Dear Happy Investor, Many of us look at what stocks we want to buy. But not everyone looks at the industry. However, investing in the best industry leads to (much) higher returns. Also, it lowers our risk because the best industries can boost even mediocre stocks.

Below I will provide insight into how I look at the best industries and how I ideally invest in stocks from the best industry. Also, at the bottom of this article you will find an example of a strong stock within a strong industry. Chances are you've never heard of it 😉 .

On to sustainable financial success!

Table of Contents

How does Zacks Rank work for the best industry with best stocks?

There are several ways to invest in an industry. Personally, I invest mainly for the long term because the best stocks can lead to exponential returns. The thing is, industries play an important role in stock development. Growing industries attract a lot of capital. This allows even mediocre companies to grow faster than average, compared to other industries.

In other words, by simply investing in the best industries, you are more likely to get better stocks with higher returns. It's not a guarantee of profit, but it does increase the probability of profit. It is important to understand this difference.

From a long-term perspective, you want to invest primarily in strong growth markets. These are the booming industries of the future. However, there is also the short-term perspective.

What if we invest in the best stocks from the best industries at this particular time?

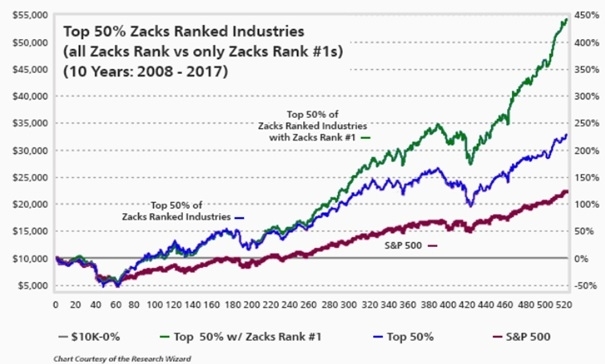

"Studies have shown that 50% of a stock's price movement can be attributed to its industry. In fact, an average stock in a strong group is likely to outperform a great stock in a poor group." - Zacks Rank

Zacks Rank addresses this last question. They use a ranking methodology that looks at a combination of value, growth, momentum, and EPS revisions. At Zacks, the latter is central: companies that continuously realize higher earnings give higher returns on average. In the long term, it is more difficult to determine which companies are structurally realizing earnings growth. But in the short term, this tactic is more reliable.

Zacks Ranking focuses on the stocks that score the highest on its ranking methodology. They receive a #1 score. This means an increased probability of higher than average returns (note: it's not a guarantee!). In addition to the #1 score for stocks, they also give a ranking to industries. They claim that the combination leads to much higher returns:

Source: https://www.zacks.com/zrank/zacks-industry-rank.php

Source: https://www.zacks.com/zrank/zacks-industry-rank.php

The best industries to invest in now for the short term (2022)

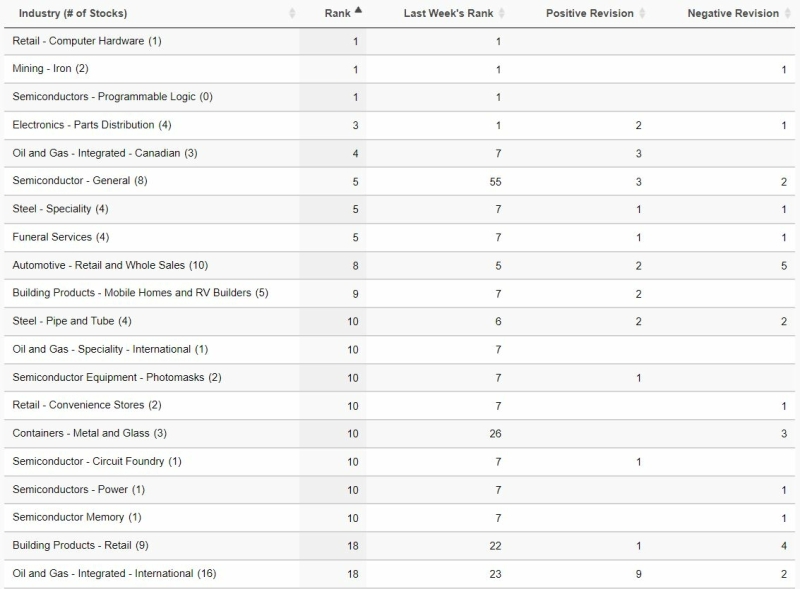

What are the best industries to invest in now for the short term (3 - 12 months)? According to Zacks Rank, these industries are at the top based on positive EPS revisions:

Source: Zacks.com, March 2022

Source: Zacks.com, March 2022

Not coincidentally, these are also the industries that are in the news. For months there has been talking of a shortage of chips from the semiconductor industry. More recently, the price of oil has gone through the roof. And also the prices of building materials including wood and steel are rising very quickly over the past few months.

Understand well that these are short-term developments (partly accelerated by the covid-19 crisis). It is important to also keep the long-term perspective in mind. For example, the oil industry currently offers higher than average returns with the best oil ETFs and stocks, but it does not seem interesting for the long term.

Below I explain how I invest in the best industries and which stocks.

How to invest in the best industries and stocks?

There are several strategies to use, from very active and complex to simple and passive. Basically, we can trade in two ways, short term vs long term (or a combination).

Short Term Trading:

- Hitch a ride on ETFs for the best industries, and trade short term (6 - 12 months)

- Buy the best stocks from the best industries for the short term (6 - 12 months)

Short-term trading should, in theory, lead to the highest returns. However, this is just very difficult because market timing is complex. Even more difficult is trading based on fixed rules and disregarding your (daily) emotions. Another perspective is an increase in transaction costs with frequent buying and selling.

Long-term trading:

- Buy & hold ETFs for industries with high long-term CAGR (market growth)

- Buy & hold the best stocks within the best industries

One advantage to buy & hold is that we realize, typically, return-on-return which can lead to exponential growth. A disadvantage is that it is extremely difficult to select the best companies that thrive over the long term.

In terms of investing in stocks from the best industries, it is of course best if we can combine short and long term. What if we could invest today in unique companies that have both short- and long-term potential? This can lead to very high returns.

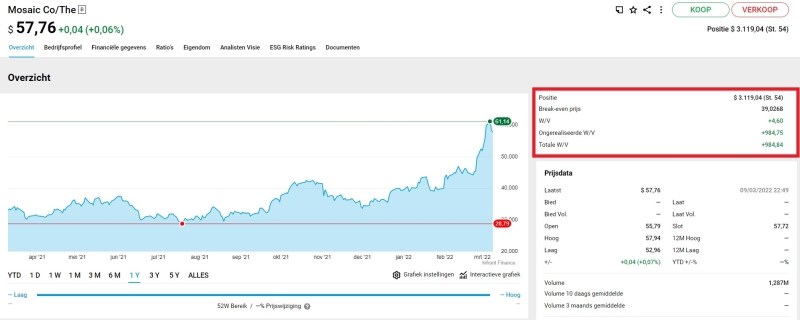

An example of a "best" stock from the best industry is The Mosaic Company. This "boring" company produces fertilizers. It is in the top 50% best industries, namely agriculture. And she belongs to Zacks Rank #1 as well as scoring high on other services (see below). I purchased this stock several months ago and am currently at >50% return. I don't necessarily see this investment for the long term, but possibly for the next 12 - 24 months.

I do full-time research on stocks and ETFs. In doing so, I combine my knowledge and experience, with a specialization in business strategy, with paid services such as Zacks, as well as Seeking Alpha, Motley Fool, Capitalist Exploits, and smaller services. From all these services, my knowledge and research, I select the potentially best stocks for high returns.

I could say that, in my experience, the Capitalist Exploits review scores the best as paid services for new stock ideas.

Source: Happy Investors Dutch portfolio, March 2022

Source: Happy Investors Dutch portfolio, March 2022

Source: Zacks.com, March 2022

Source: Zacks.com, March 2022

![10x Best Real Estate Stocks [2022] Short Term Value Companies](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/best-real-estate-stocks-2560x1100.png)

![What is the best thing to invest in? Stocks to Crypto [2022]](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/what-is-the-best-thing-to-invest-in-2560x1100.png)