Dear Happy Investor, is investing in artificial intelligence (AI) still relevant in 2022? And if so, what are the best artificial intelligence stocks at the moment? In this article, we look at several aspects regarding investing in artificial intelligence. Why would we want to do this? And in which stocks? What are the risks? Wouldn't it be better to just go for an ETF?

Let's start right away.

On to sustainable financial success!

Table of Contents

Why invest in Artificial Intelligence (AI)?

Investing in artificial intelligence is a no-brainer. Artificial intelligence has no (technical) boundaries. AI applications lead to greater efficiency within the business world. Higher efficiency means lower costs. And lower costs mean a higher profit margin. Therefore, companies like to invest in artificial intelligence because the business case (return on investment) is often favorable (on paper).

Moreover: algorithms are consistent, do not complain about her salary and can work 24/7.

Also, artificial intelligence is a pure form of innovation. Innovation is the driving force of economic growth. Investing in innovation is therefore lucrative in the long term. And this is the reason for investing in artificial intelligence: a future-oriented investment.

People and companies like to invest in the future. The highest returns are achieved by early entry into new growth sectors. Virtually everyone understands this. As happened recently when people started investing massively in metaverse. The danger with such impulsive moves is that they are driven by hype.

Now investing in artificial intelligence is no longer "early", but it has become more relevant today. This is because every new technology proceeds according to a hype cycle. This concept was coined by Gartner.

According to the Gartner Hype Cycle for artificial intelligence towards 2022, AI applications such as chatbots, self-driving cars and AI software are coming off the floor in particular. In the overview of the best artificial intelligence stocks below, I have taken these applications into account. After all, these developments offer a current use case and actually practical applications right now. And that, of course, sells better than an AI concept that might be operational once in 5 years.

Responsible AI, Small and Wide Data, Operationalization and Efficient Resource Use Will Be Key to Scaling AI Initiatives - Gartner.com, September 7, 2021

10x Best Shares in Artificial Intelligence

What are the best artificial intelligence stocks at the moment? Below you will find an overview for inspiration. There are two comments. First, most shares are not "pure" AI stocks, but are part of its business. Second, the term "best" is rather subjective. This framework looked purely at potential long-term growth in relation to artificial intelligence. This is a limited framework, keep that in mind.

Here are 10 of the potentially best artificial intelligence stocks (ranked from relatively lower to higher risk):

- - Alphabet (GOOG)

- - Intuitive Surgical (ISRG)

- - Nvidia (NVDA)

- - The Trade Desk (TTD)

- - Palantir (PLTR)

- - Snowflake (SNOW)

- - Upstart (UPST)

- - UiPath (PATH)

- - C3.ai (AI)

- - Databrick (IPO via freedom24)

As indicated, I have taken into account AI developments from the Gartner hype cycle. For example, many of these companies are focused on AI software. From personalized ads (Alphabet and The Trade Desk) to data analysis using AI algorithms (Snowflake, Databrick, C3.ai, ...).

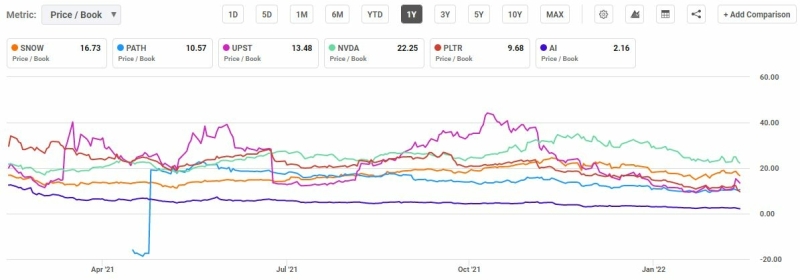

Currently, in my opinion, these companies are among the best artificial intelligence share. But note: this is not to say that I would want to buy them all. The financial valuation of these potentially best AI stocks are high (see chart). Even after the recent crash in growth stocks. This means anyway that they are all long-term investments. But on a financial valuation basis, there are better stocks than these. We want to buy unique companies at a favorable price (like Alphabet). The combination lowers risk and increases returns. Those who pay the top price will sooner or later run into substantial losses. I too have often experienced this. Don't be greedy, be patient.

Want to know more about our research? Check out the Capitalist Exploits review for which stocks we buy.

Analysis of the "best" AI stocks

To illustrate how risky these "best" stocks to artificial intelligence are, I will share some charts:

Source: Seeking Alpha tools

Source: Seeking Alpha tools

The graphs show some ratios of financial valuation. A simple analysis on merely these ratios actually says it all: investing in the best AI stocks today has high risk. They are purely growth stocks with an unfavorable valuation.

The first graph concerns the P/E ratio. From a risk perspective, we want to invest in value stocks with a future P/E ratio

Investing in profitable growth stocks, such as Alphabet, already has higher risk. But this is acceptable if they can deliver and possibly even exceed its future growth. Investing in loss-making growth stocks, however, involves much higher risk.

Now there are also great opportunities here. This is really an early entry into the new dominant players of the future. But the chances of you being right are extremely small. This is something I know. Still, I sometimes invest in loss-making growth stocks. Simply because it's fun to strive for exponential returns. But do accept the high risks to money loss.

Don't want to do this? Right you are. Then opt for an ETF.

Investing in Artificial Intelligence ETF

Individual stock picking is extremely difficult. And especially so within the technology sector. I have been investing in technology stocks, including artificial intelligence, for many years. This has gone well for a good while, but in bad periods you have to reckon with substantial price drops. More recently in 2018 and 2021, a 50% price drop was quite normal for this type of growth stock.

Within my investment strategy, Develops for Financial Freedom achieve, I use important rules of thumb to manage risk. From predominantly technology, I have moved in part to value stocks and ETFs.

Ideally, I want to write that I can provide you with the best AI stocks for the long term. That you and I will make exponential returns with it. And although I believe in the unique stocks I invest in (like Alphabet from this article), I want to point out that for 90% of us, it's smarter to invest in ETFs. Especially as a novice investor, you are, most likely, better off in the long run with ETFs.

What do you do if the "best" AI stock drops by -50%?

What do you do at time of stock market correction? Do you hold on, or do you (unconsciously) choose to panic sell? When things get tough, many people give up quickly. Sometimes you have to take a loss, but more often you just have to be patient.

Emotions are very powerful. Especially when we invest our hard-earned savings. If you don't want to experience this process it is better to choose ETFs.

Diversification is the best friend of the long-term investor who strives for sustainable financial success. - Happy Investors

Investing in artificial intelligence with an ETF cannot be called "safe" by the way. Although it is safer than individual stocks. An AI ETF can still show considerable price volatility, but the long-term profit potential is higher.

The "best" artificial intelligence ETFs at this moment

This is an overview of 5 artificial intelligence ETFs:

- - Global X Robotics and Artificial Intelligence ETF

- - WisdomTree Artificial Intelligence ETF

- - iShares Robotics and Artificial Intelligence ETF

- - First Trust Nasdaq Artificial Intelligence ETF

- - ROBO Global Robotics and Automation ETF

Note that these types of ETFs also contain many non-AI stocks. They have common ground with them, but they are not "pure" AI stocks. There are very few of those, by the way.

Another aspect with these "best" artificial intelligence ETFs is that they are purely focused on this theme. A theme ETF can lead to higher returns in the long run. The condition: the theme is growing faster than average. If this is not the case, then a theme ETF will underperform.

It is therefore unwise to invest too much money in just one theme ETF. Diversification is the best friend of the long-term investor who strives for sustainable financial success.

More inspiration for ETFs? Check out research on the best ETFs.

What is the future for artificial intelligence stocks?

The only thing we know for sure about the future is that it holds surprises. How shares within artificial intelligence will develop is impossible to say for sure. However, from my reasoning, I do dare to take a number of starting points, namely:

- - Artificial intelligence is a pure form of innovation, the driving force behind economic growth

- - With technology stocks it is often the case that "the winner takes it all". Sometimes this happens thanks to a first-mover advantage, but often not. Google was not the first search engine

What do these principles mean for the future of artificial intelligence stocks?

If what I believe is true, then I expect these stocks to rise in the long run. However, since "the winner takes it all" and we are usually not sure who that winner is, we are talking about high risk here.

Therefore, we have several options:

- - Avoid these types of stocks

- - Doing a lot of research in an attempt to buy the best AI stocks with the intention of exponential returns

- - Do a lot of research and buy the relatively "safer" AI stocks that have an already profitable earnings model (e.g. Alphabet and Nvidia)

- - Save time and effort and take a little less risk by buying an ETF

How do you feel about investing in artificial intelligence, and what would be your approach? Let me know in the comments below to learn from each other!

![8x Best ETFs eToro to Buy [2022] Higher Yield, Lower Risk](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/best-etf-etoro-2560x1100.png)

![What is the best thing to invest in? Stocks to Crypto [2022]](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/what-is-the-best-thing-to-invest-in-2560x1100.png)