Suppose we want to buy and sell the best ETFs for 2023 in the short term. What do we look at, how do we find the best ETFs for 2023? As Happy Investors, we strive for long-term returns so that we become financially free. Multiple roads lead to Rome: real estate funds, stocks, ETFs, crowdfunding, et cetera.

Short-term trading in the best ETFs is one way to achieve above-average returns. The essence is simple: buy stock funds that are going to perform best in this year. Unfortunately, this tactic also has several drawbacks and risks, including the classic mistake of market timing.

Below, we explain how we might determine the best ETFs for 2023. Please note that this is an explanation to arrive at a particular way of investing. We are in no way insinuating that anyone should invest this way. We are not giving buying advice, nor personal investment advice.

How do we find the best ETFs for 2023?

![]()

An ETF is an equity fund. This fund tracks multiple stocks. This is the advantage of ETF investing. We can easily and quickly achieve risk diversification.

This is important to understand: the more diversified the fund, the more the result tends to average returns with lower volatility.

In other words, the more stocks (positions) a fund has in multiple sectors and countries, the more stable this fund moves in price relative to more specific funds (themed ETFs). This is why global ETFs are better suited for novice investors.

In our opinion, the best ETFs for 2023 are specific theme ETFs. This is because there are always certain themes that are "hot" or a "hype." The big money flows into those funds (and the stocks they track).

In short, we find the best ETFs for 2023 by looking at popular themes.

There are two ways to do this:

1. Based on macroeconomic developments, we will predict (or speculate?) which sectors are currently very undervalued and will become booming business in the short or medium term; or

2. We look at which ETFs are currently performing best.

The first way is the best for returns. It is also the most difficult. Our partner Capitalist Exploits was right when they indicated in 2017 -2018 that commodity stocks and energy companies are undervalued. Their opinions within the Insider subscription show particularly high returns from 2021. On the other hand, they had to wait a few years for that.

For novice investors looking to buy the best ETFs, option 1 may be too high. You have a better chance by following option 2. You then follow "the big money," so to speak. You're kind of following the herd. Not first, but not last either. You hitch a ride. Go with the flow. And after 6 or 12 months, you sell these "best ETFs" and start all over again.

Finding the best-performing ETFs based on factor analysis

If we take a closer look at option 2, we may be able to find the best short-term ETFs. In addition to price performance, which we call momentum, we look at other factors.

Based on these factors, we can analyze an ETF:

- Momentum (price rise or fall).

- Cost (expense ratio)

- Dividend

- Risk (volatility, positions, geography, sectors, etc.)

- Liquidity (AUM)

The best ETFs for 2023 and short term (6 - 12 months) will score strongly on momentum. This means relatively strong performance relative to other ETFs based on 3, 6, and 12 months. Up to even 1 or 5 years.

Momentum is the factor to watch for short-term traders.

This also gives drawbacks to these "best trackers," such as:

- Momentum can turn quickly: those who enter too late buy at a peak, and may be left with one-time highs

- Costs: these can be high in the case of themed ETFs

- Risk: to (temporarily) outperform the market average by much, the risk must (almost certainly) be higher

- Liquidity: themed ETFs usually have less assets under management (AUM), which does not help liquidity

Earlier in our newsletter, we explained how we constructed our dividend stock portfolio based on factor analysis. This currently outperforms market averages.

Using the same principle, namely factor analysis, we can potentially find the best trackers for 2023.

The best trackers for 2023

What are the best trackers for 2023? Let's examine this question based on our assumption that we can find this year's best trackers based on momentum. We also consider the other factors.

Now you may be thinking: how can I analyze thousands of trackers?

The answer: we can't do that ourselves. We use paid databases to do this. We let computers do the work. By the way, there is no other choice given the complexity and impermanence of data.

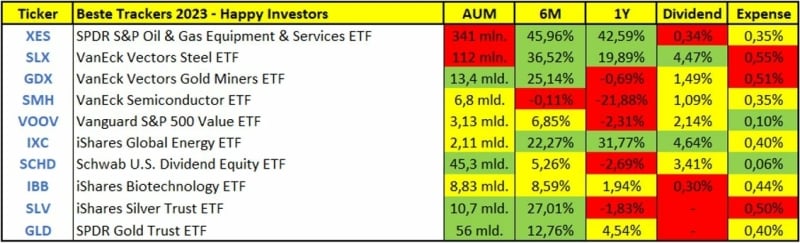

From our databases, we have selected a "top 10" best ETFs for short-term traders:

The S&P 500 ETF (VOO) has the following return: 1Y = -12.57%. 6 months = -0.05%. This is the benchmark in terms of average returns. So any tracker that has achieved higher returns over the same period has offered higher than average returns.

The best trackers in 2023 based on momentum are:

- Oil ETFs

- Steel ETFs

- Energy ETFs

- Other commodities ETFs such as gold and silver

These trackers have advantages and disadvantages. Either way, the risk profile is high. If only because of the specific sectors these "best ETFs" focus on. The risk here is that momentum can wane. Then you are left with an ETF that gives negative returns over 1, 3 or maybe even 5 years. How this will play out for commodity ETFs depends on macroeconomic developments. For example, some experts argue that this cycle is just beginning.

Energy is and will remain relevant. For the long term, perhaps renewable energy ETFs, such as the iShares Global Clean Energy ETF, offer a little more certainty? Just pay close attention to the valuation ratios (P/E, P/B, etc. combined with long-term growth).

What do you think: Is 2023 the year where momentum for these sectors continues?

The other trackers in this list are also interesting. These seem like good long-term ETFs to us:

- Value ETFs: value stocks are generally (slightly) less volatile. Value is a "hot" topic for 2023, given ongoing issues such as energy costs, inflation, interest rate increases, and the like

- Dividend ETFs: dividend ETFs are always a valuable addition to a portfolio. We have a soft spot for Schwab U.S. Dividend Equity ETF (SCHD). A very low-cost tracker that has performed extremely well for years

- Semiconductor: Taiwan Semiconductor, ASML, the semiconductor industry is highly relevant and demand remains high. ASML continues to raise its earnings forecast. A semiconductor ETF can be an excellent long-term investment, especially now that the tracker has fallen recently.

How to trade the best ETF of 2023?

If you want to buy the potentially best ETFs based on momentum (the "go with the flow" tactic), you choose active investing/trading/trade. This amounts to swing trading.

Short-term trading in these trackers can be done using technical analysis. The table above shows a number of trackers with strong momentum. They perform significantly better than market average. Based on technical analysis, you can determine buy (support level) and sell (resistance level).

It can also be simpler (but less effective): buy X number of trackers with strong momentum now. And sell after 6 or 12 months. All we look at now is the duration, and use this as a fixed rule of thumb.

Also important is to analyze the ETF based on its positions. Which stocks are in its TOP 10? And how much weighting are these given relative to the total? If these are all good stocks with future Value (i.e. low valuation, nice future growth), then the average valuation of the ETF will also be attractive. This kind of information can be found in the prospectus or fact sheet. Look at the average P/E and P/B ratio combined with Return on Equity (ROE), et cetera. Take into account macroeconomic developments.

In our investing courses, we explain various strategies and tactics. What suits you best can only be determined by you.

Where do I buy these trackers?

The above list of potentially best trackers is specific. Not all ETFs can be bought everywhere. It is important to consider which investment apps have low fees. You man consider the best investment platforms. We like brokers as Ally, Vanguard, Mexem, Interactive Brokers, eToro, and Freedom24.

Finally, you can look into buying a similar alternative from your current broker.

What is your opinion or experiences with the "best trackers"? What do you think will do well in the stock market in 2023?

Disclaimer: Investing has risks to money loss. This article does not contain personal investment advice.

![Best ETFs [2023] 10x Best Trackers with Momentum | Happy Investors](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/best-etfs-2023-2560x1100.png)

![10x Best VanEck ETFs to Buy [2022]](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/best-vaneck-etfs-2560x1100.png)

![Best Energy ETF: 7 Energy Investment Funds [2022]](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/best-energy-etf-2560x1100.png)

![8x Best ETFs eToro to Buy [2022] Higher Yield, Lower Risk](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/best-etf-etoro-2560x1100.png)