Dear long-term investor, are you considering including gold mining stocks within your portfolio? In this article, we cover an overview of the best gold mining stocks (for inspiration). We will analyze three of them on financial valuation in particular. In addition, we will look at some favorite junior gold mining stocks. They have a higher risk, but also potentially higher returns.

Finally, we discuss important criteria for analyzing the best gold mining stocks. As a long-term investor, this is important. Thus, you can conduct your own analysis to increase your profit probability. Knowledge = power.

On to the gold mines!

Table of Contents

10x Best gold mine stocks to buy right now

Nevada gold mines owned by Barrick Gold. Source: Barrick.com

Nevada gold mines owned by Barrick Gold. Source: Barrick.com

What are the best gold mining stocks to buy now? Investing in gold mining shares is of high risk. It requires expertise. Based on research, we obtain some favorite stocks that score well on valuation, growth, profitability and momentum. Please note that buying gold mining shares is only suitable for advanced investors. As a beginner investor, an ETF is wiser.

The best gold mining stocks at the moment:

- Gold Fields Limited (GFI)

- Harmony Gold Mining Corp. (HMY)

- Eldorado Gold Corp. (EGO)

- Seabridge Gold Inc (SA)

- Kinross Gold Corp. (KGC)

- Paramount Gold Nevada (PZG)

- GoldMining Inc. (GLDG)

- Galiano Gold Inc (GAU)

- Gold Standard Ventures (GSV)

- DRDGold Limited (DRD)

The above TOP gold mining stocks perform well based on valuation, growth, profitability and momentum. In doing so, the TOP 3 seems to be a favorite choice at the moment. One drawback to this list is that no in-depth research has been done on specific conditions, such as remaining gold mine contents and new projects.

Below, we will take a closer look at the top 3 to see why they are currently among the best gold mining stocks.

Tip: the year 2022 does not seem like a "golden" period for gold mining stocks. In comparison, there are many other better stocks from other industries, which can realize (significantly) higher returns in both the short and long term. Check out our stock subscription for this.

Tip #2: We are affiliated and partnered with Capitalist Exploits. This is by far one of the best stock subscriptions in the world for investing in commodities (and more), including gold, copper, uranium, oil, agriculture, et cetera. Read our Capitalist Exploits Review.

Which Gold Mines ETF to buy?

Would you still prefer to buy a gold ETF because of its risk diversification? The largest tracker to follow the underlying value of gold is the SPDR Gold Shares (GLD).

Other interesting ETFs are:

- VanEck Vectors Gold Miners ETF (GDX)

- VanEck Vectors Junior Gold Miners ETF (GDXJ)

- Aberdeen Standard Physical Gold Shares ETF (SGOL) - physical gold

- SPRD Gold MiniShares Trust (GLDM) - physical gold.

These ETFs can be purchased commission-free through eToro. Click here for more information

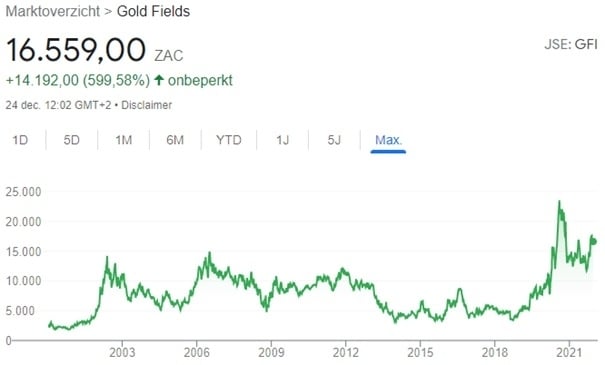

Analysis best gold mining share: Gold Fields Limited

Why is Gold Fields Limited (GFI) among the best gold mining stocks to buy now? Its shares possess an attractive valuation compared to the industry. For example, it has a favorable current P/E ratio of 10.09. The company also scores well on the basis of growth and profitability. Its market capitalization is approximately $9 billion.

In addition, the company has some interesting characteristics. For example, it has a diversified business with gold mining operations in Africa, Australia and South America. It also produces about 6% copper out of its total gold production (2.2Moz). In terms of gold production, there is "some" consistency around the 550 - 600K oz level per quarter:

Key Data Gold Fields Limited. Source: Investors Presentation Q3 2021 Gold Fields Limited

Key Data Gold Fields Limited. Source: Investors Presentation Q3 2021 Gold Fields Limited

Besides good news, there seem to be problems with her Salares Norte project in Chile. Apparently, they are suffering from chinchillas there....

Relevant figures from analysis:

- P/E FWD: 10.29

- P/B FWD: 2.15

- P/CF FWD: 5.67

- EBIT Growth FWD: 37.33%

- EPS Growth: 20.43%

- EBIT Margin: 39.6%

- ROE:28.34%

- Dividend: 3.41%

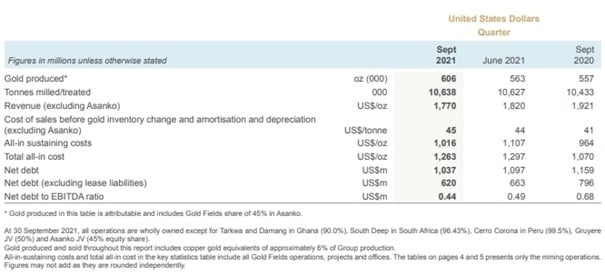

Analysis best gold mining stock: Harmony Gold Mining Corporation

Why is Harmony Gold Mining Corporation (HMY) among the best gold mining stocks to buy now? This company has a relatively smaller market capitalization of $2.5 billion. Its shares score very well on (short-term) financial valuation. Moreover, other figures from growth and profitability are also okay. This was different in the past with loss-making results. But for Q3 2021 an EPS growth of 699% has been reported.

The company operates mainly in South Africa. With 11 "underground" gold mines and some other operations, HMY is no small player. It also has a gold and silver mining operation ongoing in Papua New Guinea. For 2021, its gold production has increased sharply (+26%) to 1.54 Moz. A deep dive into its future gold production is necessary to complement this limited analysis.

Relevant figures from analysis:

- P/E FWD: 7.69

- P/B FWD: 1.15

- P/CF FWD: 3.95

- EBIT Growth FWD: 15.54%

- EPS Growth: 46.3%

- EBIT Margin: 15.1%

- ROE: 18.66%

- Dividend: 2.41%

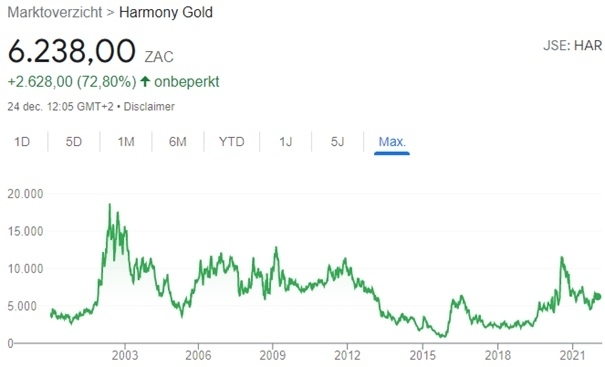

Analysis best gold mining stock: Eldorado Gold Corporation

Why is Eldorado Gold Corporation among the best gold mining stocks to buy now? The Canadian company has 25 years of experience with gold mines in Canada, Turkey and Greece. Nevertheless, management does not always seem to make the right choices. Moreover, sales are declining and they have had to report a loss. Nevertheless, there seems to be hope in the future with the development of the Skouries project in Greece. This potential project would make Eldorado Gold one of the cost leaders in the coming years. However, the project is still in the feasibility phase, so there is still a lot of uncertainty.

The valuation of Eldorado Gold is more difficult to determine. On the one hand, it scores poorly on profitability, such as a very low ROE and high P/E ratio. On the other hand, it has a very favorable P/B ratio of 0.47.

Currently, EGO is among the best gold mining stocks, but we don't think the company is that good. Here, further analysis would be needed to determine its future profitability. If that turns out to be positive, it could be a potential stock in relation to its low P/B ratio.

Relevant figures from analysis:

- P/E FWD: 46.38

- P/B FWD: 0.47

- P/CF FWD: 5.36

- EBIT Growth FWD: 60.06%

- EPS Growth: n/a

- EBIT Margin: 20.35%

- ROE: 1.59%

- Dividend: 0%

Cheap junior gold mining stocks to buy right now

The analysis of the best gold mining stocks above includes all types of stock market values. For advanced investors, it can be lucrative to invest in (cheap) junior gold mining shares. They have a small market capitalization, so they have the potential to grow more. The downside is that they also contain much more risk, such as less diversification and a higher probability of failure.

Which best and cheap junior gold mining stocks to buy? We are now looking at cheap gold mining stocks. Not cheap in price, but cheap in financial valuation based on ratios (P/E, P/B, P/CF, ...). Because the focus is on junior gold mining shares, we draw the line at $500 million market capitalization.

These are low-cost junior gold mining stocks with

- Paramount Gold Nevada (PZG): $31 mln market capitalization

- GoldMining Inc (GLDG): $185 mln market capitalization

- Galiano Gold Inc (GAU): $159 mln market capitalization

- Gold Standard Ventures (GSV): $164 mln market capitalization

- Fury Gold Mines Limited (FURY): $88 mln. market capitalization

- Golden Star Resources (GSS): $425 mln market capitalization

- Allegiant Gold Ltd. (AUXXF): $22.8 mln market capitalization

These are all cheap junior gold mining stocks that score high on cheap valuation. Which one has the most potential is beyond the scope of this study. This requires an in-depth analysis of future developments. Many of these companies have fallen in price for good reason.

It is up to you as a long-term investor to examine how justified this is, and whether the future prospects are more positive than the stock price reflects now. Keep in mind the high risks that junior gold mining companies carry.

How do I find the best gold mining stocks? Criteria for analysis

As a long-term investor, it is very important to invest in companies that we understand. An in-depth analysis of the company is indispensable. Understanding the meso and macro environment are also very important. Especially with gold mining stocks, as the gold price has a strong influence on profitability. For example, almost every commodity market has a strong cycle. In some periods, the gold price is relatively low. And in other periods, the gold price rises by x2 to sometimes x5 or more.

The best gold mining stocks are already making profits when the gold price is low. In periods when the gold price rises sharply, profitability will increase exponentially. This leads to very substantial price appreciation.

Therefore, you find the best gold mining stocks based on extensive analysis. Here are some crucial criteria:

- - Current gold production (Moz) and ongoing projects for production growth

- - Management team with "skin in the game"

- - Diversification in business activities (one vs. multiple gold mines, geography, other revenue streams, et cetera)

- - Financial structure (profit per Oz gold, debt, et cetera)

- - Financial valuation compared to other gold mining stocks

- - Share price momentum

- - Macroeconomic developments including the gold price

The best gold mining shares can be recognized by companies with a favorable future potential (projects) that are available at a cheap share price (relative to its intrinsic value).

Why invest in gold mining shares: pros and cons

In many aspects, gold mining shares can be analyzed just like any other stock. In this context, it gives the same advantages and disadvantages. With disadvantages we refer to the associated risks. Evidently, junior gold mining shares are riskier than full-fledged gold mining companies. It's all about finding the right balance between risk and return.

Investing in gold brings a distinctive advantage. Gold is seen as an inflation hedge. Moreover, it offers low correlation to other investment markets, such as equities and real estate.

However, investing in gold also has a particular risk: the gold price. The gold price fluctuates over time (although less than other commodities such as copper and uranium). This leads to a stronger market cycle. And this means that market timing is more important. When investing in gold, it is not always the case that "time in the market beats timing the market". Especially when investing in gold mining shares, timing the market is of greater importance. This aspect brings higher complexity and therefore higher risk. The risk can be mitigated somewhat by selecting the best gold mining companies.

In other words: also when investing in gold mining companies, conducting fundamental research is again essential for the long-term investor.

What are your thoughts on investing in gold and the best gold mining stocks? Let us know in the comments below.

![10x Best Real Estate Stocks [2022] Short Term Value Companies](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/responsive/6403080/best-real-estate-stocks-2560x1100_614_264.png)

![What is the best thing to invest in? Stocks to Crypto [2022]](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/responsive/5849118/what-is-the-best-thing-to-invest-in-2560x1100_614_264.png)