Dear long-term investor, are you wondering which is better: stocks or crypto investing? Recently there has been a lot of attention regarding "finfluencers". Especially about inexperienced investors who promote crypto, without really understanding what they are talking about. Like too little awareness about the real risks of crypto. For years we have been writing about the risks in crypto investing, and why it is better to invest in stocks. There are big differences. Differences that (can) put your financial future at risk.

The most important lesson with stocks or crypto investing is this: crypto is more or less speculation on large gains or losses over a short period of time, where stocks are investing for sustainable long-term gains.

Investing in stocks or cryptocurrencies: difference in risk and return

There are major differences to stock vs. crypto investing. In essence, this comes down to a difference in risk and return. This difference is amplified by the fact that particularly novice investors (of young age group) are venturing into crypto coins. This is a good thing. Innovation does not usually come from old structures. However, specifically, when investing in stocks or crypto this gives an increased risk because of knowledge and experience matter. Especially with crypto.

Cryptocurrencies behave like “anabolic” stocks. They can grow at a rapid pace, but shrink rapidly when demand decreases. This amplified effect means higher volatility. Volatility means price fluctuation.

The more severe price fluctuations, the stronger the emotional reaction.

This is why so many novice crypto investors lose money: it is an emotional roller coaster in which rational thinking (the prefrontal cortex) has less control.

Less control in investing leads to more speculation. And speculation usually leads to a lot of loss in the long run and less often to a lot of profit.

Stock or crypto investing difference 1. Speculating ≠ investing

The big difference between stocks or crypto is the fact that crypto is not investing for the time being. Crypto is still speculating even in 2022. This does not have to be wrong, as long as one understands that speculation contains a lot more risk than investing in stocks.

I sometimes speculate too. It's fun and it can lead to high returns. In stocks, too, I speculate in fast-growing but loss-making growth companies. However, I only buy on the basis of extensive fundamental analysis. This entails examining matters such as strategy, management, product quality, degree of innovation, and the earnings model. If I conclude that this fast-growing company could be the potential market leader of tomorrow, then I invest for the long term.

Like cryptocurrencies, small growth companies are also very volatile (and risky). There's just one crucial difference: the majority of all crypto coins do not create economic value.

A small growth company, if managed correctly and with good market conditions, can grow into a profitable business. They create economic value. With crypto coins, there is no such thing(?).

Now crypto investors argue that we can invest in the underlying technology, the blockchain. And yes, this was also the reason for me to invest in Ethereum in 2017. But what I didn't know at the time is that this is actually a form of speculation.

I don't know if Ethereum will create more economic value in 5 years from now. I speculate (read: hope) that demand will increase in the future. But we can back this up on fewer facts. Whereas with stocks we can substantiate on multiple facts and thus draw more calculated conclusions. That is investing.

Now Ethereum is still okay, but what about hopeless crypto coins that have no Use Case?

Buying because you think such a coin will go x10, is a form of speculation that leads to large losses in the long run. But, pherhaps, these 10 new crypto coins with potential can deliver massive gains.

Stock or crypto investing difference 2. Profit/loss in relation to time

Another difference between stocks or crypto investing is that crypto coins provide more spectacle. There is a difference in win/loss in relation to time. Cryptocurrencies give a lot more profit/loss in the short term than stocks. This spectacle gives an adrenaline rush. It is fun, new and exciting.

Some stocks have this too, by the way (like growth stocks):

Let's face it: crypto investing is more fun than investing in stocks.

Where stocks rise or fall on average by about 1 - 4%, with cryptocurrencies it is perhaps 6 - 10%. This difference in volatility reinforces speculation behavior. Because yes, getting rich with 100 euros is really possible with cryptocurrencies. Something that is virtually impossible with stocks. And this mindset leads to even more risk-taking among crypto investors.

But it is precisely those who are patient who will become rich with certainty.

Those who strive to get rich quickly must take a lot of risks. This can lead to success. The new SHIBU millionaire. But of the one person who does succeed, there are dozens who fail. They have lost a lot of money, but you rarely hear them about it.

My tip to you: use crypto to its strengths. Understand that it is very risky and full of speculation (behavior). On the other hand, it offers an opportunity for exponential returns. Therefore, invest with very small amounts, which you can miss 100%. In this case, it remains a fun game. And who knows, you can thereby make a lot of return without risking your financial future.

The guideline is to speculate with max. 3% of your money. The other 97% should be invested.

Stock or crypto investing difference 3. Circle of Influence

Our reality seems to hold a number of truths. From physical laws like gravity to more questionable ideologies like the "law of attraction", "money" or "god". If someone believes 100% in her ideology, that is truth for her. This can lead to major pitfalls, from which we can learn lessons in relation to stocks or crypto investing. Such as "I believe in this company/crypto project and so I keep buying in, even when the price drops (to zero)".

Another "truth" in life seems to be that of ownership. By this I mean: if I take 100% ownership of my [relationship/career/development/...] then I will prosper on this. This seems to be true. But unfortunately, you don't have influence over everything. What you do have influence over falls within the Circle of Influence. In both life, career, and investing, we can increase this circle of influence.

Now we come to the point: the difference in equities or crypto investing is the extent to which we can increase the circle of influence.

In stocks, we can take more ownership to increase our influence on the end result. Not the end result of whether a company grows or not, but on the end result of profit or loss. As an investor, you have no control over the price movement, but you do have control over when you buy. Those who buy at the right time increase their chances of profit and minimize risk.

With crypto coins, we cannot calculate the intrinsic value(?). Often the "management" is anonymous and the "strategy" unclear. Figures on the market growth are missing. So what is left? Guesswork and technical analysis? Only a few cryptocurrencies have more to offer. Perhaps 95% (or more) of all altcoins are hot air.

With stocks, we can fundamentally examine the company. We can even visit the headquarters to experience the work culture and speak to the employees.

The point is this: when investing in stocks, you gain more control by doing research. This allows you to calculate approximately how much a company is worth (intrinsic value) and estimate what its future potential is. Buy at times when the share price is below the intrinsic value and future potential seems favorable. This lowers risk and increases profit opportunity.

Stocks or cryptocurrency: which is the best investment?

There are big differences between investing in stocks or crypto valuta. What is the best investment only you can determine for yourself. For novice investors, we can speak in terms of certainty. With equities, the certainty of a positive final result is higher than with cryptocurrencies. Both assets are risky, but as explained above, we can increase our chances of profit through research.

Based on research, certainty can be increased.

Now, what is the best investment when I want to build wealth with certainty? Stocks or crypto?

The more security you want, the less risk you should take. This ranges from investing with fixed returns to investing without risk. The advantage of this strategy is that the financial future becomes more certain. Suppose we can for a bundle of low-risk ETFs in stocks and bonds. In such a composition, the average return becomes more certain. This is not a law of nature (unfortunately), but history shows that the probability of return increases over the long term. As long as the global economy is growing, this seems to be true in the future as well.

In other words, a patient investor who buys 20-year diversified ETFs can reasonably assume that they will realize an average of 6 - 8% per year. This is especially true for the best Dividend ETF's.

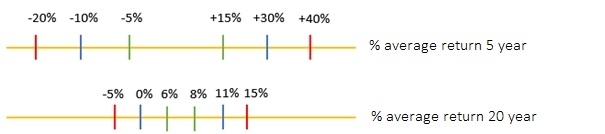

When investing in stocks or crypto, this average return becomes more uncertain. After all, if stocks or crypto are wrong, the average return may be significantly lower. This uncertainty leads to a less accurate assumption of average return. I can best illustrate this with an image:

Crypto = red, stocks = blue, ETF = green

In the short term, an equity investor (blue) may be able to achieve -10% to +30% average return. In the long term, this converges more towards the mean (e.g. 0 - 11%). With crypto (red), this spectrum is broader because it is more uncertain whether it is a good long-term investment. With ETFs (green), this spectrum is narrower, as there is more certainty here.

And, if you are young, you could also in invest in more risky ETF's for higher gains. Check your best ETF's for young people

The illustration is not 100% accurate. The point is that more risky investments have more uncertainty about returns. And that the factor 'time' alone reduces this risk as investments converge more towards the average. Factors such as 'knowledge, experience and research' cause you to move more to the right side of the spectrum (above average performance). For example, the best investors structurally achieve >15% returns per year.

Why stocks are better investment than cryptocurrency

Potentially, crypto can lead to much higher returns than stocks. And yet, my tip would be to invest mostly in stocks, and less in crypto. As illustrated above, it is always about balancing risk and return.

Want to be successful long-term investors? Build a diversified investment portfolio with positions in multiple investment markets. The higher the risk (crypto), the smaller the position.

Investing is a marathon. A sprinter goes faster, but also runs more risk of failure (injuries, fatigue, falls). A marathon runner doses her strength and runs steadily, from start to finish, at a slower pace.

In terms of investing: apply a lot of diversification and aim for a nice average return. At 10%, you would already be doing well. The younger you are, the more risk you can take for the long term. This means not 100% in crypto or stocks, but for example 7.5% in crypto instead of 3% (no advice).

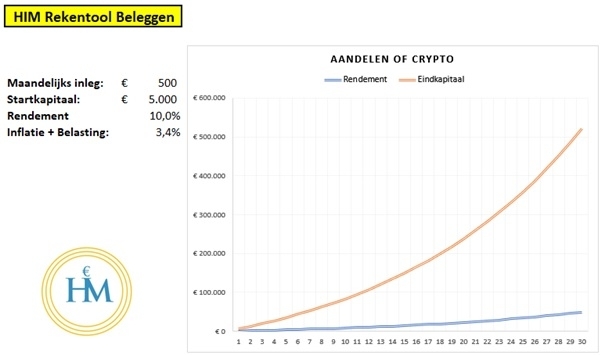

Besides return, the monthly deposit and the long term are also important. The higher the last two factors, the better the financial end result. This image shows that:

Source: Happy Investors calculation tool

Source: Happy Investors calculation tool

Investing does not go in a nice, straight line as the image suggests. But in the long run, your capital increases faster because of the return-on-return effect.

In short: choose a healthy dose to invest in stocks and crypto. Supplement with lower-risk investments such as real estate and perhaps bonds. Invest with money you can miss 100%, hold on to for the long term and reinvest the profits. You too will become financially free.

![Stocks or Crypto Investing? Big Difference in Loss & Profit [2022]](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/stocks-or-crypto-investing-2560x1100.png)

![What is the best thing to invest in? Stocks to Crypto [2022]](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/responsive/5849118/what-is-the-best-thing-to-invest-in-2560x1100_614_264.png)