Dear Happy Investor, the purpose of this article is to ensure that you start earning more money in less time in order to achieve financial independence. After all, this is the basis for financial independence; a situation where you are free from financial stress. And not only that: financial independence provides you the freedom to do what you really want.

That may be working less and spending more time with family, or perhaps by starting your own business. To me, financial independence means being able to enjoy life more in the way I choose to. With that, achieving financial freedom is an enrichment of life. Not because you can buy expensive stuff, but because you can buy more time. Time is much more valuable than material possessions. Especially when you spend it wisely on valuable relationships and pursuing your passion.

Do you want to learn how to achieve financial independence?

Let us begin!

Contents:

6 Steps to Become Financially Independent

Step 1. Increase Your Income

Step 2. Minimize Expenses

Step 3. Build Your Passive Income

Step 4. Invest all cash flow in assets

Step 5. Reinvest Cash Flow from your Assets

Step 6. Buy Luxury Goods Only from the Income of your Assets

The Secret to Achieving Financial Independence

In this article, I will explain to you the secret to achieve financial independence. I will spare you the nonsense and get straight to the point about what it takes. First, I will show you the steps by which you achieve financial independence. Then I will share my own story with some valuable lessons you must know.

6 Steps to Become Financially Independent

The process below contains 6 steps. You should know that the process towards financial independence takes many years. For some a little longer than others, depending on your skills, environment, and, above all, your Mindset. If you follow the steps correctly and stick to them consistently, then financial independence is inevitable. It’s not an illusion, it really is achievable like so many others.

Before you begin, a few things need to be in place. I can explain this using a formula. This formula is not perfect, but it does capture the necessary basics:

Achieve Financial Independence = Believe + Discipline + Focus + Necessary Knowledge + Financial Goal

Again, this formula is simplistic and not perfect. But the essence is crucial. Those who do not believe in their own purpose will fail. Those who don’t have the discipline and focus to go through the 6 steps to financial independence will fail. And those who don’t gain the necessary knowledge about the how, will fail as well. And those who don’t have an understanding of what the financial goal is that needs to be achieved, will fail. I like clarity. I think this is pretty clear, isn’t it?

Now don’t worry! By following 6 steps we can learn how to achieve financial independence.

In 6 Steps to Financial Independence:

- Step 1. Increase income

- Step 2. Minimize costs

- Step 3. Build passive income

- Step 4. Invest all cash flow from points 1, 2 and 3 in assets

- Step 5. Invest all cash flow from point 1, 2, 3 and 4 in assets

- Step 6. Purchase only luxury goods from the income of step 5, until financial independence is achieved.

It’s important to note that you don’t just start Step 2 once Step 1 is completed. The steps are a bit intertwined. For example, you can easily do steps 1, 2 and 3 simultaneously, provided you set the right goals. Steps 4, 5 and 6 can also be done simultaneously. There is some overlap.

I will share a short story of myself to illustrate this process.

My story: the road to Financial Independence

Since a young age I was fascinated in money. By now I am a lot wiser, and realize that money is just a (necessary) means to buy something much more valuable: time. But the interest in making money was there from an early age. It also helped me that I grew up with a (wonderful) father who has been an entrepreneur his entire life. Entrepreneurs think very differently than the average person. Entrepreneurs are creative, look for solutions and have rock-hard discipline and perseverance. A good example to grow up with. And I grew up with this background. Moreover, I always had the belief (in myself) that I would have a prosperous life. Remember the formula?

Achieve Financial Independence = Faith + Discipline + Focus + Necessary Knowledge + Financial Goal

Mindset and Belief are Crucial to Becoming Financially Independent

It starts with belief. What is it that you believe in? What is it that you want to achieve? For me, the goal is not to be a millionaire. But to have financial independence so that I can have much more freedom. For example, I accept a certain standard of living, which also means I have lower monthly expenses that have to be covered by a lower income. Everything starts with belief. And if you believe strongly in something then you also know about yourself that you can achieve it. It’s as simple as that, actions flow from thoughts. Everything is about mindset. Belief, self-discipline and focus fall under mindset. By the way, it has not always been the case that I am very driven and disciplined. This evolved after a stimulus of failure. It didn’t represent much. Rather a luxury problem.

When I was still studying at HBO, I had failed my thesis due to a variety of circumstances. At first, I blamed these circumstances. Until I realized that it was me. I was the cause of the failure because had I really done my best to achieve my thesis? No. This stimulus (thesis failure) changed my mindset significantly. Instead of looking outward, I looked inward from that moment on. I am responsible for my own success. No one else is. Take ownership and responsibility for that, because no one else will help you. Since that moment, I started living differently. I went to college and graduated with honors. But that was just the beginning. Discipline, motivation, self-confidence and the accumulation of knowledge became crucial building blocks of my success.

What about you? Are you taking full ownership and responsibility for your own (financial) success? The answer to this question can change your life.

Commission-free Crypto and FOREX Trading with NAGA

Do you want to trade Bitcoin and crypto? NAGA is one of the biggest all-in-one crypto brokers where you can buy crypto 100% commission-free. You can also use the AutoCopy to copy the Top Traders of NAGA. In fact, you can even become a Top Trader yourself and earn up to 10.000 dollars a month if you are really good at it. Anyway, this broker is perfect for anyone who wants to trade crypto 100% commission-free. You can set up an account for free and try it out.

Want to know more? Click for more information

Step 1. Increase Your Income

I only started working full-time when I was 25 years old. I used the years before to study, and a lot of it. I saw more value in gaining knowledge than working for a tenner an hour in a side job. Not that I didn’t have side jobs (which I did learn a thing or two from), but I kept it to a minimum. I was (and still am) making an investment in knowledge, rather than providing physical labor in exchange for an hourly wage. An hourly wage that barely rises and over which I do not have much control myself. Thus, to this day, I read many knowledge books and relevant articles on the topics I want to learn more about.

My mindset and background led to me ending up in a reasonably well-paid entry-level job. This is also important to you. If you don’t yet have the right mindset and/or belief, work on that first. After that, an investment in knowledge is crucial. Knowledge makes you valuable. Even if you are older, this can still be done by reading knowledge books yourself or by taking for example good studies and (online) courses. There is a well-known motivational saying that who spends 1 hour every day learning a specific domain, he or she will be a national expert within five years. How would this change your life, when you are the best?

Provide multiple streams of income

So I started at age 25 with a full-time job. In addition, I built my own (small) webshop in my spare time. And later two successful websites. The first step to achieving financial independence is to increase your income. I am assuming for a moment that this is a full-time job. The only thing you have to do is to make sure you get a higher income. This is partly in your control. By performing excellently at work you will be able to get some promotions. And if you are not rewarded according to effort, you can always switch jobs and catch a big pay increase.

However, you can only increase your income to a certain extent. It is unlikely that you will get a 10% pay increase every year. At best, it’s once every two to three years, with occasional outliers. And that’s why it’s important to start generating other sources of income in addition to your full-time job. The goal should be to generate multiple streams of income so that you are not dependent on just your salary with an employer. This is step 3, building passive income. But before I explain to you how I successfully applied Step 3, I want to briefly go over Step 2 with you.

Happy Investors Recommendation: Higher Return and Lower Risk? Tip: Asymmetrical Investing!

What if you could get higher stock returns while having less risk. Sounds too good to be true? It’s not if you know how to start with asymmetric investing. These are investments where the potential gain is greater than the potential loss. The only way for asymmetric investing is if you have a lot of knowledge and experience. This is for advanced professionals and is also used in the largest mutual funds with a minimum deposit of millions.

I’m not an expert in asymmetric investing, but I do know a very good party named Capitalist Exploits which I highly recommend. I’ve joined their Membership one year ago and it brings a lot of value for unique investment opportunities with commodities. I’m talking about +300% gains on Uranium, Copper, Agriculture, and 60+ buying opportunities. The Membership brought me a significant return on investment! These are true professionals. In addition, they also have a free newsletter where they share masterful tips and research on asymmetric investing with us once a week.

Want more information? read my full Capitalist Exploits Review and Experiences

Step 2. Minimize Expenses

Financial independence begins with creating more income than expenses. I call the difference between the two cash flows for convenience. We can think of this as follows:

Cash flow = income – expenses

Typically, we look at monthly cash flow. This means how much money you have leftover each month to save or invest. Suppose you have 2000 euros in monthly expenses, with an income of 2500 euros. Then the monthly cash flow is 500 euros. This is not the official definition of cash flow. That one is much more difficult. But this is about understanding a simple concept. If your monthly expenses are higher than your monthly income, then you have a negative cash flow. If your monthly expenses are lower than your monthly income, then you have positive cash flow.

Positive cash flow is the foundation for achieving financial independence.

In Step 1, we talked about increasing your income. Increasing your income is more challenging in the short term than decreasing your expenses. Reducing costs can be done quite easily in the short term. In doing so, you will need to look critically at your expenses, and ask yourself if you really need something. Does it add value to your life, or can you do without it? In this way you can cut quite a few costs. But not everything. You will have a basic standard of living. That makes sense too, it’s okay to live a little as long as you understand that you’re making an investment now so you can live like a boss in the future.

Generate Positive Cash Flow, and continue to increase it through investments

See the example above. Now suppose you get your expenses down from $2000 to $1250 per month. Your income remains the same. Then we get:

Cash flow (1250) = income (2500) – expenses (1250)

By reducing your expenses from 2000 to 1250 euros, you have a higher positive cash flow of 1250 euros per month. You now have 1250 euros left on your savings account every month. This is the amount we will use in step 4. People who want to achieve financial independence, or just become rich, don’t use positive cash flow to buy stuff, but to invest. In fact, that’s what step 4 is all about: investing money.

But first, we have step 3: building passive income. If you’ve read my free book on making more money in less time, you know that passive income is the way to achieve financial independence. And that’s what we’re looking for. You can only minimize your expenses (step 2) to a certain level. You can’t keep cutting back endlessly (without negative consequences for your social life). But you can basically increase your income endlessly. That’s why this is step 1. Because you need to keep the focus on increasing your income while keeping your expenses low.

In step 3, we are going to increase the income even further. As you know by now, passive income building will require you to work harder for the first few years. But it’s an investment. Because once set up correctly, and it starts running, you will make more money in less time. And the result of this is that your positive cash flow will continue to increase as you go along.

Step 3. Build Your Passive Income

In this article, we are not going to talk about how to generate passive income. Through the link on the right you will learn that. Important, because passive income is a basic requirement for becoming financially independent. I myself started with a full-time job at the age of 25. At the same time I was building a (not so successful) webshop. I also focused on minimizing my household expenses. By now I was living together with my girlfriend. We live in a beautiful and nice house. And we do fun activities, both together and with friends and family. But in doing so, I have always paid close attention to what adds value and what does not. This has enabled me to enjoy life and keep costs down. This goes perfectly well together. Don’t let yourself go crazy.

But as I said, you can only lower the costs to a certain level, without destroying your social life. We want to live, and the social aspect is important to that. If that’s less important to you, then achieving financial independence just gets easier. And for those who like to go out two nights every weekend and take luxurious, expensive trips, it will be considerably more difficult. Perhaps finding the right balance is the best path.

Let Money Work for You! Starting on the best investment platforms is half the battle

Are you still working hard for your money? Why don’t you consider letting the money work for you! Create passive income and attain financial freedom. Starting on the best investment platforms is half the battle. Do you want to know what the very best investment platforms are? Then click on the blue link to compare the best investment platforms now. Here you can read my independent comparison of the best online brokers for stocks, crypto, and P2P. Save money and choose the best investment platform!

Keeping focus and being creative

Because I myself knew what I wanted (financial independence) from a young age, I had the focus from the beginning. My expenses were low, and my salary from my full-time job I tried to consistently increase. I started with a salary of about 3000 euros gross. A high starting salary, for sure. And through dedication, knowledge, and taking ownership, I managed to get some nice salary steps as well as a very challenging promotion. Three years later, at 28, I was earning about 4300 euros gross per month. That’s a high salary for that age.

But I didn’t gamble on one horse. I continued to develop my webshop. By now I was one year into building my webshop. In that time I decided that I did not want to invest money in advertisements, but was going to write articles to attract people to my webshop. This meant that I traded my time (writing articles) for money (converting visitors into customers on my webshop). In hindsight, not a smart choice, and I was better off using ads (money) to get more customers (even more money). Money makes money. Anyway, at the time I decided to do things differently and set up a second website. This website became a blog, a blog about women’s fashion and jewelry. I know… how to make it up. And even worse, how did I keep up writing hopeless articles about women’s fashion and jewelry? For the answer, we have to go back to our formula:

Achieve Financial Independence = Belief + Discipline + Focus + Necessary Knowledge + Financial Purpose

Knowledge and know-how is crucial to achieve financial independence

I had it all. Except for the necessary knowledge to write about women’s fashion. That’s not exactly my passion, by the way… However, I did have knowledge about Search Engine Optimization (SEO). I learned this in my spare time: how do I get free visitors to my website? And this was the basis for the success of my first blog website, called loisir.nl. I still have this blog today. I let someone who knows about women’s fashion write the articles. Not only does this improve the quality of the blogs (knowledge), but I also make more money in less time (money makes money). Because, that’s how I learned about Affilliate Marketing in addition to SEO. At one point I noticed that I was getting more and more visitors.

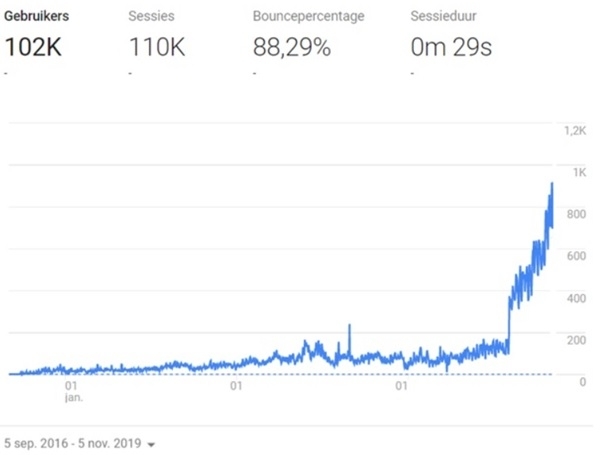

My webshop’s turnover remained the same, and besides, this also costs time and money. I had to put together my own packages and ship them. That was easy to do. But a big disadvantage was the return of the products by customers. My customers got free shipping, but they had to pay the shipping costs themselves when returning products. This minimized the number of orders returned to about 15%. So about 1.5 out of 10 products. And that just costs money. You lose the cost of shipping and packaging, but you also have to unpack the package and update the assortment of the webshop. Not very interesting at all. That is why I decided to keep my webshop, but not to put much focus on it. I used drop shipment, so I could minimize my work. Then I shifted my focus to the loisir.nl website, the blog that was attracting more and more visitors. For example, below you can see a graph of the number of visitors over the years:

Building Passive Income the Right Way Takes a Lot of Time, but Gives Exponential Growth

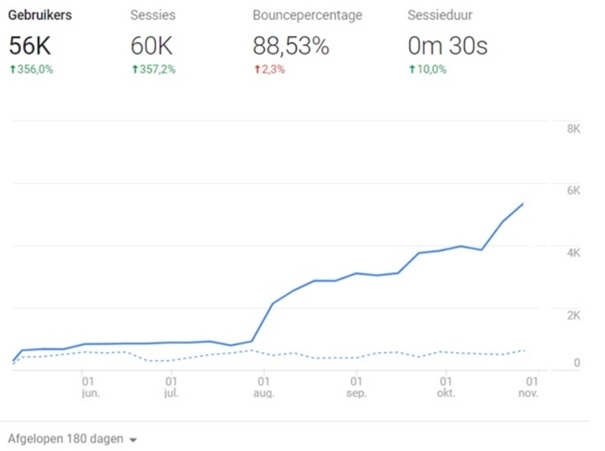

Take a look at the graph. This is over the period September 5, 2016 to November 5, 2019. It is abundantly clear that it first took 2.5 years of time before the website really experienced major growth. For example, I had 102,000 visitors to my website during this three-year span. But almost half of these visited my website between June 2019 to November 2019. This is easy to see on the following graph:

So in the past 180 days, I have had as many visitors to my website as I had in the previous two years. That is the power of exponential growth. It takes a couple of years to get the basics right, and from that point on things can go fast, very quickly.

Combine multiple tactics for Passive Income

By now I am earning a very nice salary through a full-time job. In my spare time I also earn income through my webshop and the websites. These are not yet completely passive, this still requires a few years before I can call it passive income. But do you remember the six tactics for passive income from Part 2 of this book? The lesson I want to impart is that you can combine these tactics. My webshop is small, but does function on the drop shipment revenue model now (passive income ideas blog) so I don’t spend much time on it. And the websites generate income through Affiliate Marketing. These are multiple tactics, but they don’t stop there. I also apply the tactics of investing and real estate funds, and these really generate passive income.

For example, I have good experiences with investing in real estate funds. So this is directly step 4. But before we go to step 4, I want to give you a personal experience briefly.

Turnover is nice, but profit is what it’s all about

What I want to give you is not to be blinded by turnover. It sounds very cool to tell your friends and family that you have a turnover of 50,000 euros with your webshop. But turnover is not everything. It’s about the profit you make. Suppose you have a shop that turns 50,000 euros turnover. You do this next to your full-time job. That sounds like a lot, doesn’t it? But the net profit margin of a webshop is always low. You have many costs such as procurement, shipping, returns, damages, etc.. So suppose your net profit margin is 20%. This means that over a turnover of 50,000 euros, you will make a profit of 10,000 euros per year. Not a bad side income next to your full-time job, that’s for sure. But don’t stare blindly at this.

Because another example is Affiliate Marketing via a content platform. Basically, you only have costs for a website. A cheap website will cost you about 25 euros per year. If you generate 15,000 euros per year through Affiliate Marketing, then you have a net profit margin of 15,000 – 25 = 14,975 euros per year. And more importantly: if you automate the website and the process (part 2 of this book), you will spend less time than with the webshop. In short, turnover does not say much. The profit does. And also how much time you spend on it. Profit per hour is a good indicator of success!

Step 4. Invest all cash flow in assets

Step 4, 5 and 6 are fairly easy to understand, and by far the most fun of all. In terms of time, we do have a few years to go (that’s steps 1 through 3) before we can enjoy steps 4 through 6. But the heavy lifting is done during steps 1 through 3. Step 4, 5 and 6 are all about the last two elements of our formula:

Achieve Financial Independence = Faith + Discipline + Focus + Necessary Knowledge + Financial Goal

Step 4 is all about increasing your financial capability so you can achieve your financial goal. For this, you need knowledge on the one hand but again rock-solid discipline and focus. You also need a roadmap to achieve goals.

Now that the hard work up to Step 3 is done, it’s time to take serious steps toward financial independence. You do this by investing all positive cash flow, i.e. the money you have leftover each month, in assets. Assets can be seen as investments that generate money, usually as monthly recurring income.

Examples of assets are:

- (Dividend) stocks, ETF’s or other investments

- Investments in real estate funds

- Buying and renting real estate

- Solar panels

- Royalties

- Monthly income from selling books, articles, or other sources of information

Assets make money. You put in 1000 Euros, and at least more than 1000 Euros come out. Or you put in 1000 euros and for the next few years, the investment generates and monthly income (for example 50 euros per month). For example, I myself make high returns by investing in a low-risk real estate fund. How that works you can read in my SynVest review, which is the real estate fund where I have been investing for years and earn high returns.

Besides assets, it is also valuable to invest in yourself by taking courses, attending networking events, and reading knowledge books.

Examples of what are not assets:

- Your own house (you do not earn anything as long as you live in it, only possible profit at overvalue)

- An extension to your house (garage, pond, …)

- Cars (the worst investment ever)

The trade-off between time and money is subjective

Personally, I find that some tenders are more difficult to assess. Take for example a robot vacuum cleaner. You would say that this product has no payback period. You pay 300 euros for it, and apart from that it only costs money (energy). If your goal is to become rich, then the above reasoning is correct. But my goal is to gain financial independence. In that, there is not only money but also free time. So some investments may not yield money but may be worth it. For example, a robot vacuum cleaner provides more free time because you don’t have to vacuum yourself anymore. Or take another example, sportswear. Sportswear doesn’t make money. You pay for it and your money is gone. But sportswear is a stimulus to (continue to) exercise. By doing so you invest in your physical condition, which is very important for those who want to perform well.

Returning to assets. The idea is that you invest as much of your capital as possible in assets that generate income (on a monthly basis). The secret to financial independence is therefore to have enough assets (investments, solar panels, real estate, et cetera) that generate enough money each month to cover all your monthly expenses. We then have:

Monthly Income Assets ≥ Monthly Expenses = Financial Independence

The sign of ≥ stands for “is equal to or greater than. When your monthly assets generate as much income as you spend each month, you have achieved financial independence. You no longer have to work (compulsorily) to cover your monthly expenses. Of course, it depends on how high your expenses are, and also how sustainable it is. If your fixed costs increase, then suddenly you will not generate enough income from your assets. Therefore, we should go for the situation where our monthly income from assets is greater than our monthly expenses.

The best way to achieve this is to keep investing in your assets. This is therefore step 5.

Step 5. Reinvest Cash Flow from your Assets

When you have reached the situation where the income from your assets is higher than your expenses, you are in a very good position. Now the trick is to keep the discipline and focus, to secure your financial independence once and for all! You do this by sticking with it for a few more years and just continuing to work. All the cash flow you have leftover each month (income + reduce expenses + passive income + income from assets) you will then have to reinvest in even more assets. From this moment on your assets will start to grow exponentially, and you will not only be financially free but also a millionaire. That’s why investing in assets is the very best way to structurally generate more income.

Step 6. Buy Luxury Goods Only from the Income of your Assets

After many years (realistic is 10 to 15 years) you have reached step 6. And with it your goal: financial independence! Step 6 is not really necessary, but it is the best step of all. You can finally enjoy all your extra income. You’ve worked hard for years to increase both your income and your passive income. You’ve also made concessions in recent years regarding your lifestyle. You’ve left out unnecessary luxuries like an expensive house, expensive cars, and expensive, unnecessary consumer goods. You have fought hard, maintaining self-discipline and focus. Even when there was great social pressure (and believe me, you are going to experience it). All this time you have believed in yourself and worked hard to reach step 6.

All you have to do now is enjoy it. You no longer have to reinvest your income in your assets. Your assets are now yielding so much that you can buy the luxuries you want. Personally, I hope you choose the most valuable. Use your money to buy time. Stop working full-time and chase your passion. Also, spend more time with your family and friends. Ultimately, the goal is to be happy. To have a life full of fulfillment and happiness. Without stress.

Then now is the time to get started. Work on your dreams. Make them a reality!