Dear Happy Investor, the MSCI China Consumer Discretionary ETF offers a diversified investment in Chinese consumer goods companies. As part of diversification, it makes sense to invest a small portion of assets in Asia and/or emerging markets. However, our CHIQ ETF analysis shows that it can be a rather risky move. Volatility is high, and the spread is limited to purely Chinese consumers. While other moves are possible, such as a global ETF or one of the best ETFs.

In this MSCI China Consumer ETF analysis (CHIQ), we explain the pros and cons. You'll also find an analysis of the top 10 stocks, and we look at the risks and price expectations (returns).

ETF Analysis: MSCI China Consumer Discretionary ETF (CHIQ)

This tracker aims to produce investment outcomes that are similar to the MSCI China Consumer Discretionary 10/50 Index in terms of price and yield. The fund invests at least 80% of its total assets in the underlying index's securities, as well as ADRs and GDRs based on the index's securities. The underlying index measures how well firms in the MSCI China Index (the "parent index") perform in the consumer discretionary category, as defined by the index provider.

The fund's goal is to provide investors with capital appreciation and current income with minimum volatility.

Strategy of MSCI China Consumer Discretionary ETF

CHIQ focuses on one of China's most popular investing categories: the consumer. While this simple fund gives you a broad view of the consumer discretionary sector, it excludes small caps and applies position limitations on the biggest brands. All main share classes, including A, B, and H shares, red chips, P chips, and international listings, are covered by CHIQ. In addition, the fund's quarterly-rebalanced index utilizes a 10/50 market-cap-weighting technique.

Pros and Cons of MSCI China Consumer Discretionary ETF

An analysis of MSCI China Consumer Discretionary ETF on pros and cons.

Pros

- The MSCI China Consumer Discretionary ETF is a great way to get exposure to the consumer sector in China without taking on too much risk.

- It was created specifically to help investors gain exposure to the consumer discretionary sector in China, which can be an important part of diversifying their portfolios.

- The CHIQ tracker focuses on companies that are leaders in their respected industries

- It has a high concentration on large-cap stocks with a significant market capitalization

- The fund only holds 76 stocks at one time, so it's easy to track its progress and compare it to other funds' holdings at any given time!

Cons

- The fund is highly concentrated in a single industry - the consumer discretionary sector. This means that the fund is subject to sector-specific risk, or the risk that an entire industry will experience negative returns at the same time. For example, if consumers stop buying cars or start eating out less often, then this could hurt the performance of the fund.

- This ETF is extremely volatile, which means it's expected to rise or fall with the market by more than twice as much as an S&P 500 index fund would. This can be good if you're looking to make a lot of money on a particular stock or sector, but it also means that this ETF will lose value faster than other investments when the market goes down

- The number of holdings of 76 is not very high. Moreover, the top 10 are about 50% of the total. This may make this fund less suitable for risk-averse and/or passive investors

Here are some important financials about our CHIQ ETF analysis:

- Ticker: CHIQ

- Annual return since inception: 3.44%

- Dividend: 0.73%

- Number of holdings: 76

- Total expense ratio: 0,65%

- P/E-ratio: 54.15 (according factsheet)

Based on these financials in our China Consumer ETF analysis, we could say that it is rather expensive with 0.65% per year. More importantly, the P/E-ratio is very high for an exchange-traded fund. Maybe this is justified if the holdings are showing strong future growth figures. But still, a high P/E indicates a larger down-side risk meaning it could drop and give a better entry point in time.

Tip: you should know that there are many alternatives such as the best eToro ETFs.

TOP 10 Stocks Analysis of MSCI China Consumer Discretionary ETF (CHIQ)

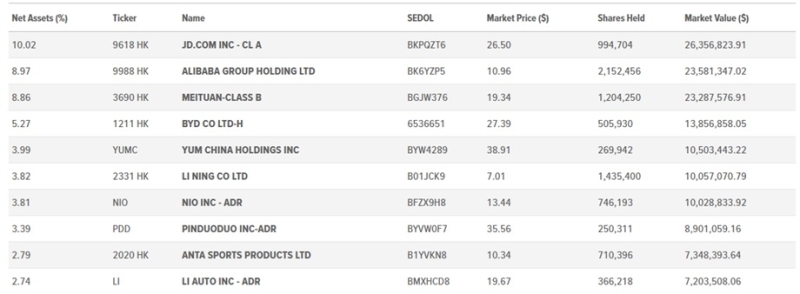

source: factsheet CHIQ may 2022

source: factsheet CHIQ may 2022

The top ten largest holdings account for 53.67% of the portfolio. The fund is also highly focused in Hong Kong and China stocks, with almost 95.94% exposure combined. This means the top 10 holdings have a significant impact on the total CHIQ ETF. According to our experience and analysis, this could lead to higher returns if the top 10 selection is of strong stocks. However, according to our CHIQ ETF analysis it will also imply that it is quite volatile. Hence this exchange-traded fund is not suitable for novice investors unless they can manage the volatility.

Analysis of top 10 stocks within CHIQ ETF

Let us have a closer look and analyze a few stocks that CHIQ is tracking. Good to know is that none of these stocks are among our best selections. Chinese stocks are under a lot of pressure from the Chinese government. This depresses earnings tremendously. And possibly the long-term growth potential.

Want to invest in stocks? Check out our best stocks based on factor analysis and calculation models. This is a proven strategy that leads to higher than average returns.

JD.com Inc.

JD.com, Inc. is a technology-driven online retailer. It sells audio, video, and book items, as well as gadgets and other stuff. The JD Retail and New Businesses sectors are responsible for the company's operations. JD Retail specialises on online retail, online marketplaces, and marketing.

JD.com has invested heavily in high-tech and AI delivery via drones, autonomous technologies, and robotics, and now boasts the world's largest drone delivery system, infrastructure, and capabilities. It has lately begun testing robotic delivery services and creating drone delivery airports, as well as launching its first driverless delivery van.

The New Businesses sector includes third-party logistic services, international business, and technology efforts, asset management services for logistics property owners, and JD Property's development property sales. Qiang Dong Liu created the firm on June 18, 1998, and it is headquartered in Beijing, China.

Alibaba Group

Alibaba Group Holding Ltd (Alibaba Group) is a technological infrastructure and e-commerce company. Merchants and enterprises can use the company's basic technical infrastructure services to promote, sell, and operate on the Internet. Core commerce, digital media and entertainment, cloud computing, and other innovation projects are among its companies.

Taobao, Tmall, Freshippo, Aliexpress, Lazada, Alibaba.com, 1688.com, ele.me, Youku, DingTalk, Alimama, Alibaba Cloud, and Cai Niao are some of Alibaba Group's subsidiaries. Through Koubei and Cainiao Network, it also provides logistic services.

Alibaba's influence extends to the internet payment system alipay.com, which works similarly to Paypal. It also owns a substantial share in Sina Weibo, China's equivalent of Twitter, as well as Youku Tudou, an online video provider akin to YouTube.

Alibaba, unlike eBay, does not charge a listing fee. Instead, advertising on its multiple websites provides the majority of its revenue. Online marketing, cloud computing, and logistics operation are all available.

Hong Kong, China, Taiwan, the United States, the United Kingdom, Italy, France, Germany, the Netherlands, Japan, India, Australia, and New Zealand are all places where the corporation does business. The Alibaba Group is based in Hangzhou, Zhejiang Province, China.

Meituan

According to the Chinese government, Meituan is the largest meal delivery business in China, with a market share of 70.7 percent. Wang Xing launched the firm in 2010, with its headquarters in Beijing. The firm offers a variety of applications and websites for various services.

Meituan provides its consumers with a rich, convenient, and customised experience in food delivery, trip planning and booking, local service search and bookings, mobile payments, and other sectors, thanks to cutting-edge technology and a wide range of products and services.

Meituan's main app, Dazhong Dianping, links over 240 million users and five million local businesses across China through a wide range of lifestyle services such as meal delivery, ride-hailing, reviews, and discounts. Consider it a cross between Yelp, Tripadvisor, Uber, Groupon, and Grubhub.

How diversified is MSCI China Consumer Discretionary ETF?

The MSCI China Consumer Discretionary ETF is focused across the consumer discretionary sector. However, with only 76 stocks in its portfolio and a limited geographic focus on China's consumer discretionary sector, CHIQ is not very diversified at all.

The fund is overweight on consumer discretionary stocks relative to other sectors in its benchmark index, which makes it more concentrated than other funds. And while consumer spending has grown rapidly in China over the past decade, it remains relatively small compared to developed countries like Canada or the U.S.

CHIQ may be vulnerable during times when consumer spending falls off or slows down (such as during economic downturns), but it will also have room for growth if consumer spending increases significantly.

Risks and Returns of MSCI China Consumer Discretionary ETF (CHIQ)

Let us analyse risks and expected returns of MSCI China Consumer Discretionary ETF (CHIQ).

Risks of MSCI China Consumer Discretionary ETF: what to consider?

According our MSCI China Consumer Discretionary ETF analysis it comes with risks. Firstly, the fund may not be able to provide adequate liquidity at all times because of this increased demand for shares during periods when there are no significant events occurring or little news being released about individual companies within this sector of Chinese economy.

MSCI China Consumer Discretionary ETF is a non-diversified fund. Investors should consider its investment objectives, risks, charges, and expenses carefully before investing. Expect high volatility.

Foreign investments involve risks not ordinarily associated with U.S.-domiciled investments, including economic, political and social risks and currency fluctuations that may adversely affect the value of your investment in the fund.

Investments in emerging markets are subject to additional risks that include social instability, government intervention or other governmental action that could adversely affect the value of your investment in the fund.

A high risk according our CHIQ ETF analysis is the Chinese government. Nobody knows what they are planning. We have seen that their regime has a strong impact on companies and their stocks.

Potential annual return of MSCI China Consumer Discretionary ETF

In order to make an accurate forecast for MSCI China Consumer Discretionary ETF (CHIQ), it is important to consider several factors:

- The state of the economy in China: if you're expecting growth rates in consumer spending in China to decline, then you should think twice before buying shares of CHIQ. On the other hand, if you think that consumer spending will continue growing at a healthy pace, then it might be a good idea to invest in this fund.

- The level of competition from other companies: if there are many competitors offering similar products or services as those offered by CHIQ, then its earnings may suffer significantly

- The P/E-ratio is very high, even considering the top 10 stocks within the CHIQ tracker

Usually a more concentrated ETF with 50 – 100 holdings could give a higher annual return. After our CHIQ ETF analysis we are not so sure about that. We consider it as high-risk tracker, only suitable for experienced investors. Since its inception in 2009 up to 2020 this tracker has resulted in a loss. CHIQ ETF is in our opinion less suitable for long-term investing, and more suitable for short-term trading or momentum trading.

Where to buy ETF’s?

It is important to choose the best investment platforms. They offer a wide range of ETFs so that you can build a good portfolio. They also have low transaction costs. Some even offer commission-free investing. In the long run, this saves a lot of costs.

![8x Best ETFs eToro to Buy [2022] Higher Yield, Lower Risk](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/best-etf-etoro-2560x1100.png)