Dear Happy Investor, as you know I’m fully into long-term investing to achieve financial freedom and even -independence. Investing money is the best way to get richer in the long term. However, a lot of people are afraid of investing their own money. Is that the same for you? Are you afraid of losing your money you’ve worked so hard for? The answer for you would be to investing money without risk. But does that even exist? And if yes, how can you invest money without risk?

Well, to be honest: there is no such thing as investing money without risk. Investing always involves risk.

Nevertheless, it is possible to invest money with less risk. These called low-risk investments, which have a low probability of losing money and a high probability on positive returns. And also keep in mind that you should always invest for the long term. Time is your friend when it comes done to investing.

In this article, I will explain 7 options for investing money with less risk!

Contents:

Savings rate: getting poorer thanks to inflation

Low-risk investments, these are the 7 options!

- Investing in low-risk ETF’s with worldwide positions

- Low-risk real estate funds

- Investing in stock market indices

- Investing in Government Bonds

- Invest in the company you work for

- Investing in a mutual fund

- Investing in Peer-2-Peer Lending with high distribution in safer loans

Conclusion about investing money without risk

Savings rate: getting poorer thanks to inflation

Before we move on to all the options for investing money without risk, I want to briefly go over with you why investing is so important. What many people don’t know is that you literally get poorer when you put your money in a savings account. Seriously? Yes, really. This is because the savings rate at a bank is lower than the inflation rate.

Inflation works as followed: the average yearly inflation rate is 2%. This means your money decreases in value by 2%. Suppose the savings rate is 1%. Inflation is higher than the savings rate, so your money decreases in value by 1%.

To lose 1% of your money in a year won’t kill you. However, if you accumulate a yearly 1% decrease in the long term, your money will be worth significantly less.

So what is the alternative? Well, investing money without risk does not exist, but if you leave it in the savings account you will become poor with 100% certainty. So if you don’t like risk, then maybe you consider low-risk investments as a possibility?

The choice you make is life-changing. Not only do you need to invest to save your money’s value. You also want to invest because it can make you rich in the long term. Yes, even with low-risk investments you can!

This reasoning is a simple matter of being smart with money.

Low-risk investments, these are the 7 options!

Oké, you get the point. Now let’s look at what options we have for low-risk investing. So in this case, our goal is not to make big profits, but instead, invest safely and increase our money’s value over time.

Let us take a look at 7 options for low-risk investing.

1. Investing in low-risk ETF’s with worldwide positions

Maybe you have already heard about Exchange Traded Funds (ETF). Simply put, you can see an ETF as a basket of shares. When you invest in an ETF, you actually invest in all the companies that are listed within the ETF.

If you want low-risk, the key is to invest in low-risk ETFs only. Sounds logical, but to do so you will need knowledge. A guideline is to check for ETF’s that contain more than 1.500 stocks that are spread among the world (i.e. 30% USA, 30% Europe, 40% Others).

An Exchange Traded Fund is publicly traded. This means you can easily buy or sell shares in an ETF at any time of the day. However, to reduce your risk you should only invest for the long term. This means to buy an ETF and hold on to it for at least 7 – 15 years. You can further reduce the risk by doing (a lot of) research. Know what you are doing, and don’t buy ETF’s randomly.

One trick that will do it is to remove your brokers’ app so that you won’t check your phone every ten minutes! (been there, done that).

ETFs are less volatile in comparison to stocks. However, it is still possible that your money will fluctuate by 2% (up or down) each day. Don’t bother about this. Think and invest long term, and review your ETF portfolio on a monthly basis.

That is the last piece of advice: never buy just one ETF. Always create a portfolio with multiple low-risk ETFs.

Happy Investors Recommendation: Higher Return and Lower Risk? Tip: Asymmetrical Investing!

What if you could get higher stock returns while having less risk. Sounds too good to be true? It’s not if you know how to start with asymmetric investing. These are investments where the potential gain is greater than the potential loss. The only way for asymmetric investing is if you have a lot of knowledge and experience. This is for advanced professionals and is also used in the largest mutual funds with a minimum deposit of millions.

I’m not an expert in asymmetric investing, but I do know a very good party named Capitalist Exploits which I highly recommend. I’ve joined their Membership one year ago and it brings a lot of value for unique investment opportunities with commodities. I’m talking about +300% gains on Uranium, Copper, Agriculture, and 60+ buying opportunities. The Membership brought me a significant return on investment! These are true professionals. In addition, they also have a free newsletter where they share masterful tips and research on asymmetric investing with us once a week.

Want more information? read my full Capitalist Exploits Review and Experiences

2. Low-risk Real Estate Funds

Another good way to invest with minimal risk is to choose a reliable real estate fund. By experience, I can tell you that this is an interesting way to receive good returns against lower risk. Also, to get rich with real estate is possible with a long-term investing strategy.

However, you will have to think carefully about the timing of this. Real estate is considered to be a reasonably safe investment choice over the long term. and with long-term, I mean at least ten years. The longer the time frame, the better. In this way, your portfolio has time to recover from substantial losses during crisis’s

For example, we have all have experienced the housing crisis in 2009. The real estate market had fallen ridiculously in value after the crisis. But ten years later the real estate market was recovered and at a higher price level than before the housing crisis. And the lucky ones started with investing just after the crisis. They become very wealthy within a relatively short time.

But timing the market is not advisable. Only the real estate experts can predict, sort or less, whether the housing market is falling or rising. And even they fail often. So how can you invest your money without risk in real estate?

It is possible to go for low-risk investment in real estate by choosing (non-listed) real estate funds. Build a portfolio with low-risk ETFs and low-risk real estate funds, and you are halfway there.

Commission-free Crypto and FOREX Trading with NAGA

Do you want to trade Bitcoin and crypto? NAGA is one of the biggest all-in-one crypto brokers where you can buy crypto 100% commission-free. You can also use the AutoCopy to copy the Top Traders of NAGA. In fact, you can even become a Top Trader yourself and earn up to 10.000 dollars a month if you are really good at it. Anyway, this broker is perfect for anyone who wants to trade crypto 100% commission-free. You can set up an account for free and try it out.

Want to know more? Click for more information

3. Investing in stock market indices

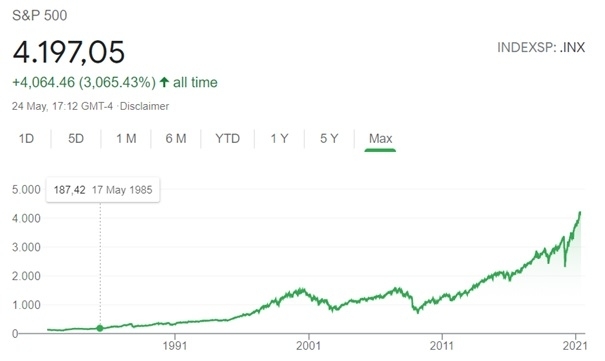

The S&P 500, Dow Jones, Nasdaq. Even if you are a real rookie when it comes to investing, you will probably have heard of these names. These are stock markets. The S&P 500 is the most important stock market in the United States in which the largest USA companies are listed. Think of the S&P 500 as a big basket with 500 different companies in it. Some bigger than others. If the economy is doing well, most of the companies in this basket will grow along. On average, more companies will grow than companies with bad results. The result of this is that the total S&P 500 index will increase in value.

In the image, you can see the trend of the S&P 500.

As an investor, you can buy a share of the S&P 500. By doing so you actually invest in 500 USA companies that are connected to this index. You could say that you believe in the United States industry when you buy an S&P 500 share. This way you can hitch a ride on the economy because if things go well your share will become worth more money. Besides the S&P 500, you can also invest in other indices across the globe.

By investing in a stock market index, you can hitch a ride on the economy of a certain country. This way have less risk because your money is spread over the largest listed companies of that country.

However, I’m in favor of low-risk ETFs with more than 1.500 stocks that are positioned across the globe. This is a better choice for those who want to invest money without risk (in this case: less risk).

Let Money Work for You! Starting on the best investment platforms is half the battle

Are you still working hard for your money? Why don’t you consider letting the money work for you! Create passive income and attain financial freedom. Starting on the best investment platforms is half the battle. Do you want to know what the very best investment platforms are? Then click on the blue link to compare the best investment platforms now. Here you can read my independent comparison of the best online brokers for stocks, crypto, and P2P. Save money and choose the best investment platform!

4. Investing in Government Bonds

Government bonds are a great opportunity to invest money without risk. A government bond can be seen as a debt certificate from the state to you. If you buy a government bond, you are, as it were, lending money to the state. In return you receive interest, and after 5 or 10 years you can reclaim the purchase price. Or you can trade the government bond for a lower or higher price in the meantime.

Usually, the yearly return on a government bond is very low (i.e. 1%). Conversely, it is one of the best ways to approach investing money without risk.

Make no mistake, government bonds can also give very high returns (with higher risk). For example, when Turkey was in crisis when the Lira collapsed in 2018/2019. Then you could get about a 15% return on their government bonds because the country was in danger of going bankrupt. Anyway, there you have it; this exceptional situation involved quite a lot of risk.

If you want to invest money without risk it is better to choose a government bond of a Western country like the Netherlands or Germany. Then you get a modest return but have almost no risk. After all, how big is the chance that the Netherlands goes bankrupt? You can also easily buy government bonds yourself via your investment platform.

5. Invest in the company you work for

Do you know the saying “insider information”? This is a well-known term in investing which means that you have in-depth internal knowledge of a certain company. Because you have this knowledge you know, for example, when they are going to make an acquisition, and so you can buy shares at the moment before and sell them again immediately after. Insider information is punishable. Just so you know. But what insider information does approach, and is not punishable, is investing in the company you work for. This can be a good option if you have detailed information about whether the company you work for is growing faster than the competition. In short, if your company is doing very well and is certain to grow in the coming years, it is relatively safe to buy shares in it. I say relatively because investing money in one share is certainly not without risk.

But do you believe very strongly in the company, and do you know (with certainty) what the growth prognosis for the next 3 years is? Why not put some money aside and invest in the company you work for? Personally, I always look at the free website of Investing.com. in the search bar, you can type the name of the company, to see if they are listed. Another way is to use Google to type the name of the company with “stock” behind it. So for example “Microsoft stock”. And then you’ll immediately see the stock price.

Note: Never invest large amounts of money in just one individual company. That is enormously risky! A guideline is a maximum of 2% of your total portfolio.

6. Investing in a mutual fund

A mutual fund is similar to an ETF. It is a basket with different stocks in it. A big difference is however that a mutual fund is actively managed. Another difference could be that a mutual fund is not always listed on a stock exchange.

When you invest in a mutual fund, you hand over your money to the fund manager. The fund manager manages all the money and buys a mix of stocks, bonds, and alternatives. One disadvantage with this option of investing without risk is that you pay a percentage fee to the fund manager. On the other hand, it is a great advantage that you have your money invested by experts who work full-time on the stock market.

One mutual fund is not without risk. You can approach investing money without risk by selecting multiple mutual funds.

So, build a portfolio with low-risk ETFs, low-risk real estate funds, government bonds, mutual funds, and alternatives. You get the point: risk diversification is the key to approaching the ‘investing money without risk’-utopia.

7. Investing in Peer-2-Peer Lending with high distribution in safer loans

Peer-2-Peer Lending is a new way of investing. The name says it all, you lend money to someone else. Nowadays there are Peer-2-Peer platforms. On these, you can register yourself for both borrowing money and lending money. You can lend money to people from all over the world at fairly high returns of around 9 to 16%.

Although P2P-Lending is becoming increasingly more reliable, it is still to be considered high-risk. So why is P2P-Lending in my list of options for investing money without risk?

Well, it could be a good choice to invest a smaller amount of your portfolio (i.e. 5%) in P2P-Lending to reduce your risk exposure of stocks and real estate. This can be done via the “auto-invest” option, via which you can spread your money among 100+ loans with an A+ rating.

Conclusion about investing money without risk

We have learned that investing money without risk does not exist. There is always a risk. In fact, you even have risk when you put money in a savings account. If inflation is higher than the savings rate, which is recently the case, you become poorer.

You don’t want this. I think. And that’s why the alternative is low-risk investing. If you don’t like risk you can go for low-risk investing. In this article, we have listed these low-risk investments, and this is the summary:

- Low-risk ETFs with worldwide positions

- Low-risk real estate funds

- Stock market indices

- Government bonds

- Investing in the company you work for (never exceed 5% of your total portfolio!)

- Mutual funds

- Peer-2-Peer Lending with high distribution in safer loans

I suggest that you build a diversified portfolio with positions in all of these low-risk investments. The more diversified and equally spread your portfolio is, the lower your risk exposure to one investment in particular. Also, only invest with money that you can afford to lose. And finally, only invest for the long term of at least 7 – 15 years, but preferably 20 – 30 years. A long-term investment strategy helps you to reduce risk.