Dear Happy Investor, in this article we discuss different types of cryptocurrencies and their applications. The main types of cryptocurrencies are discussed, from digital payment to NFTs. Understanding these applications gives us more knowledge and insight to make investment decisions.

Let's begin.

Content

- My experiences with different types of cryptocurrencies

- Which different types of cryptocurrencies are there?

- Crypto types (Blockchain Platform) used for digital payments

- Crypto Types (Blockchain Platform) used to build Smart Contract

- Cryptos (Blockchain Platform) used in to build Decentralised Finance (DeFi)

- Crypto Types (Blockchain Platform) used in Application of Non Fungible Tokens (NFTs)

- Crypto types used as Stable Coins

My experiences with different types of cryptocurrencies

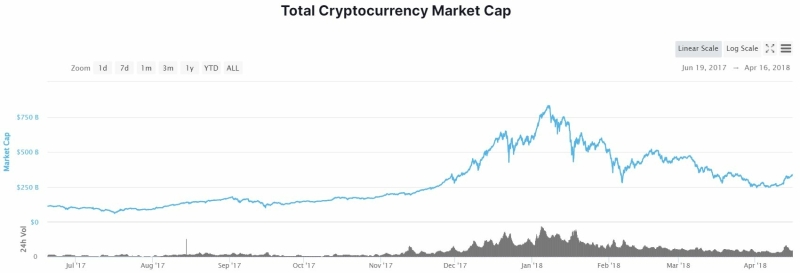

Summer 2017. I am enjoying the nice weather. With my laptop open I am sitting in the garden. I am in the final year for completing a master's degree in Management & Organization. What a life. At the time, I had been investing for some time already. Particularly in growth stocks, as my interest is in innovation. And then, while scrolling on my laptop, I came across an interesting article about different types of crypto currencies.

I found information about the Bitcoin. But the second article was even more interesting. This was about Ethereum and other types of cryptocurrencies. The technology behind this is what sparked my great interest. Blockchain technology is revolutionary and is going to provide a lot of opportunities.

At the time, I had bought Ethereum, among other things. Not with large amounts, but eventually with large profits in early 2018. Then I also experienced the other side: within a few months, many of the different crypto coins (altcoins) were still at only small profits or even losses. I held this for a long time until mid-2021, but that bizarre crash was the reason for me to think hard.

I thought: how can I become financially independent in a sustainable (consistent) way? From this question, Happy Investors was also born. To help others with sustainable financial success. And this, unfortunately, does not include the different types of cryptocurrencies. It is too uncertain, too fickle and above all too risky. Since 2018, I have started to fully immerse myself in investing in stocks, including ETFs but especially growth and value stocks.

However, this is not to say that crypto does not offer opportunities. It's just a very high-risk game. Below you will find explanations of the most important types of crypto coins (altcoins).

Which different types of cryptocurrencies are there?

There are different types of cryptocurrencies. They all work on blockchain technology, but have different applications and uses. There is also a difference in use. Some types of crypto-currency are designed as a unit of payment, while others have more the purpose of smart contracts. Also, certain types of crypto-currency have a limited expenditure. Since its inception, it has been established that only X number of coins can be created (mining). Thus, the supply is fixed. But there are also altcoins where one can create additional crypto coins at any time. The latter is unfavorable for long-term investors/speculators.

Crypto types (Blockchain Platform) used for digital payments

The main function of Crypts initially was to be used as a mode of digital payments. Today there are many cryptocurrencies used as a mode of digital payment. Bitcoin was the first in the lane, while other cryptocurrencies are also being used as a payment mode these days.

Bitcoin (BTC)

BTC or Bitcoin is considered to be the first-ever official crypto currency in the world. It was founded by Satoshi Nakamoto in 2008. The currency was put into circulation when its implementation was released as open-source software in 2009. The term “mining” is referred to be the production method of Bitcoins. They may be traded for a variety of currencies and services. Since Bitcoin, several types of crypto currencies have been launched. Some are well thought out. Other types of crypto currencies are pretty hopeless and are also called meme coins.

How Bitcoin Works?

Bitcoin allows users to conduct end-to-end transactions using blockchain technology. The transactions are secured by the blockchain's mechanism and accessible to all users. The transactions can only be decrypted by the owner using a "private key" issued to that owner. Bitcoin users have total control over sending and receiving the money. It allows for anonymous transactions all over the globe. Proof-of-work (PoW) is a complicated, time-consuming process that bitcoin miners apply to verify blocks of transactions and earn additional bitcoins.

There are different types of crypto coins. What is interesting about Bitcoin is that it has a limited number of coins. Only 21 million coins can be created. It becomes increasingly difficult for miners to create new Bitcoins as we reach this limit. Other types of crypto currencies do not have a limited number. When investing in crypto, it is important to choose especially crypto coins with a limited number, because by definition this increases the value. After all, supply remains constant while demand may increase over time. The price will increase as a result. Note that in addition to supply and demand, there must also be relevance to the use case.

Litecoin (LTC)

Litecoin was created in 2011 for the purpose serve as a Bitcoin alternative. Litecoin is an open-source worldwide decentralised payment network which means it has no central authority, like some other types of cryptocurrencies.

How Litecoin Works?

Litecoin, like Bitcoin, employs a proof-of-work mechanism (PoW) to verify transactions on the blockchain, but it's considered a lighter, faster version of Bitcoin due to several tweaks. The primary difference between Litecoin and Bitcoin is that Litecoin employs the script mining algorithm to allow faster transaction times. Every 2.5 minutes, Litecoin creates a new block to be mined, which is about four times faster than Bitcoin's 10 minutes. However, contemporary Litecoin is no longer of interest, as other types of crypto currencies have been developed that realize much faster transactions.

Binance Coin (BNB)

Before becoming the home currency of Binance's blockchain, Binance Coin launched in July 2017 on the Ethereum blockchain. BNB or Binance Coin is a token that is used as a medium of exchange on world's biggest crypto exchange, Binance. It operates on Binance's blockchain platform and was built on the Ethereum blockchain initially. It may be used to make payments, plan travel, provide entertainment, provide internet services, and even provide financial services.

XRP (Ripple)

Ripple is an open-source protocol that aids tokens. The tokens represent cryptocurrency, fiat currency and commodities. It is based on a distributed open-source protocol and was founded in 2012. Ripple promises to be able to conduct "secure, instantaneous, and instantly free international financial transactions of any size with no chargebacks." The native XRP is used in the ledger.

How Ripple Works?

XRP, unlike Bitcoin and many other cryptocurrencies, cannot be mined; instead, a limited number of coins – 100 billion XRP – are already in circulation. Moreover, unlike Bitcoin and other cryptocurrencies, XRP is not reliant on the blockchain's complex digital verification process. The Ripple network has a one-of-a-kind transaction validation system, in which participating nodes poll each other to confirm transactions. As a consequence, XRP transactions are less costly and faster than Bitcoin transactions.

Read more about cryptocurrency investing for dummies.

Crypto Types (Blockchain Platform) used to build Smart Contract

Just as Bitcoin is famous for being used as the mode of digital payment, there are types of crypto coins that are specifically used to end-to-end smart contracts. In smart contract the agreement is made on predefined conditions using coding. The contact the executed and matured if already feed conditions met. Ethereum has the most famous blockchain network that specializes in building smart contracts.

Ethereum (ETH)

Ethereum was created in 2015 as an open-source platform based on blockchain technology. Ethereum was conceived by a programmer namely Vitalik Buterin in 2013. Besides this, Di Lorio, Hoskinson, Gavin Wood, and Joseph Lubin are other names who founded Ethereum. Thanks to Ethereum, many other types of crypto currencies have been developed, all of which operate on its technology.

How Ethereum Works?

This is the second most important type of cryptocurrency. Ethereum is a blockchain network that was built as a programmable blockchain. It was built to enable people to create, publish, monetize, and utilize decentralized programs rather than maintain a currency (dApps). Ether (ETH), the Ethereum platform's native currency, was designed as a method of payment. The production of ETH also employs a proof-of-work approach. Ethereum has benefited from many initial coin offers due to the Ethereum blockchain's deployment in several ICOs. Non-fungible tokens (NFTs) have also risen in popularity owing to Ethereum.

In the context of investing, we want to spread out. This means including different types of crypto coins in a portfolio.

Cardano (ADA)

Charles Hoskinson is a co-founder of Cardano in 2015 and launched the platform and the Ada token in 2017. Cardano employs proof-of-stake (PoS), which removes the time-consuming PoW calculations. It also removes massive electricity usage required for mining coins like Bitcoin, making the network more efficient and sustainable.

Cardano's core applications include traceability and identity management. The first application may make it easier to acquire data from a variety of sources. The latter may be used to inspect the production process of a product and, in certain situations, to prevent fraud and counterfeit items.

Cardano is being developed in five phases to help the network accomplish its goal of being a decentralized application (dApp) platform with a multi-asset ledger and verified smart contracts. Each phase, or era, of the roadmap is founded in the research-based methods and peer-reviewed insights that have helped Cardano build a scholarly reputation.

Although Cardano has been around for a while, it is still considered one of the new crypto coins with potential.

Cryptos (Blockchain Platform) used in to build Decentralised Finance (DeFi)

Decentralized finance is the way of keeping your money on decentralized wallets just like you do with the banks. But you will not be charged as banks do, and you can send the received money in a matter of seconds. Such success would not have been achieved without the blockchain network. Certain blockchain networks introduce this technology. Aave (AAVE), Synthetix (SNX), and yEarn (YFI) are fine examples of DeFi tokens.

Solana

BDSwiss was founded in 2012 and has since launched on a fantastic development trajectory. Forex and commodity trading continue to be commission-free. Commodities, indices, and equity CFDs are priced acceptably.

How Solana Works?

The Sol cryptocurrency is generated via the Solana blockchain platform. Solana has grown significantly in decentralized finance (DeFi), notably with its smart contract technology. The smart contract technology consists of programs that run on the platform according on predetermined conditions.

Crypto Types (Blockchain Platform) used in Application of Non Fungible Tokens (NFTs)

Besides its wide applications, the blockchain network has been progressively growing in the art industry. You can have your unique art in your name and nobody can replace it; however, it can be shared, but it will have a record of your unique ID, so your rights will be protected. NFTs can be anything digital, including drawings, music, photographs, videos, and any digital file.

Well-known NFT crypto types are: MANA of Decentraland, SAND of The Sandbox and AXS of Axie Infinity are examples of NFT tokens.

Crypto types used as Stable Coins

Some types of crypto currencies are used as stable coin. These are blockchain-based cryptocurrencies whose tokens are backed by an equal number of US dollars make it a stablecoin with a price tied to $1.00 USD. Stablecoins mirror typical fiat currencies, such as the dollar, euro, or Japanese yen, stored in a separate bank account.

Tether

Tether's precursor, "Realcoin," was unveiled in July 2014 as a Santa Monica-based firm by co-founders Brock Pierce, Reeve Collins, and Craig Sellars. The first tokens were released on the Bitcoin blockchain on October 6, 2014. The Omni Layer Protocol was used to do this.

How Thether Works?

Tether is the cryptocurrency that was referred to as a "stablecoin," or one that is backed by fiat cryptocurrency. The value of the tether is tied to the US dollar, a fiat currency.

Tether is designed to promote consumers stability, transparency, and low transaction fees. Tether is considered to be the less volatile currency in crypto market as its price doesn’t change frequently. Trading pandits always use it as the crucial product of their entire portfolio.

Tether is a cryptocurrency tied to the US dollar that claims to have a 1:1 value to the US dollar, however this claim has been called into doubt. Tether, Ltd. claims that no tether redemption is guaranteed, meaning that tethers cannot be traded for US dollars.

![5x Best DeFi Coins with Long-term Potential [2022]](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/responsive/6446244/best-defi-coins-long-term-2560x1100_614_264.png)