Dear Happy Investor, a pension fund is a plan or scheme which provides retirement income. Among all types of institutional investors, pension funds are by far the largest ahead of mutual funds, insurance companies, hedge funds, and private equity. They invest a lot of money, but how exactly do pension funds invest?

In this article, we describe how pension funds invest. Because they are so huge, we can gain valuable insights from them!

Contents:

What is a pension fund?

Where do pension funds invest in?

How do pension funds invest? Types of pension plans and investment strategies

Defined benefit plan (DB) and defined contribution plan (DC)

How we can learn from how pension funds invest?

What is a pension fund?

A pension fund administrates and manages retirement plans, which require an employer to make periodic contributions to a pool of funds set aside for the worker’s future benefit. The pool of funds is invested on behalf of the pension plan participant (i.e., the worker). The periodic contributions and returns on the investments generate the participant’s retirement wealth. Consequently, the participant transfers his or her retirement wealth into a lumpsum or into an annuity.

The pool of funds is invested either on a collective basis or an individual basis. The latter is like what we are used to in retail investing. An advantage of collective investing is that risks, such as financial and longevity risks, can be shared and diversified. The collective returns are ultimately converted back to individual pension plan accounts. An advantage of individual investment accounts is the transparency and the idea of having “your own pot of money”.

Pension funds have generally large amounts of money to invest on behalf of their pension fund participants. Consequently, they are major investors in listed and private companies. Because of the pension funds’ magnitude, they play an important role in the financial markets where they dominate as the largest institutional investor. For 2020, PWC estimated that the worldwide asset management industry managed $101.7 trillion of assets of which pension funds manage $56.5 trillion.

In other words, pension funds own 56% of assets in the financial markets worldwide. But how do pension funds invest? It may be smart to follow this trend 😉 .

You can buy Stocks and ETF’s commission-free at eToro via this link

Where do pension funds invest in?

Pension funds invest in almost all asset classes. They have a wider spectrum of asset classes to invest in compared to retail investors, such as hedge funds and private equity. In general, this is how pension funds invest: 60% in risky assets, such as stocks, and 40% in safer assets, such as bonds. So, this is a wise rule-of-thumb to follow as an individual investor as well!

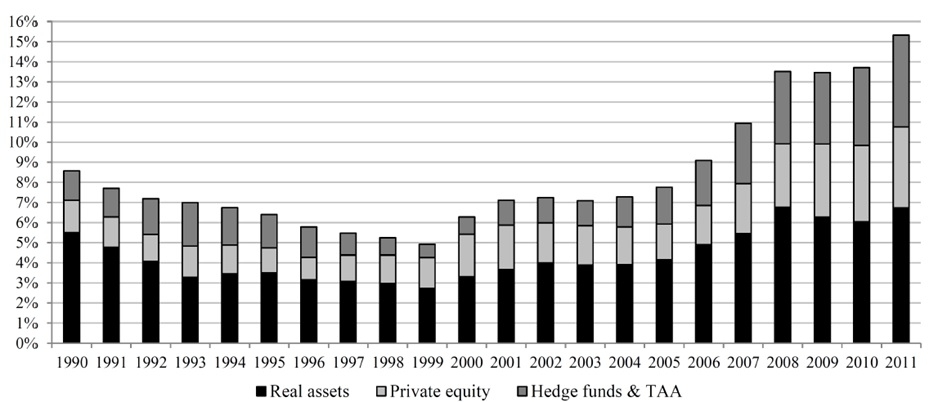

Figure 1: Source is A. Andonov (2014) ‘Pension Fund Allocation and Performance’

Nowadays, pension funds are also investing more in other asset classes. This transition is partially attributable to the low-interest rate environment and the lower stock market returns, but also because the other asset classes promise superior absolute returns and they have a low correlation with equity and bonds. The alternative asset classes can be broadly categorized into three groups:

- Real assets which include real estate, infrastructure, natural resources, and (even) commodities

- Private equity includes investments in venture capital, leveraged buyout (LBO), mezzanine, and distressed financing

- Hedge funds and tactical asset allocation (TAA) mandates which employ long and short strategies, including leveraged positions

The investments in these asset classes rose from 8 percent in 1990 to 15 percent in 2011. The figure shows this development throughout the years and explains how pension funds invest.

As an individual investor, it is perhaps wise to follow this trend. How pension funds invest is different from individuals. Pension funds have much more detailed information than us as individual investors, and because they are so large, they are the trendsetters in the financial market. So, to form a well-diversified portfolio with enhanced risk-return tradeoffs, it could be beneficial to shift a fraction of your portfolio to these three groups of asset classes.

Let Money Work for You! Starting on the best investment platforms is half the battle

Are you still working hard for your money? Why don’t you consider letting the money work for you! Create passive income and attain financial freedom. Starting on the best investment platforms is half the battle. Do you want to know what the very best investment platforms are? Then click on the blue link to compare the best investment platforms now. Here you can read my independent comparison of the best online brokers for stocks, crypto, and P2P. Save money and choose the best investment platform!

How do pension funds invest? Types of pension plans and investment strategies

How do pension funds invest? The type of pension plan matters for the pension fund’s investment strategy, and we can learn from them! Pension funds offer different pension plans. A pension plan is either defined benefit, defined contribution, or a hybrid version. Let’s see what we can learn.

Happy Investors Recommendation: Higher Return and Lower Risk? Tip: Asymmetrical Investing!

What if you could get higher stock returns while having less risk. Sounds too good to be true? It’s not if you know how to start with asymmetric investing. These are investments where the potential gain is greater than the potential loss. The only way for asymmetric investing is if you have a lot of knowledge and experience. This is for advanced professionals and is also used in the largest mutual funds with a minimum deposit of millions.

I’m not an expert in asymmetric investing, but I do know a very good party named Capitalist Exploits which I highly recommend. I’ve joined their Membership one year ago and it brings a lot of value for unique investment opportunities with commodities. I’m talking about +300% gains on Uranium, Copper, Agriculture, and 60+ buying opportunities. The Membership brought me a significant return on investment! These are true professionals. In addition, they also have a free newsletter where they share masterful tips and research on asymmetric investing with us once a week.

Want more information? read my full Capitalist Exploits Review and Experiences

Defined benefit plan (DB) and defined contribution plan (DC)

A defined benefit (DB) plan is “defined” in the sense that the retirement benefits are promised and known in advance, but the contributions depend on the behavior of the financial market. An employer promises an ex-ante specified amount of pension payments, such as a lump sum or annuity, which depends on the participant’s (i.e., worker’s) age, salary, and tenure. So, DB plan investments need to make sure that they can guarantee the promised amount of return to the pension plan participant. In other words, a DB plan has a liability to his or her pension plan participant. For this reason, DB plans need to precisely match their assets (i.e., their investment strategy) with their liabilities (i.e., their goal). Typically, DB plans shift to a more conservative portfolio (i.e., larger fraction of bonds in your portfolio) when the retirement age approaches.

A defined contribution (DC) plan is “defined” in the sense that the contributions of the employer are fixed and known in advance, but the benefits are unknown and depend completely on the behavior of the financial market. Thus, a DC plan is the opposite of a DB plan. Frequently, DC plans are based on individual accounts rather than the collective idea of DB plans.

How we can learn from how pension funds invest?

Reducing the risk just like in the DB scheme is something you can do as an individual investor. For example, you have ETFs for younger people that are riskier. The younger you are, the more risk you can possibly afford. Then it’s important to reinvest the return in safer investments. Think of this as low-risk investing. So the older you get, the safer you will play. After all, investing has risks of losing money and you want to avoid this when you reach your retirement age.

How pension funds invest is a good lesson that we as individual investors can apply!

As an individual investor it can help you a lot to think as a DB plan and set an investment goal for yourself. Namely, we know that we are subject to investor biases, but having a (realistic) investment goal helps to overcome some of these biases such as myopic loss aversion.

Nowadays, target-date funds are extremely popular in the market. These have similar characteristics as a DB plan: they pay out at a pre-determined date and gradually shift their investment strategy to a more conservative approach so as to minimize the risk when the target date approaches.

For an individual investor, the DC element is also attractive. Namely, we know that an investment goal can lead to anchoring behavior resulting in a disposition effect: you hold on to losing investment too long in the hope of reaching your goal, or anchor. So, investing according to the rules of DC plans helps avoiding regret and disappointment, because you simply try to reach the highest investment return possible.

Of course, there are many other ways of how we can learn from how pension funds invest. And, what important lessons do you take away from it? If you have any questions/comments, please let me know in a comment below!