Dear Happy Investor, If you are investing or about to invest, then you are always confronted with the classical struggle. Do I take more risk to get a high positive, but possibly negative (!), return on my investment? Or, do I take a less risky investment with lower gains? Risk aversion plays a crucial role in this trade-off and is well-known by professional investors and traders. Actually, risk aversion forms the foundation for many advanced investment strategies in finance.

In this article, you can test your risk aversion as an investor. I explain the role of risk aversion for both starting and senior investors. Then, I provide implications of risk aversion when investing, including some suggestions and tips. For example, how to handle your investments during the covid-19 crisis? (And future crisis).

PART 1: Explaining risk aversion in relation to investing

What is risk aversion?

Testing your risk aversion: are you a risky investor?

PART 2: Implications risk aversion for investing

Follow big institutions and base your investment strategy on your risk aversion

Age and risk aversion: risky versus risk-free

Financial crisis and risk aversion

PART 1: Explaining risk aversion in relation to investing

Let us begin with explaining risk aversion (with investing) and how you can test your risk aversion. The latter is crucial as it should fit with your long-term investing portfolio.

What is risk aversion?

Let us start with two basic definitions. Risk aversion is the preference of people for a sure outcome over a gamble with equal or higher expected value. On the other hand, rejecting a sure outcome in favor of a gamble with equal or lower expected value is known as risk-seeking behavior (risk proclivity). To illustrate both concepts, let’s test your risk aversion below. This is a classical test for risk aversion in finance, academic research, and professional institutions (Eckel and Grosman, 2008).

Testing your risk aversion: are you a risky investor?

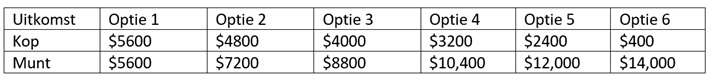

Suppose that you are going to invest, and you can choose one of the six investment options below, which do you choose? The payoff (in USD $) of your investment option depends on the outcome of a coin toss. Try to make a serious choice, because it will help to assess your risk aversion.

Since risk aversion is an individually specific preference for each investor, there are no wrong answers possible. If you prefer to invest in Option 1, then you are risk-averse: your payoff is a sure outcome, always $5600 (independent of flipping heads or tails). And if you prefer to invest in Option 6, then you are risk-seeking: the expected payoff of gambles 5 and 6 is equal, so in Option 6 you take additional risk without additional gains.

If you choose option 1, 2, 3 or 4, then you classify as a risk-averse investor. If you choose option 5 or 6, then you classify as a risk-seeking investor. Typically, these tests find that 60% of the people prefer sure Option 1 over the gamble Options 2 to 6.

Happy Investors Recommendation: Higher Return and Lower Risk? Tip: Asymmetrical Investing!

What if you could get higher stock returns while having less risk. Sounds too good to be true? It’s not if you know how to start with asymmetric investing. These are investments where the potential gain is greater than the potential loss. The only way for asymmetric investing is if you have a lot of knowledge and experience. This is for advanced professionals and is also used in the largest mutual funds with a minimum deposit of millions.

I’m not an expert in asymmetric investing, but I do know a very good party named Capitalist Exploits which I highly recommend. I’ve joined their Membership one year ago and it brings a lot of value for unique investment opportunities with commodities. I’m talking about +300% gains on Uranium, Copper, Agriculture, and 60+ buying opportunities. The Membership brought me a significant return on investment! These are true professionals. In addition, they also have a free newsletter where they share masterful tips and research on asymmetric investing with us once a week.

Want more information? read my full Capitalist Exploits Review and Experiences

PART 2: Implications risk aversion for investing

Now you understand risk aversion and know your degree of risk aversion as an investor, it is time to discuss the implications of risk aversion for investing.

Follow big institutions and base your investment strategy on your risk aversion

Risk aversion essentially determines your preferences for your risk-return tradeoffs. If you are less risk-averse, then you are willing to take more risks. Knowing your risk aversion helps in determining your optimal investment product.

Generally, if you buy mutual funds or ETFs (Exchange Traded Funds), then you are frequently offered 3 alternatives: defensive, neutral, or offensive. The offensive investment products invest more in risky assets such as stocks, while the defensive investment products invest in less risky assets such as risk-free bonds.

An offensive product is designed for more risk-seeking investors: you can expect a quite high return, but the risks (i.e., volatility of your return) can be quite large. Contrary, a defensive product is suitable for more risk-averse investors: you receive a quite sure return, but the expected return is lower than the offensive product.

So, if you’re struggling which investment you want to make, then determining your risk aversion frequently helps you. Namely, most financial institutions base their products on risk aversion, and they use tests as I presented above. Use this information to your advantage.

Commission-free Crypto and FOREX Trading with NAGA

Do you want to trade Bitcoin and crypto? NAGA is one of the biggest all-in-one crypto brokers where you can buy crypto 100% commission-free. You can also use the AutoCopy to copy the Top Traders of NAGA. In fact, you can even become a Top Trader yourself and earn up to 10.000 dollars a month if you are really good at it. Anyway, this broker is perfect for anyone who wants to trade crypto 100% commission-free. You can set up an account for free and try it out.

Want to know more? Click for more information

Age and risk aversion: risky versus risk-free

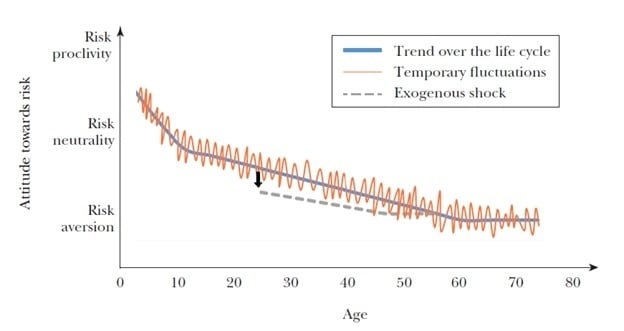

One of the main characteristics of risk aversion that stands out, is the following: if you become older, then you become more risk-averse. Younger individuals are typically more willing to take (financial) risks than older individuals. Please see the blue line in the figure below (Schildberg-Hörisch, 2018). The orange line represents temporary fluctuations in the investor’s risk aversion such as stress or emotions.

Schildberg-Hörisch, H. (2018). Are Risk Preferences Stable?” In: Journal of Economic Perspectives 32.2, pp. 135-154.

If you are an investor for the long-term, then the relationship between age and risk aversion comes in handy. Namely, when you are young you might want to take more financial risks because (i) your investment horizon is still large and (ii) you are probably less risk-averse than your parents. For this reason, I suggest that young individuals could take a more offensive investment product than the elderly. I won’t go into detail, but also females are typically more risk-averse than males (the cause might be evolutionary).

When you take more risk, the volatility of your portfolio will increase. Hence it is very important to always hold a diversified portfolio with equally weighted holdings in stocks, ETFs, mutual funds, et cetera.

Once you become older, then you should slowly transition your portfolio to a more defensive investment product. A defensive product guarantees a surer return on your investment than an offensive product.

Let Money Work for You! Starting on the best investment platforms is half the battle

Are you still working hard for your money? Why don’t you consider letting the money work for you! Create passive income and attain financial freedom. Starting on the best investment platforms is half the battle. Do you want to know what the very best investment platforms are? Then click on the blue link to compare the best investment platforms now. Here you can read my independent comparison of the best online brokers for stocks, crypto, and P2P. Save money and choose the best investment platform!

Financial crisis and risk aversion

The figure also depicts an exogenous downward shock in risk aversion, the grey dashed line. You can think of the exogenous downward shock as the financial crisis of 2008 or the COVID-19 pandemic. On average, risk aversion decreases during times of financial crises. Stated differently, investors tend to become more risk averse during market crashes.

As a long-term investor, you can potentially benefit from this effect. Short-term investors move with the market, so during a crisis they follow the herd and take a more risk-averse investment approach which comes with lower (surer) returns. As a long-term investor, you shouldn’t care too much about short-term market crashes because you invest for the long run and you have thought well about your risk aversion and strategy.

Thus, the most important advice I can give to long-term investors: stick to your investment plan during a crash and do not change your investment style, because it will come at the cost of lower returns. If you feel the urge to do something, only buy during a market crash in line with your previously determined investment strategy (i.e., buy low, sell high).

From experience, I know how difficult this is. I have experienced multiple dips from -20% to even -40% of my entire portfolio. That’s a lot of money evaporating, in a relatively short period of time. This does not feel comfortable, to say the least. And yet it is important to buy the same stocks and ETFs in your portfolio during these periods. At least, as long as nothing fundamental goes wrong with your shares and their business models.