ssga.com, October 28, 2021

Analysis best dividend tracker: iShares Europe Dividend UCITS ETF (IDVY)

After analyzing iShares Europe Dividend UCITF ETF, I obtain the following relevant data:

- - Strategy: diversified eurozone companies with highest dividend yields

- - Positions: 30

- - Dividend yield: 4.11

- - Dividend Growth 5 Years: N/A

- - Top 10 equities weighting: 44.01%

- - Expense ratio: 0.40%

- - P/E ratio: 10.1

- - P/B ratio: 1.07

The last one from my TOP 10 best dividend ETFs is the iShares Europe Dividend UCITS (IDVY). There are several trackers for dividend companies from Europe. Of these, IDVY has one of the smaller holdings with only 30 positions. Moreover, the top 10 holdings are 44.01% of the total.

Why would you take this risk?

You might want to do this because you expect IDVY to give higher returns compared to larger trackers. Based on financial valuation, this would be plausible. The P/E ratio is only 10.1. Now there are no growth companies in this tracker, but even then the valuation is low. This could be interesting for Value investors.

Investing in high dividend stocks is not always wise, by the way. You run the risk of investing in stagnant or declining companies. They may pay high dividends, but company growth is negative. In the long term, this means possible downsizing or even bankruptcy. As a result, the stock price will fall, which can make your total return negative.

Another risk are value traps. Sometimes stocks are deliberately very cheap because the future outlook is negative (see above). These kinds of companies seem cheap, but they are not. When they shrink in profit, the P/E ratio increases at the same price. The result: your shares become more expensive in the long run instead of cheaper. You don't want that, because the result can be another price loss.

IDVY, however, is an ETF. By spreading out over 30 different companies, you can reduce this kind of risk and increase your chances of profit. The IDVY (and IDV) can be purchased through DEGIRO. Alternatives such as the STOXX 100 Dividend are also available.

![]() Source: iShares.com, October 28, 2021

Source: iShares.com, October 28, 2021