Dear Happy Investor, investing in the best innovation ETF can lead to (much) higher than average returns. Although the best innovation ETFs have a high risk/return profile, we believe it is interesting for a long-term investor. Innovation is the catalyst for economic growth. Innovative companies, therefore, grow faster than traditional companies. On the other hand, this type of business model also has increased risks, such as failing investment projects and rapidly changing environments. It has advantages and disadvantages. Below you can read all about the potentially best innovation ETFs.

On to sustainable (financial) success!

What is an Innovation ETF, and why should we invest in it?

An innovation ETF is a security that tracks the stock of companies whose main focus is on research and development. Innovation ETFs invest in companies that have products or services that are considered "innovative." These could include anything from jetpacks to smartphones, but they'll always be companies that are making strides in terms of technology or processes.

Innovation ETFs help you diversify your portfolio: while it may seem counterintuitive at first glance, an investment in innovation ETFs actually helps you diversify your portfolio by giving you exposure to a new sector of the economy.

The main advantage of this type of Exchange Traded Fund is that it can help you make money while also helping society at large. For example, many such funds focus on companies that engage in environmental sustainability practices, ensuring that they won't pollute the environment or contribute to climate change. For example, Alphabet is considered as a sustainable company (low CO2 emissions) and is often included in sustainability ETFs as well. Others focus on companies that do research into health care, seeking out treatments for diseases like cancer and Alzheimer's disease.

There are many kinds of innovation ETFs available today. Some focus on specific technologies like drones or artificial intelligence. Others look at areas like healthcare, transportation, or energy production. The latter could disrupt companies that are currently included in the best energy ETF.

Innovation ETF risk and returns

The risk of innovation ETFs is higher than the market as a whole, but it also offers potentially higher returns. The first thing you should know about innovation ETFs is that they are not necessarily going to perform well. The best way to think about innovation ETFs is as a high risk/return investment. If you're looking for something safe and stable, innovation ETFs probably aren't for you and you should consider global ETFs.

Innovation ETFs are highly volatile and have a low correlation with other assets. They are appropriate for investors who can tolerate significant volatility and are willing to take on significant risk in exchange for possible high returns.

This means that if you're looking for a safer investment option (for example, if you're close to retirement or risk-averse), this may not be the right fund for you. In addition, there are no guarantees when it comes to investing in an Innovation ETF. While this fund has shown good results over time and may continue to do so in the future, there's no guarantee that these returns will continue indefinitely—or even at all.

If your portfolio is already full of high-risk stocks and bonds, an Innovation ETF may be too much of a gamble for your needs. If this describes your situation, we recommend speaking with an advisor about other options that better suit your personal risk tolerance level.

Another thing to keep in mind about innovation ETFs is that they require a lot of research and analysis before investing. There are many different types of innovation ETFs available on the market today, so it's important that you choose carefully when deciding where to put your money. If you don't do enough research beforehand, there's a chance that your investment could fail miserably.

5x Best Innovation ETF’s for long-term investing

The investor's goal of buying an innovation ETF should be to outperform the S&P 500 or any other index. In this perspective, it isn’t necessary to take excessive risks. Below you will find innovation ETFs that have a high risk/reward profile. However, we believe that for novice investors it is better to pick the more popular funds. They have high liquidity, relatively lower volatility, and focus on large-cap innovative companies.

We believe that the Invesco QQQ Trust Series 1 could remain the best innovation ETF for long-term investors. It is the most popular technology fund, focusing on innovation. They primarily focus on the big well-known tech companies such as Microsoft and Apple. These are mega caps. But still: if their valuation is good and they deliver strong future growth then even mega-caps can outperform the S&P 500.

At this specific moment, the valuation of QQQ is high. Patience is required for a better entry point. However, don’t try to time the market (too much).

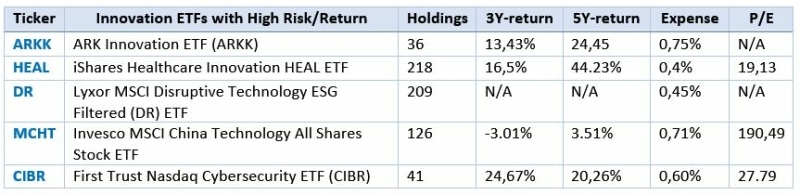

Here is more inspiration with 5 of the best Innovation ETFs for long-term investing:

- ARK Innovation ETF (ARKK)

- iShares Healthcare Innovation HEAL ETF

- Lyxor MSCI Disruptive Technology ESG Filtered (DR) ETF

- Invesco MSCI China Technology All Shares Stock (MCHT) ETF

- First Trust Nasdaq Cybersecurity ETF (CIBR)

Tip: read more about the best ETFs.

ARK Innovation ETF (ARKK)

ARKK, which is run by the well-known fund manager Cathie Wood, is a great choice for investors who want to take on more risk for the chance of higher returns. ARKK is for companies that work on "disruptive innovation," which includes things like automation, robotics, AI, and the "internet of things."

Wood says that her funds are made to be held for at least five years so that investors can make the most of the stocks of new companies that could grow very quickly. ARK has several funds. We consider them among the best eToro ETFs, but it is only suitable for experienced investors.

Pros

Innovation is really at the core of this fund, so if you're looking for an ETF that will help you profit from new technology and keep up with cutting-edge developments, ARKK could be an excellent choice.

The portfolio is diversified across several industries, so you won't be putting all your eggs in one basket. Also, the fund has a good track record overall and has had positive returns for most of its existence.

Cons

This innovation tracker is extremely risky and speculative. Only suitable for experienced investors who can endure the emotional aspects of extreme volatility. In many cases we do not consider the holdings among our best stocks. The reason is that the valuation is difficult to calculate. However, it may be a great diversification upon value stocks.

iShares Healthcare Innovation ETF (HEAL)

The iShares Healthcare Innovation ETF (HEAL) was created by BlackRock, Inc., which manages over $10 trillion in assets. HEAL invests in companies that are either developing new medicines or medical devices, providing services to the elderly population or providing other healthcare related services such as health insurance plans.

Its focus is on healthcare innovation, and it invests its assets in companies that are expected to benefit from advances in medical technology.

Pros

Because it includes many different types of companies in the healthcare industry, this innovative ETF is diverse for this sector. It has exposure to many different areas of the healthcare industry. This means that it will be less affected by negative events in one area of the industry than an ETF that only focuses on one sector. This ETF also provides more access to foreign markets than many other ETFs do.

Cons

This fund has only been around since 2017. It doesn't have a long track record of performance to draw on. Like any other sector-focused investment vehicle, this ETF has risks associated with investing in just one particular area. If the entire healthcare industry takes a downturn, this fund's value will take a hit as well.

Lyxor MSCI Disruptive Technology ESG Filtered (DR) UCITS ETF

The Lyxor MSCI Disruptive Technologies ESG Filtered (DR) UCITS ETF includes companies that are expected to generate significant revenue from sectors such as 3D printing, Internet of Things, cloud computing, fintech, digital payments, healthcare, robotics, clean energy and smart grids as well as cybersecurity.

The companies chosen for this fund are those that have the greatest potential for growth based on their “potential impact on society, environment and economy. This ETF could be suitable for young investing, but beware of the high risks and long-term profile.

Pros

The fund tracks an index that is specifically designed to trade in accordance with ESG principles, so you can enjoy the benefits of a clean and socially responsible portfolio without having to do any of the research yourself.

Index provides exposure to companies in the most innovative sectors of the economy. Also, the fund offers exposure to small and medium sized companies, which have been proven to outperform large-cap stocks over time.

Cons

The fund does not have a track record of performance yet, so it is difficult to determine whether or not it will outperform its benchmark in the future.

The fund has a low liquidity, which means it can be difficult to sell your shares when you want to get out of the fund.

Invesco MSCI China Technology All Shares Stock Connect UCITS ETF

The MCTS Exchange Traded Fund (ETF) is provided by Invesco. This ETF provides exposure to Large and Mid-Cap Chinese Information Technology Equities. The investment objective of this fund is to achieve long-term capital growth through a portfolio of stocks that have potential for growth and dividend income from companies listed on the Hong Kong Stock Exchange (HKEX).

The fund also invests in large-cap stocks with a focus on technology. The fund uses an active approach and follows a quantitative model that seeks to identify stocks that are expected to outperform their peers over a 12-month period.

Pros

The ETF holds all Chinese technology stocks, which may have better growth potential than other industries.

The ETF has low volatility and risk, which makes it a good choice for investors looking to minimize risk while still taking advantage of the growth potential in China's technology sector.

Cons

It has a lower trading volume than some other similar funds, which could make it harder to buy or sell shares during times of high volatility or low liquidity in the markets.

It's an emerging market fund, so it may not be suitable for investors who don't want to take on added risk.

First Trust Nasdaq Cybersecurity ETF (CIBR)

The Index is designed to track the performance of companies engaged in the cybersecurity segment of the technology and industrials sectors. It includes companies primarily involved in the building, implementation, and management of security protocols applied to private and public networks, computers, and mobile devices in order to provide protection of the integrity of data and network operations.

The dividends in the fund are reinvested (accumulating).

Benefits

The tracker is focused on innovative companies within cybersecurity. This is a relevant topic with a fast-growing market.

Disadvantages

CIBR ETF should be seen as a risky theme ETF. The theme is relevant, but should these companies be disrupted, such as by blockchain technology, the fund will be able to realize substantial losses.

![Young Investing: 7 Best ETFs to Buy for Young People [2022]](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/responsive/5056539/best-forward-looking-etfs-1170x500_335_143.png)