Dear Happy Investor, In this article we analyze the IWDA ETF. IWDA is the ticker for iShares Core MSCI World ETF. A popular global ETF among novice and/or passive investors. In this comprehensive IWDA ETF analysis, we examine the fund from A to Z. We begin with an introduction and its strategy. Next, we analyze key fundamentals and the top 10 holdings. Then we finish the IWDA ETF analysis with risks and potential returns. We also provide many tips and explanations to better situate your portfolio.

On to becoming financially independent!

ETF Analysis: iShares Core MSCI World ETF (IWDA)

iShares Core MSCI World is an exchange-traded fund (ETF) that aims to pinpoint the performance of an index consisting of enterprises from developed countries. The Fund's investment goal is to offer investors with a total return that matches the MSCI World Index, taking into consideration both capital and income returns. This fund provides investors with global exposure to a diverse variety of assets in a single portfolio. As a result, it may be employed as a component of an asset allocation strategy or as a stand-alone investment in the global economy.

The goal of the IWDA ETF is not to achieve the highest possible return, as advanced investors do with the best stocks. IWDA aims for the market average. Given the large diversification, IWDA ETF is suitable for beginners and passive investors. However, one should take into account interim decreases of up to 30 - 50%. Be prepared for this.

Strategy of iShares Core MSCI World ETF

The Fund invests in a representative sample of large, mid-sized and small capitalization stocks across various industries. It has a low level of volatility, making it a good choice for investors who are looking for stability.

In addition, iShares offers automatic rebalancing and reinvesting services free of charge, which can help make the fund more cost-effective over time.

Here are some important financials about this ETF analysis:

- Ticker: IWDA

- Annual return since inception: 10.41%

- Number of holdings: 1567

- Dividend: accumulation

- Total expense ratio: 0.20%

- P/E-ratio: 17.99 (according factsheet)

Pros and Cons of iShares Core MSCI World ETF

After our IWDA ETF analysis we conclude some pro’s and con’s.

Pro:

- Low fees: iShares Core MSCI World ETF has an expense ratio of just 0.2%, which is low compared to other funds in its category.

- Wide diversification: The ETF holds over 1500 stocks from 24 developed markets around the world. This provides global market exposure, and reduces risk compared to investing in a single country or region.

- Liquidity: iShares Core MSCI World ETF trades on major exchanges, so you can buy and sell shares whenever you want.

Con:

- No dividend yield: The fund doesn't pay dividends, which means that if you're looking for a way to generate income from your portfolio, this may not be a good choice.

- Experience investors can achieve higher returns than the diversified IWDA ETF

TOP 10 Stocks Analysis of iShares Core MSCI World ETF (IWDA)

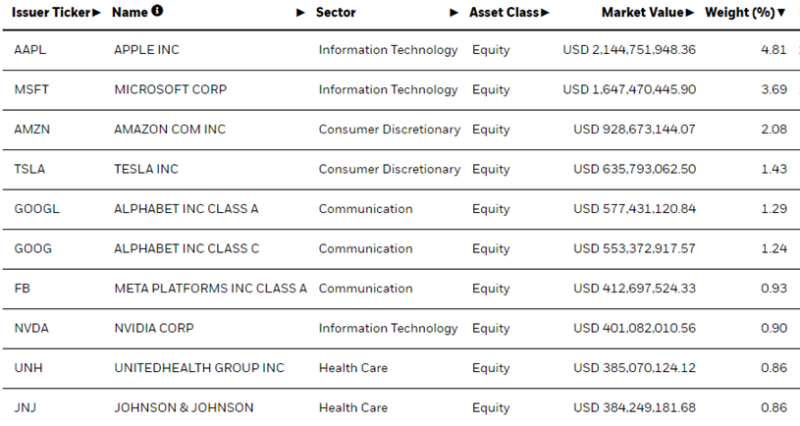

Top 10 holdings IWDA ETF. May change over time. Source: IWDA Factsheet

Top 10 holdings IWDA ETF. May change over time. Source: IWDA Factsheet

The top 10 holdings in total ETF make 18.09%. This means the top 10 doesn’t have to much impact on the total tracker.

Analysis of top holdings IWDA ETF

Let's analyze a few of the top holdings in IWDA ETF.

Apple Inc

Apple Inc. is a global software company headquartered in Cupertino, California, that specializes in consumer devices, software, and online services. Apple is the world's most valuable company, the fourth-largest personal computer vendor by unit sales, and the second-largest mobile phone manufacturer, with revenue of US$365.8 billion in 2021. As of May 2022, it is the world's most valuable company. Along with Alphabet, Amazon, Meta, and Microsoft, it is one of the Big Five American information technology corporations.

Apple is a technology company that creates, manufactures, and sells smartphones, tablets, personal computers (PCs), and other portable and wearable devices. Software and related services, accessories, networking solutions, and third-party digital content and applications are also available through the corporation. iPhone, iPad, Mac, iPod, Apple Watch, and Apple TV are just a few of Apple's products. It sells iOS, macOS, iPadOS, and watchOS, as well as iCloud, AppleCare, Apple Pay, and accessories. Apple's digital content and apps are sold and delivered through the Apple Store, App Store, Apple Arcade, Apple News+, Apple Fitness+, Apple Card, Apple Pay, and Apple Music.

Apple's company generates enormous revenues and free cash flow, allowing it to maintain a rising dividend. This is the sort of firm that a dividend growth investor should include in their portfolio.

Tesla Inc

Tesla was formed in 2003 by a group of engineers who wanted to show that driving electric vehicles doesn't have to be a sacrifice - that they can be better, faster, and more fun to drive than gasoline cars. Elon Musk, the company's creator and CEO, founded Tesla with the goal of "accelerating the advent of sustainable transportation by bringing attractive mass-market electric cars to market as quick as possible." Tesla's successful business strategy is built on this objective.

Tesla now manufactures not only all-electric automobiles, but also renewable energy generating and storage systems that are infinitely scalable. Tesla thinks that the quicker the world transitions away from fossil fuels and toward a zero-emission future, the better. The corporation manufactures and sells the Model Y, Model 3, Model X, Model S, Cybertruck, Tesla Semi, and Tesla Roadster automobiles. Tesla also sells solar power and installs and maintains energy systems, as well as providing end-to-end sustainable energy solutions that include generating, storage, and consumption.

Tesla sells directly to consumers, unlike other automobile manufacturers that sell through franchised dealerships. It has established an international network of company-owned showrooms and galleries, the majority of which are located in major cities. The corporation operates in Asia Pacific and Europe and has production sites in the United States, Germany, and China.

Tesla does not pay a dividend to shareholders, which is a key consideration for income investors. We believe high-quality dividend growth equities, such as the Dividend Aristocrats, should be considered by income investors seeking reduced volatility. Tesla is related to growth stocks. This implies higher risk but could also lead to potentially higher returns.

Read about the best dividend ETFs.

Meta Platforms Inc

Meta Platforms Inc., formerly known as Facebook, Inc., is a social media and technology conglomerate. The Company's products let users to connect and share with friends and family via mobile devices, personal computers, virtual reality (VR) headsets, wearables, and in-home devices. Mark Elliot Zuckerberg, Dustin Moskovitz, Chris R. Hughes, Andrew McCollum, and Eduardo P. Saverin launched the corporation on February 4, 2004 in Menlo Park, California.

Family of Apps (FoA) and Reality Labs (RL) are the company's two segments. Facebook, Instagram, Messenger, WhatsApp, and other services are included in FoA. Consumer devices, software, and content linked to augmented and virtual reality are included in RL.

The business believes that the metaverse is the next step in the evolution of social connection. Because the company's mission is to assist in bringing the metaverse to life, they changed its name to reflect this dedication.

Meta is a growth stock, which means that while it may seek to build quickly and experience higher sales and profit each quarter, all of its profits are reinvested in the business to help it grow. This means that it does not pay dividends to its stockholders.

How diversified is IWDA ETF?

iShares Core MSCI World ETF is one of the most diversified ETFs in the market. It holds over 1400 stocks and has a very low correlation to the S&P 500, which makes it an ideal choice for investors looking for diversification.

The fund offers exposure to companies from around the world, including developed markets like the U.S., Europe, and Japan as well as emerging markets such as China and India. The fund also includes exposure to commodity-producing countries such as Australia and Canada. This broad exposure gives investors access to a wide variety of industries, sectors, and countries while helping them limit their risk by not being overly concentrated in any one area.

The portfolio has a low correlation to the market as a whole, meaning it's less likely to move in the same direction as other investments. This makes it a good choice for investors who want something less risky than an S&P 500 index fund but still want some exposure to global companies.

Our IWDA ETF analysis shows that it has historically outperformed the VWRL ETF. The reason: VWRL has more positions (3500+). More is not always better. In addition, VWRL pays dividends, and IWDA reinvests dividends. Over time, this increases the compound interest effect.

Check our best eToro ETFs.

Risks and Returns of iShares Core MSCI World ETF (IWDA)

The index is heavily weighted toward US stocks. In fact, US companies make up more than half of the holdings in the fund's portfolio and they account for more than half of its total market capitalization. If you're looking for exposure to other parts of the world, this fund may not be right for you.

Another issue is that this fund does not include emerging markets or smaller companies, which means that it may not perform well during periods of economic growth or recovery. Small cap stocks can offer higher returns over time. A small cap ETF is therefore a great complement to IWDA ETF.

Potential annual return of iShares Core MSCI World ETF

According to Wallet Investor’s live Forecast System, iShares Core MSCI World ETF stock is a good long-term (1-year) investment. Based on their forecasts, a long-term increase is expected, the ETF’s price prognosis for 2027-04-26 is 136.6 USD. With a 5-year investment, the revenue is expected to be around +75.35%.

Where to buy ETF’s?

It is important to choose the best investment platforms. They offer a wide range of ETFs so that you can build a good portfolio. They also have low transaction costs. Some even offer commission-free investing. In the long run, this saves a lot of costs.

![8x Best ETFs eToro to Buy [2022] Higher Yield, Lower Risk](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/best-etf-etoro-2560x1100.png)