To buy or not to buy the VanEck Sustainable World ETF? In this analysis, we examine the TSWE ETF to determine if it is an interesting investment. And for whom. This article includes an analysis of VanEck Sustainable World ETF based on its strategy and key metrics. We then look at the top 10 holdings and conclude with a risk and return analysis.

Do we want to buy VanEck Sustainable World ETF based on price predictions and risk? After this article, you'll know the answer.

ETF Analysis: VanEck Sustainable World ETF (TSWE)

The VanEck Sustainable World ETF (TSWE) is a fund that seeks to provide investors with exposure to companies that are engaged in sustainable development. The fund's investment objective is to achieve long-term capital appreciation.

VanEck's Sustainable World ETF offers investors a way to invest in sustainable companies from around the world. The VanEck Sustainable World ETF is designed to provide exposure to companies with positive net operating cash flow, as well as superior growth rates and a high return on equity.

Because the TSWE ETF offers physical exposure, investors who purchase it will really become owners of a portion of each of the 252 holdings that the fund tracks.

To determine whether or not to buy VanEck Sustainable World ETF, we need to analyze TSWE on multiple facets: from strategy to its top 10 holdings.

Strategy Analysis of VanEck Sustainable World ETF (TSWE)

Our VanEck Sustainable World ETF analysis shows that the fund is highly diversified and offers exposure to almost all regions of the world, with a focus on companies active in renewable energy, water technology and sustainable agriculture.

The tracker invests in the 250 most liquid, highly capitalized companies in the world that adhere to the UN Global Compact Principles for Responsible Corporate Behavior. In addition, it excludes companies that do not adhere to responsible business ethics, such as alcohol, animal testing, defense, weapons, gambling, pornography, tobacco and nuclear power.

It may not be the most sustainable ETF, but sustainability is an important criteria for the tracker. The focus on ESG might be a reason for you to buy or not buy VanEck Sustainable World ETF.

Pros and Cons Analysis of VanEck Sustainable World ETF (TSWE)

From our analysis of VanEck Sustainable World ETF, we obtain some advantages and disadvantages that may influence whether or not to invest in this fund.

Pros

TSWE is a solid choice for investors looking to invest in sustainable initiatives and companies that are working towards a more environmentally friendly world.

It has an excellent asset allocation, with a large portion of its portfolio dedicated to renewable energy and clean technology. This helps investors diversify their portfolios without sacrificing returns.

TSWE has a large number of companies in its index, which means that it tracks a wide swath of the global economy. This will help you get exposure to more companies and markets than you might be able to find on your own.

Cons

The VanEck Sustainable World ETF has some drawbacks. For example, it doesn't track any specific industry or sector; instead, it invests in companies across the globe. This can lead to some issues when it comes time for investors to make sure their investments are diversified enough and don't have too much exposure to one thing or another.

Also, because there's no specific industry or sector being tracked, it's not possible for investors to know how well their investments are doing relative to other industries or sectors—they simply cannot tell if they're doing better than average or worse than average within an industry or sector.

The ETF has a 0.2% expense ratio, which is higher than the other similar funds. Investors should consider whether they are comfortable with this level of fees when evaluating this ETF as an option for their portfolio.

If you want to invest in the cheapest ETF’s with low costs, than you should consider the best eToro ETFs.

Here are some important financials about this ETF analysis:

- Ticker: TSWE

- Annual return since inception: 10.40%

- Dividend: 1%

- Number of holdings: 253

- Total expense ratio: 0,20%

- P/E-ratio: 16.7 (according factsheet)

TOP 10 Stocks Analysis of VanEck Sustainable World ETF (TSWE)

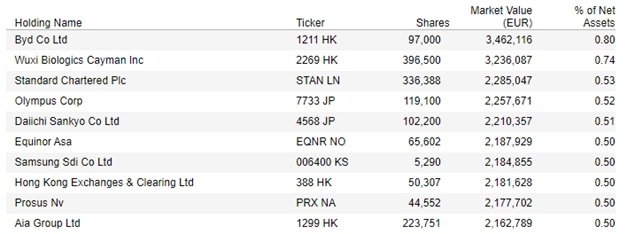

The top 10 holdings in the overall ETF are only 5.6%. From analysis, we can speak to a very proportionate spread of capital across its holdings. Typically, this should give less volatility. One drawback is that it may come at the expense of potentially higher returns.

Analysis of top 10 holdings

Let's analyze some of the stocks within the VanEck Sustainable World ETF.

Byd Co Ltd stock

BYD Co Ltd (BYD) is a company that develops, manufactures, and sells various electronic products including rechargeable batteries, solar products, mobile components, and more. In addition to that, the organization provides services for complete product assembly. It manufactures and sells both conventional automobiles powered by internal combustion engines as well as new energy vehicles.

The company has created a wide variety of products, some of which include rechargeable batteries, photovoltaics, handset components, smartphones, laptops, notebook computers, gaming gear, and other consumer-related goods. Automobile products include high-end, medium-end, and low-end automobiles, as well as full car molds, auto parts, DM (dual mode), and pure electric vehicle models.

It provides its goods and services to makers of portable electronic equipment such as handsets, electric power tools, and other types of portable electronic equipment.

Wuxi Biologics Cayman Inc stock

WuXi Biologics Cayman Inc., doing business as Wuxi Biologics, is a company that offers solutions for the discovery, development, and manufacture of biologics. The company provides services in the areas of protein creation, assay development, antibody generation, screening, characterization, and optimization, as well as testing and regulatory affairs.

It does this by utilizing the WuXiBody bispecific antibody platform to identify new antibodies, the CRISPR gene editing technology to improve cell growth and productivity, and the microbial expression and fermentation platform to create new proteins and plasmids.

Through its platform technology, Wuxi Biologics is also able to offer services such as the development and manufacturing of cell culture products, scaled-up manufacturing, and other related services.

Olympus Corp stock

Olympus Corporation, more commonly known simply as Olympus, is a producer of optical and digital precision machinery and instruments. The company designs, manufactures, and distributes medical and healthcare equipment and gadgets, as well as imaging and information technology products, to a variety of different industrial markets.

It provides scientific solutions such as laser scanning microscopes, industrial and biological microscope systems, remote visual inspection products, and non-destructive testing systems; medical solutions such as endotherapy devices, endoscopes, and endoscopy products; and medical systems such as endoscopes, microsurgery, and ultrasound products to assist medical professionals in the treatment of patients.

In addition to that, it provides services in the areas of biomedical materials and system development.

How diversified is this ETF?

VanEck Sustainable World ETF (TSWE) is a highly diversified exchange-traded fund (ETF) that holds a basket of companies with a wide range of business activities. The ETF offers exposure to a broad range of industries, sectors, and geographies.

The fund is not affiliated with a single country or region; rather, it seeks to track the performance of a broad index of companies that have been identified by their managers as having strong ESG credentials while maintaining exposure to global equities.

From our VanEck Sustainable World ETF analysis, we would venture to say that the tracker is suitable for the somewhat passive ETF investor. The tracker is not going to beat the market. Possibly, however, it will match the average. And the focus on sustainability is a positive trend.

Do you want to beat the market? In that case you can still include this tracker in your portfolio together with riskier assets, such as the best shares.

Other Remarks

The fund's managers have created a portfolio that provides exposure to both developed and emerging markets. This gives investors access to a wide variety of companies and industries, allowing them to invest in a broad range of financial instruments without sacrificing exposure to specific sectors like energy or food production.

Another point is that TWSE is not suitable as a dividend ETF. For that, the dividend is simply too low. Check out the best dividend ETFs.

Risks and Returns of VanEck Sustainable World ETF (TSWE)

The fund is highly diversified, so it's relatively stable. However, it is not without risk: the sustainability theme means that some of these companies are more exposed to environmental risks than others, and there's always the chance that one or more of the companies will fail to achieve their goals.

Investors looking to buy the VanEck Sustainable World ETF (TSWE) may be concerned about the risks and returns associated with this product. The following analysis will detail the risks, along with the potential returns.

Risk analysis VanEck Sustainable World ETF (TSWE): what to consider?

The first is the risk of losing money when things don't work out quite as planned. Because sustainable world funds are designed to reflect how the world is changing, they tend to have higher volatility than other types of funds. This means that if you're looking for a long-term investment, you may want to consider one that invests in stocks instead of bonds or other fixed income products.

The TSWE has had a volatile history since its inception, and it has not always performed well in spite of this volatility.

The final risk from analysis is the number of positions. In our view, 250 holdings with proportional distribution is a significant risk diversification. On the other hand, it offers less risk diversification than, say, a global ETF, with 1000+ stocks in its portfolio.

Price prediction VanEck Sustainable World ETF (TSWE)

The sustainability focus of this ETF makes it potentially attractive for investors looking for a low-cost way to invest in clean energy companies or companies with environmentally friendly practices.

It also makes it appealing for individuals who want to invest in companies with a focus on sustainability without having to actively research or manage these investments themselves - which can be time consuming and expensive when done incorrectly.

Is there a good price forecast for VanEck Sustainable World ETF? Not really. Past results are no guarantee for the future. The return since inception is 10.40%. However, this is over a very favorable period from 2013. During that period, other trackers were much better on a return basis.

A realistic long term price forecast for TSWE is an average return of 6 - 9% per year, depending on time periods and term of investment.

Where to buy ETF’s?

It is important to choose the best investment platforms. They offer a wide range of ETFs so that you can build a good portfolio. They also have low transaction costs. Some even offer commission-free investing. In the long run, this saves a lot of costs.

![Buy Stock Mercadolibre or Not? Analysis [2022] Happy Investors](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/responsive/6843525/mercadolibre-stock-buy-or-not-2560x1100_878_377.png)

![Buy Palantir Stock or Not? Advice [2022] Happy Investors](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/responsive/6791848/buy-palantir-stock-or-not-2560x1100_878_377.png)

![10x Best VanEck ETFs to Buy [2022]](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/responsive/6608497/best-vaneck-etfs-2560x1100_734_315.png)