Investing in value stocks? If so, follow the path of well-known investors like Warren Buffet and Peter Lynch. One invests in strong companies for the long term, the other invests for both the short and long term. But both are looking for Value. And this is how they achieve higher than average returns: value stocks with low downside risk and high upside potential.

In this article, we'll discuss the pros and cons of value stocks. I'll also explain how I find them myself (and how you can too). And finally, we'll cover examples of value stocks with momentum.

On to sustainable financial success!

What is a Value stock?

A value stock is a stock that trades at a price below its intrinsic value. This means that the price of the stock is lower than the actual worth of the company. Value stocks are often companies that have been around for years, with steady revenue and earnings growth, but have yet to see their stocks reach their full potential.

Consider a value stock to be a share in a publicly traded corporation that is currently available at a discount: If you buy shares of the company today, you will be in a position to profit when other investors discover what they are passing up in the future.

The most commonly used term is Value stocks. Value implies future value because the current price is below the (future) intrinsic value. Both a large company that pays a dividend and a growth stock can be Value stocks. But typically, growth stocks usually come with a premium on its stock price, reducing the likelihood of undervaluation. So Value stocks are usually found in stable companies that are trading below its intrinsic value for whatever reason.

Pros of Value Stocks

Value stocks offer investors some advantages, including:

- Lower risk: If you can buy shares of a strong company below its intrinsic value, you create a buffer. This buffer is also called margin of safety. The larger the margin of safety, the lower the risk of price loss from the purchase price

- Potentially higher return: a value share can trade below its intrinsic value for a long time, until the moment the market discovers that the company is actually worth more. The result is that people step in, causing the stock price to rise at a rapid pace. This gives you higher returns than ETF investing, while the risk is acceptable.

- Volatility: the volatility is generally lower than riskier assets such as growth stocks, most small cap stocks, etc.

- Dividends: unlike growth stocks, most, but not all, "traditional" value stocks pay dividends

Cons of Value Stocks

Not all value stocks are a good investment. They have some disadvantages, including:

- Low quality: Some value stocks are cheap for a reason. This is because they are stocks of poorly performing companies that offer low quality. These types of companies are less likely to grow in the future, and this justifies a lower valuation. In fact, financial ratios such as P/E are low, but the stock does not trade below its intrinsic value. This distinction is difficult to make for novice and expert investors alike

- Findability: really good value stocks are hard to find, as these are usually the lesser-known companies. The "under the radar" bargains that the market has not yet discovered.

- Patience: for some value stocks you need a lot of patience. They usually grow much slower than growth stocks. Therefore, it can take years before the price breaks out

As a Happy Investor, I have been investing in stocks since 2012/2013. Initially, my focus was on risky growth stocks. But over the years I have become more advanced and my capital has grown accordingly. Nowadays, I am switching more and more to Value stocks. Below I explain how I find them.

How do we select the best Value stocks

I describe the best Value stocks as follows: these are stocks of strong companies whose price is below its future intrinsic value. In doing so, the stock scores strongly on several factors, namely (1) valuation, (2) revenue and earnings growth, (3) profitability, (4) momentum and (5) short-term EPS revisions.

The combination of strong companies + high scores on these factors leads to the best Value stocks that can offer high returns in both the short and long term.

These factors are called factor analysis. This is how portfolio managers of investment funds act. They invest in stocks that score high on multiple factors, because it has been proven from them that the risk is relatively lower (because of valuation) and the return is high (because of future growth).

I personally have access to factor analysis from two paid databases. But this is not enough. Factor analysis is mainly short-term (6 - 12 months), while I prefer to invest in strong companies for the long term. This is why I apply extensive fundamental analysis to examine the company's strategy. The crucial question is: does this company have a sustainable competitive advantage? We also see the answer in financial ratios, including ROE (Return on Equity).

Asymmetric Investing (Deep Value)

There is a second way to find the best Value stocks. This is called deep Value. Our partner Capitalist Exploits works this way. They look for asymmetrical investments where the downside risk is very small (because it offers deep Value), while the upside potential is very high.

They find these types of stocks by first looking at the macroeconomic level. They look for sectors that have been neglected for years. Over time, this causes the weaker companies to drop out. Only the strong companies remain. However, the overall supply is reduced. Now, from their research, they look at these types of sectors whose demand increases over time.

If supply is reduced and demand increases, then this means more future profitability for the remaining companies. These companies often have Value stocks whose price is well below their future intrinsic value. By getting in before the herd, you get in early. And in this way high returns are achievable.

Now you may think: why do you "promote" another party? My goal is to help you to financial freedom. I myself have been affiliated with this party for 2+ years, and my experiences are extremely positive (and when you become a member you will understand why). Additionally, Capitalist Exploits offers advanced research that I cannot offer. This makes their offerings an enhancement to my own research on the best stocks.

The banner below will give you more information about how they work.

Examples of value stocks

Below are examples of value stocks for inspiration. These are stocks that currently score high on the factor analysis as explained above. In my opinion, they are not strong companies. Therefore, I currently do not invest in them. But that does not mean that they cannot offer high returns in the short term (6 - 12 months).

Let's look at the examples for inspiration for further research.

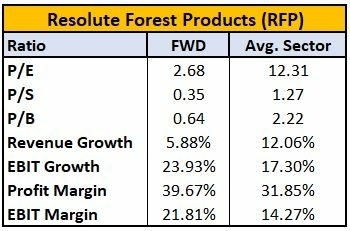

Value stock 1. Resolute Forest Products (RFP)

source: Happy Investors analysis Q2 2022

source: Happy Investors analysis Q2 2022

Resolute Forest Products Inc. is a company that operates in the industry of forest goods and provides customers with a variety of forest products. These products include market pulp, tissue, wood products, and paper, and they are sold in over 60 different countries.

The business is broken up into four distinct sub-industries, namely market pulp, tissue, wood products, and paper. Its market pulp includes both virgin pulp and recycled bleached kraft (RBK), which is made from recycled paper. It produces a variety of tissue products for the retail and out-of-home industries, including recycled and virgin paper goods in premium, value, and economy grades.

The uncoated mechanical papers, such as supercalendered paper and white paper, as well as the uncoated freesheet papers, make up the company's specialty papers. It supplies newsprint to newspaper publishers all around the world as well as commercial printers in North America for uses including inserts and flyers.

Resolute Forest Products Inc. is an example of a value stock that emerges from a cyclical movement. Timber prices have risen hard in the short term. As a result, RFP's earnings (growth) are rising exponentially. In short term, the stock has become very cheap.

I personally do not invest in this company because it is not a unique/strong company in my eyes. Moreover, you want to get in for the cyclical movement, although RFP seems to have enough momentum. Also important is that it has fairly high debt on its balance sheet. And given the size of the company's total liabilities, Resolute Forest Products has a hard time managing this debt. This is a risk.

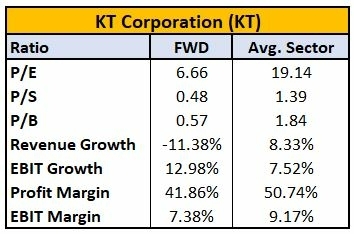

Value stock 2. KT Corporation (KT)

source: Happy Investors analysis Q2 2022

source: Happy Investors analysis Q2 2022

KT Corp is a corporation that is established in Korea and mostly offers services related to telecommunications. The business of the company is divided into four distinct divisions. The Information and Communications Technologies segment is involved in the provision of telecommunication services to individual, residential, and corporate clients, as well as the convergence industry.

The Finance division is responsible for offering various financial services to customers, such as credit cards. Satellite television services are provided through the Satellite Broadcasting Sector.

Security services, satellite service, information technology and network services, as well as global business services, which provide worldwide network services to international or domestic corporate customers and telecommunications firms, are included in the Other sector.

The primary services provided by the company are mobile voice and data telecommunications services, fixed-line services, credit card processing and other financial services, and other services. The company's primary focus is on the development of software platforms.

KT corporation's value stocks offer strong relative valuation. The relatively lower profitability and contraction in sales pose a long-term risk. On the other hand, earnings growth is expected in the near term. The company currently pays about 5% dividend.

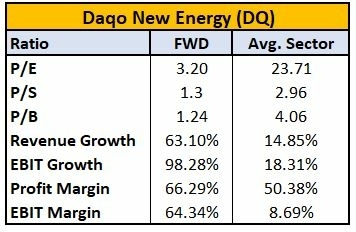

Value stock 3. Daqo New Energy (DQ)

source: Happy Investors analysis Q2 2022

source: Happy Investors analysis Q2 2022

Daqo New Energy Corp. is in the business of producing polysilicon. In order to manufacture polysilicon, the Company makes use of either the chemical vapour deposition method or a modified version of the Siemens method. Polysilicon and Wafer are two of the company's segments.

The Company produces and sells polysilicon to photovoltaic product manufacturers, who then process the polysilicon into ingots, wafers, cells, and modules for solar power solutions.

The business provides ready-to-use polysilicon that has been packaged to satisfy the requirements for crucible stacking, pulling, and solidification. As part of its downstream photovoltaic product production operation, the Company provides wafers to customers.

Through tolling agreements, the Company also provides wafer OEM service to external customers by processing polysilicon to generate ingot and wafer.

In Xinjiang, the yearly capacity for polysilicon is around 12,150 metric tonnes (MT). The annual capacity of the company's wafer manufacturing operations is close to 90 million pieces.

Daqo New Energy is the best value stock from this list. DQ scores very high on all factors. The probability of high returns is plausible. Yet there are real risks, such as the fact that this is a Chinese company. And no one can gauge the Chinese government.

Value stock 4. Flex Ltd. (FLEX)

Flex Ltd. specialises in design, engineering, manufacturing, and supply chain services and solutions. Flex Agility Solutions (FAS) and Flex Reliability Solutions are the two business divisions that make up the Company (FRS).

End markets in the FAS segment include Communications, Enterprise and Cloud (CEC), which includes data infrastructure, edge infrastructure, and communications infrastructure; Lifestyle, which includes appliances, consumer packaging, floorcare, micro mobility, and audio; and Consumer Devices, which includes mobile and high velocity consumer devices.

The FRS segment includes end markets such as Automotive, which includes autonomous, connectivity, electrification, and smart technologies; Health Solutions, which includes medical devices, medical equipment, and drug delivery; and Industrial, which includes capital equipment, industrial devices, renewables (including its Nextracker business), grid edge, and power systems.

Companies in the technology, healthcare, automotive, and industrial sectors are among its customers.

In the same way as the majority of other businesses, Flex Ltd. uses debt. Therefore, shareholders have a right to be concerned about the company's use of debt because things can quickly move from bad to worse, and lenders have the ability to seize control of the company.

Value stock 5. Green Brick Partners (GRBK)

Green Brick Partners, Inc. is both a homebuilding and land development company, giving them a broad range of capabilities. At its residential neighbourhoods and master planned communities, the Company is involved in all areas of the homebuilding process, including site acquisition and development, entitlements, design, construction, title and mortgage services, marketing and sales, and the production of brand images.

It conducts its business via three distinct divisions, which are the Builder operations Central division, the Builder operations Southeast division, and the Land development division. Builder operations Central is responsible for overseeing all of the company's construction projects in Texas, while Builder operations Southeast is in charge of overseeing all of the company's construction projects in Georgia and Florida.

It does this by purchasing land, developing it, and building homes under its eight different brands of builders in four different markets. Its primary markets are in the United States, specifically the Dallas-Fort Worth (DFW) and Atlanta, Georgia metropolitan areas, as well as the Treasure Coast, Florida area. It also has a minority stake in Colorado Springs.

In the same way as the majority of other businesses, Green Brick Partners uses debt. Over the course of the last five years, GRBK's debt to equity ratio has dramatically climbed higher. Since the operating cash flow for GRBK is negative, the debt is not being adequately paid by the company.

![How to Invest in Value Stocks + 5 Examples [2022]](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/value-stocks-investing-explanation-2560x1100.png)

![What is the best thing to invest in? Stocks to Crypto [2022]](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/what-is-the-best-thing-to-invest-in-2560x1100.png)