Dear Happy Investor, in this article we discuss investing in 3D printing. what’s 3D printing all about? What are the predictions of analysts for this market? Is it the new industrial revolution? How to invest in 3D printing? In this article we address these and other questions.

Let us begin!

Contents:

What is 3D printing? And why invest in 3D printing?

The history of the 3D printing market: high returns during hype, devastating losses thereafter

Today and the future of investing in 3D printing: an outlook on benefits and risks

How to invest in 3D printing, and why?

Investing in 3D printing with an ETF

What is 3D printing? And why invest in 3D printing?

3D printing, also known as additive manufacturing, is the construction of a three-dimensional object from a digital three-dimensional model. The term 3D printing refers to a process, namely: the process of depositing, joining or solidifying materials – under the aid of computer control – to create a three-dimensional object. Typically, materials such as plastics are fused together layer by layer.

Is investing in 3D printing a golden opportunity for long-term investors?

The manufacturing process known as 3D printing is one of the most promising and rapidly growing technologies, with applications in a wide range of industries. For an investor, such a new market can provide a useful trade-off between risk and return.

Starting to invest in 3D printing can be done in several ways. The most accessible forms are 3D printing stocks and 3D printing ETFs. Here we will go into more detail, but first a little about the history to better understand this market.

You can buy Stocks and ETF’s commission-free at eToro via this link

The history of the 3D printing market: high returns during hype, devastating losses thereafter

In 2010, a hype started around 3D printing. Patterns were about to expire, such that the technique could be used more widely. Moreover, the idea was that 3D printing would become available for individual consumers. Such a trend would enable private consumers to buy 3D printers and to start 3D printing at home, opening a whole new market.

During this hype, new small (growth) firms started to enter the market and investments in 3D printing rose sharply. Let’s look at the corporation 3D systems; currently, by means of the 12-month trailing revenue, the largest 3D-printing company in this market. See Figure 1 below.

From the start of the hype early 2010 until the peak of early 2014 their shares rose from roughly 3USD to nearly 100USD. However, like the dot.com bubble, the excitement was too premature and 3D printing for individual consumers was less successful than anticipated. 3D printers were not user friendly and experienced slow production times. For example, it takes 10 minutes to produce a very simple whistle. Consequently, the market for 3D printing shrunk heavily between 2014 and the beginning of 2020, and investors experienced heavily decreasing shares.

Figure 1: Stock price (USD) 3D Systems Corp. Source: Financial Times

Happy Investors Recommendation: Higher Return and Lower Risk? Tip: Asymmetrical Investing!

What if you could get higher stock returns while having less risk. Sounds too good to be true? It’s not if you know how to start with asymmetric investing. These are investments where the potential gain is greater than the potential loss. The only way for asymmetric investing is if you have a lot of knowledge and experience. This is for advanced professionals and is also used in the largest mutual funds with a minimum deposit of millions.

I’m not an expert in asymmetric investing, but I do know a very good party named Capitalist Exploits which I highly recommend. I’ve joined their Membership one year ago and it brings a lot of value for unique investment opportunities with commodities. I’m talking about +300% gains on Uranium, Copper, Agriculture, and 60+ buying opportunities. The Membership brought me a significant return on investment! These are true professionals. In addition, they also have a free newsletter where they share masterful tips and research on asymmetric investing with us once a week.

Want more information? read my full Capitalist Exploits Review and Experiences

Today and the future of investing in 3D printing: an outlook on benefits and risks

Fast forwarding to today, we see that 3D printing is reviving. Why? The answer is industrial 3D printing, rather than 3D printing for the individual consumers. Current estimates of analysts predict that 3D printing will lead to a new industrial revolution and that the market for 3D printing will grow each year by 29.50% from 2020 until 2025.

Many production processes can benefit from the mass production that 3D printing can deliver. Think of the automotive industry: according to a 2015 report of Wohlers, motor vehicles constituted already for 16.1% of 3D-printed material. Also, 3D-printed materials are used during aircraft construction, such as by Boeing and Airbus, but also heavily by medical specialists (surgeons and dentists) who use 3D-printed prosthetics, medical tools, and even tissue.

However, it is important to avoid the same mistake as with the individual consumer 3D-printing hype. Industrial 3D printing has a lot of potential, but will probably not replace the more conventional production processes, at least not in the short term. Industrial 3D printing should be seen for now as a complementary technology.

On the other hand, individual 3D printing for consumers might also see a revive in the future. Like personal computers and mobile phones, it takes time for companies to deliver user-friendly products and to ensure that the technology transfers to their consumers. But, once this happens, things may go fast. If households start to print themselves, then a large part of the retail and logistics industry becomes irrelevant. Why would you buy shoes in a shop if you can produce the same quality shoes at home?

Commission-free Crypto, Stocks and FOREX Trading with NAGA

Do you want to trade Bitcoin, Crypto, Stocks, and Forex? NAGA is one of the biggest all-in-one crypto brokers where you can buy crypto 100% commission-free. You can also use the AutoCopy to copy the Top Traders of NAGA. In fact, you can even become a Top Trader yourself and earn up to 10.000 dollars a month if you are really good at it. Anyway, this broker is perfect for anyone who wants to trade crypto 100% commission-free. You can set up an account for free and try it out.

Want to know more? Click for more information

How to invest in 3D printing, and why?

Overall, 3D printing might have a large impact on the economy and after several tough years, 3D-printing stocks become attractive for investors again. Not only because of the potential gains, but also because of the potential diversification benefits and risk exposures. The stock of the largest player, 3D Systems, has gained +291.81% over the last year.

Note that here again there is a lot of speculation in the price. People expect big future profits from 3D printing stocks like 3D systems. But to date, they have no proven revenue model. In fact, the expectation is that 3D systems will barely realize revenue growth in the medium term. And its net margin has been around -15% for years. In other words, there are many other small stocks with potential that probably give a higher return.

Would you like to invest in 3D printing? Perhaps the following tip will help.

As a long-term investor, you may believe in this industry. You would like to invest in 3D printing stocks. In this case, it may be smart to spread risk. You do this by diversifying across multiple 3D printing companies rather than one or a few stocks. To do this, you can opt for an ETF. As far as I know, there is currently one 3D printing ETF on the market. Below I’ll tell you which one.

Investing in 3D printing with an ETF

Bron: SeekingAlpha.com

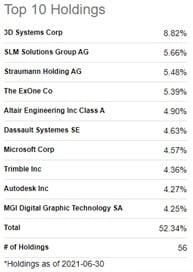

The 3D-printing ETF (ticker PRNT), issued by Ark Investment Management, seeks to provide investment results that closely resemble the performance of the Total 3D-Printing Index. The index tracks prices of stocks of companies that are involved in the 3D-printing industry. More specifically companies in the index are related to 3D-printing hardware, computer aided design (CAD), 3D-printing simulation software, 3D-printing centers, scanning and measurement, and 3D-printing materials.

In the image above, you’ll find the top 10 holdings of 3D printing stocks within the 3D Printing ETF.

You can buy this 3D-printing ETF commission-free at eToro via this link

Before we go on, I want to give you this tip: I don’t see the 3D printing ETF as one of the best ETFs for the long term. After all, this is a theme ETF. In my opinion, there are better themed ETFs, such as in the semiconductor- and the cloud sector.

The ETF was founded in 19-07-2016 and, today, the fund holds 56 3D-printing companies with roughly $556 million of assets under management in the fund. As of 30 June 2021, 3D Systems Corp. has the largest weight in the ETF of 8% (!) and, a well-known other player, Microsoft Corp. has a weight of 5% in the ETF. The geographic diversification is low and mainly focused on developed markets: 68% of the companies is based in North America and 32% in Europe. The sector diversification is a bit more dispersed: 60% in information technology, 26% industrials, 9% health care and the remaining 5% is in materials and consumers.

Hence, note that the 3D-printing ETF is not purely weighted on 3D-printing only. However, the ETF does a decent job in representing the rapidly expanding 3D-printing universe. Overall, it is a decent option for investors who want broad exposure to 3D printing.

Figure 2 below shows the stock prices of the ETF since the inception data until today. The shares currently trade at 37USD and experienced a 1-year gain of +67.30%.

If you want to invest in 3D printing, this ETF can be a choice to diversify. However, realize that it is a risky investment where the short term in particular can be very volatile.

Figure 2: The 3D printing ETF (PRNT) in USD. Source: Financial Times