Investing in gold? The best gold ETFs are often a very useful addition to a diversified investment portfolio. There are several reasons for wishing to invest in gold ETFs. For that matter, there are also reasons not to invest in gold. In this article, we cover 10 of the best gold ETFs. For beginners, or for those who want to invest passively (buy & hold for the long term). In addition, we offer tips and insight into how to invest in Exchange-Traded Funds for gold.

Let's get started!

Why invest in gold?

There are several reasons why people invest in gold:

- Hedge against inflation: Gold is often seen as a hedge against inflation because its value tends to rise when the cost of living increases.

- Diversification: Adding gold to a portfolio can help diversify investments and reduce overall risk.

- Value storage: Gold has been used as a store of value for centuries and is widely recognized as a safe haven.

- Liquidity: Gold is easily bought and sold, making it a liquid asset that can be quickly converted into cash.

- No counterparty risk: When you buy gold, you do not have to worry about the risk of default as you would with a bond issuer, for example.

It is important to note that gold does not pay interest or dividends and the price can be volatile, so investing in gold should be part of a well-diversified portfolio.

Now, we at the Happy Investors are primarily focused on the best ETF’s and dividend ETF’s. We also like investing in real estate. However, a best gold ETF is a necessary diversification for non-correlated assets. For example, gold and real estate can rise or fall in price independently of each other.

Ultimately, it is important to consider your own investment goals, risk tolerance and diversification needs when choosing between investing in gold or real estate. It is advisable to consult a financial advisor to help you make the right decision.

10x Best Gold ETF’s for long-term investing

From directly purchasing gold bullion to indirectly investing in public mining companies, you can gain exposure to gold in many ways. However, investing in gold through exchange-traded funds (ETFs) is the most efficient way for retail investors to get in on the action. The gold ETFs are often considered a 'safe haven investment' that can be relied on during economic instability.

Gold EFTs track the prices of gold in the domestic market. With Gold ETFs, you can invest in gold with the simplicity of stocks and the flexibility of the gold market. When considering gold-focused ETFs, investors should look for the following characteristics:

Size: Assets under management should equal at least $200 million. Because of a larger market capitalization, the ETF is less likely to be manipulated or traded at a significant premium.

Five-year returns: The 5-year return of an ETF reflects the fund's performance over the past 5 years. Check this performance before investing in an EFT.

Expense ratio: An ETF's annual expense ratio is the fee investors pay. Based on data from ETF.com, gold ETFs have an average expense ratio of 0.65%. So, look for a low expense ratio, ideally below 1%.

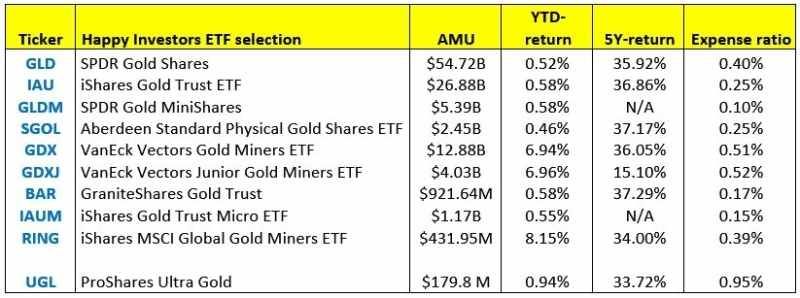

Considering these criteria, here are 10x best gold ETFs that are worth investing in:

(Data taken from: https://etfdb.com/)

Where can I buy the best gold ETFs?

When buying gold ETFs, it is very important to keep costs low. You can buy the best gold ETFs from online brokers. Online brokers not only offer a wide range of gold ETFs. They also have low transaction fees. In some cases, you can even buy gold ETFs for free, from brokers that offer commission-free rates.

The lower the transaction fees, the better. In this case, the annual expense ratio of gold funds still remains relevant. The lower this management fee, the cheaper the gold funds. Again, this is really crucial because in the long run it significantly increases your return on gold. This is because the gross return must be reduced by the fees, leaving net returns.

These are some good online brokers for buying a gold ETF:

- Vanguard – best choice for cheap ETF’s

- Ally – a cheap broker

- eToro - low cost, and offers GLD's largest and best gold ETF

- Mexem - low cost, and offers all the best gold ETFs

- DEGIRO - offers a few gold ETFs, sometimes commission free

Do your research to determine which of the best investment platforms suit you most.

What is the (average) return on gold?

The return on gold can vary depending on the gold price at the time of purchase and the time of sale. The price of gold is influenced by several factors, including supply and demand, geopolitical events and monetary policy.

In a sense, gold is never a passive investment. Even the best gold ETFs are not a passive investment. If you are a beginner with no market knowledge, you may only buy a gold ETF at the time of hype. In this case, you will pay a very high price, while the highest return on gold is achieved by buying low.

Historically, gold has an average annual return of about 2 - 3% over the long term. Depending on the time of purchase (for example, in a gold ETF), this can go up to 6 - 7% on average per year.

However, it is important to note that this return is not guaranteed, and that the gold price can be very volatile, meaning that the return on gold in any given year may be much higher or lower.

It is also important to keep in mind that gold is considered a long-term investment and its price can fluctuate greatly in the short term, but tends to rise in the long term.

Finally, it is also important to consider the costs associated with buying and holding gold. With physical gold, this is storage, insurance and management fees, which can reduce the overall return on your investment. With gold stocks and gold ETFs, the main issues are transaction costs and the annual expense ratio (for funds only).

Note: you can also invest in a silver ETF.

How to get started with gold ETFs or gold stocks?

Investing in gold shares, also known as gold mining shares, is a second way for investors to gain exposure to the gold price without physically owning the gold. In general, investing in gold stocks is much riskier than investing in gold ETFs. Therefore, beginners should be cautious. The only reason to buy gold shares, is because based on knowledge and experience, you can get higher than average returns as a result.

Here are a few things to keep in mind when considering investing in gold stocks:

- Risk and volatility: Gold mining stocks can be more volatile than the gold price itself because the stock's performance is also affected by the company's business performance and management decisions.

- Leverage: Gold mining companies often use leverage, meaning they borrow money to finance their operations. This can increase potential returns but also risk.

- Exploration and development: A significant portion of a gold mining company's spending goes into exploration and development of new mines. This can create uncertainty and risk for investors as there is no guarantee that these efforts will be successful.

- Production costs: Gold mining companies must also bear production costs, such as labor, energy and equipment. This can affect company profitability and investor returns.

- Diversification: Investing in one gold mining stock can be risky, so it is a good idea to diversify by investing in a basket of gold mining stocks or investing in a gold mining stock ETF.

The best way to invest in gold stocks is when they offer a lot of Value. This means that the current intrinsic value is significantly less than the future intrinsic value. This happens, for example, with companies that are successful in the exploration and development of new gold mines. Or a gold mining stock that plummets in price unfairly, because of media noise.

It is important to do your own research, understand the risks and potential returns, and consult a financial advisor before investing in any type of stocks, including gold mining stocks.

Want to get started successfully investing in gold? We recommend Weekly Insider from Capitalist Exploits as a learning experience. This is a team of highly experienced investors in commodities, including gold stocks.

Gold ETF 1. SPDR Gold Shares (GLD)

SPDR Gold Shares (GLD), issued by State Street Global Advisors, is one of the most popular and first U.S.-traded gold ETFs. It is also the most asset-rich ETF - more than twice the closest competitor. When it was first launched in 2004, GLD absorbed tons of capital from investors seeking gold exposure without having to store, insure, or buy the asset. For about three months, GLD was the only gold ETF available until IAU launched and began competing for inflows with lower fees.

As a gold fund, SPDR Gold Shares represent fractional ownership in physical gold bullion. As a result, investors can participate in the upside of gold prices without having to store, protect, or ensure physical bullion. Moreover, the expense ratio of this ETF is higher than those of other gold ETFs. However, its cost is still relatively low, especially considering its liquidity, compared to shipping, storing, and insuring gold bars. As a result of its large size, institutional investors like pension funds use it as an inflation hedge.

Gold ETF 2. iShares Gold Trust (IAU)

In addition to the GLD, the iShares Gold Trust (IAU) is another low-cost Gold EFT. With its relative longevity, it has amassed nearly $30 billion in assets under management and has 451.5 tons of gold in Trust. In the same way that GLD shares are worth 1/10th of an ounce of gold, IAU shares are worth 1/100th of an ounce of gold. Aside from that, it behaves much like SPDR's gold ETF. The expense ratio for IAU is 0.25%. Although it isn't as large and liquid as GLD, it is undoubtedly more affordable than the latter.

The bid-ask spreads of this iShares gold ETF aren't as tight as those of SPDR Gold Shares, so short-term traders should avoid it. It is, however, a better buy for long-term investors because of its significantly lower cost. A number of locations hold the Trust's gold, including New York, Toronto, and London. A traditional brokerage account allows investors to buy and sell shares throughout the day.

Gold ETF 3. SPDR Gold MiniShares (GLDM)

State Street Global Advisors launched SPDR Gold MiniShares (GLDM) in 2018 as a cheaper alternative to its popular gold exchange-traded fund (ETF), SPDR Gold Shares (GLD). Both GLD and GLDM track the price of gold and provide investors with exposure to the gold market, but there are some differences between the two funds.

One major difference is the expense ratio, which is the annual fee that a fund charges to cover its operating expenses. GLDM has a lower expense ratio than GLD, making it more cost-effective for investors. However, GLDM is less liquid than GLD, which means it may not be as easy to buy and sell. This may result in more slippage or the difference between the expected price of a trade and the actual price at which the trade is executed.

GLD is more suitable for traders who plan to buy and sell on shorter time horizons, while GLDM is more suitable for buy-and-hold investors who plan to hold the fund for several years. In contrast with the iShares fund, this fund charges 7 basis points less than IAU because each share represents 1/10th of an ounce of gold instead of 1/100th.

Gold ETF 4. VanEck Vectors Gold Miners ETF (GDX)

VanEck Vectors Gold Miners ETF (GDX) is another best gold ETFs to buy in 2023. It is sponsored by VanEck and provides investors with exposure to a diversified portfolio of approximately 60 companies that earn the majority of their revenues from mining activities. These companies are based in countries around the world and include well-known names such as Newmont, Barrick Gold, and Goldcorp.

GDX is structured such that market capitalization determines the percentage of assets invested in each stock. The greater the stock's market capitalization, the greater the percentage of assets invested in it will be. There are only 10 holdings in the fund, which represents about two-thirds of the fund's assets.

It's worth noting that gold miners tend to react more strongly to gold's price than gold ETFs that hold the metal - when GLD strengthens, GDX strengthens more. It's great during boom times, and it's good for short-term trades. On the other hand, it means less stability in the long run.

Gold ETF 5. VanEck Vectors Junior Gold Miners ETF (GDXJ)

VanEck Vectors Junior Gold Miners ETF (GDXJ) tracks micro- and small-cap gold and silver mining stocks instead of large-cap gold and silver miner stocks. A junior gold miner is either a smaller stock that produces gold or one that is not yet producing gold and is either exploring gold or developing a project.

There is a great deal of risk associated with holding a few of these stocks. The value of a stock could be decimated overnight if a seemingly promising project goes south. When disaster strikes, these small businesses usually don't have much cash on hand. On the other hand? These stocks can soar quickly if they succeed. Within the last year, the ETF generated a return of 39.4%.

Gold ETF 6. Absdn Standard Physical Gold Shares ETF (SGOL)

Absdn Physical Gold Shares (SGOL) sits in a strange place - it is neither as big, nor as widely traded, nor as cheap as GLD. However, the fund does have some benefits for gold investors who want transparency. When it comes to transparency, Absdn Standard goes above and beyond. SGOL holds gold bars in secure vaults in Switzerland and London that are audited twice a year.

The vault is also inspected twice per year by Inspectorate International, a leading physical commodity auditor. There is also a full list of the gold bars stored in Absdn Standard's vaults, each with a unique serial number, available on the company's website.

Moreover, with a 0.17% expense ratio, it's also fairly cheap. As an investor, you own bullion allocated by SGOL rather than just being a creditor for an aggregate deposit.

Gold ETF 7. GraniteShares Gold Trust (BAR)

A low-cost, physical-backed gold ETF, GraniteShares Gold Trust (BAR) ETF tracks gold bullion spot prices, much like SGOL and GLDM. With bi-annual inspections and a daily listing of gold bars held by the Trust, it follows a similar auditing protocol to Absdn Standard. The volume of trades in BAR is lower than in SGOL, but it shouldn't be a big issue if you're actively trading. If you're actively trading, you may want to consider GLD, which is more liquid, or a fund specifically designed for trading, such as ProShares UltraGold (UGL).

BAR shares represent one-tenth of the price of gold, similar to GLD. However, its expenses are just 0.1749%, undercutting both GLD and lower-priced IAU.

Gold ETF 8. iShares MSCI Global Gold Miners ETF (RING)

This EFT tracks the performance of global gold mining companies. These companies are based in countries such as Australia, the United States, and Canada and include well-known names such as Kinross Gold and Newcrest Mining. iShares MSCI Global Gold Miners ETF (RING) is sponsored by iShares and provides investors with exposure to a diversified portfolio of 40 stocks that earn the majority of their revenues in the mining sector.

RING has a high daily volume of trades when compared to similar ETFs, making it a popular choice among investors. Gold mining companies typically generate revenue by extracting and selling gold, and some of this revenue may be distributed to shareholders as dividends. It is important to carefully consider your investment objectives and risk tolerance before deciding whether RING is suitable for you.

Gold ETF 9. iShares Gold Trust Micro (IAUM)

This BlackRock-sponsored ETF tracks the LBMA London Gold Market Fixing Price PM Index in US dollars and provides investors with exposure to the day-to-day movement of gold prices. IAUM is known for its low expense ratio, which is the annual fee that the fund charges to cover its operating expenses. As of January 2023, the expense ratio for IAUM is 0.09%, making it one of the cheapest physically backed gold ETFs on the market. Moreover, the ETF is priced approximately half as much as IAU, making it somewhat more affordable for investors.

Despite its cheap expense ratio, the ETF has attracted just over $1 billion in AUM since its inception in 2021. A total of 18.64 tons of gold is held in Trust by IAUM at the moment.

Gold ETF 10. ProShares Ultra Gold (UGL)

ProShares Ultra Gold (UGL) is an exchange-traded fund (ETF) that is structured as a commodity pool and offers investors leveraged exposure to the gold market. The fund tracks the Bloomberg Gold Subindex and aims to provide investors with daily investment returns that correspond to 2 times the daily performance of the index.

UGL is a leveraged ETF, which means that it uses financial instruments such as futures contracts to amplify the returns of the underlying index. Leveraged ETFs can be risky, as they can result in significant losses, especially in volatile markets. It is important to carefully consider your investment objectives and risk tolerance before deciding whether a leveraged ETF is suitable for you.

Investors should also be aware that UGL resets on a daily basis, meaning that the fund's leverage is reset to its target level on a daily basis. This means that investors in UGL should be prepared to monitor their investments daily, as significant losses are possible.

![10x Popular ETFs for Beginners [2022] Happy Investors](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/popular-etfs-for-beginners-2560x1100.png)