Dear Happy Investor, would you like to buy Spotify shares? The question is whether it is a good investment. In this article you will find an analysis about Spotify shares. In doing so, we are going to look at both the financial and strategic aspects of this company. This is important because as an investor you get the highest returns by investing in unique stocks at a favorable price (valuation).

Below are my tips and analysis on whether or not to buy Spotify stock.

Table of Contents:

Where can I buy Spotify shares?

To buy Spotify shares or not? Spotify Financial Analysis 2021

Conclusion based on Spotify’s financial analysis

To buy or not to buy Spotify shares? Strategic Analysis Spotify 2021

Where can I buy Spotify shares?

You can buy Spotify shares through multiple investment platforms. For example, you can buy Spotify shares through DEGIRO if you are a long-term investor. Another option is eToro. Through that platform you can buy SPOT shares commission-free. In addition, there are other providers. It depends on your preferences what the best choice is.

Commission-free Crypto, Stocks and FOREX Trading with NAGA

Do you want to trade Bitcoin, Crypto, Stocks, and Forex? NAGA is one of the biggest all-in-one crypto brokers where you can buy crypto 100% commission-free. You can also use the AutoCopy to copy the Top Traders of NAGA. In fact, you can even become a Top Trader yourself and earn up to 10.000 dollars a month if you are really good at it. Anyway, this broker is perfect for anyone who wants to trade crypto 100% commission-free. You can set up an account for free and try it out.

Want to know more? Click for more information

To buy Spotify shares or not? Spotify Financial Analysis 2021

Source : Spotify.com

In this financial analysis of Spotify (2021), we are going to look at some financial ratios that will help us assess whether this stock has an interesting financial valuation.

At the end of this financial analysis on Spotify, I obtain a conclusion on whether or not this is an interesting stock based on current financial results.

Every week I analyze new unique stocks. Only the best stocks that can deliver high returns in the long run are published on the Happy Investors Community.

Based on this analysis, I can already reveal that Spotify is not among the selection of my best stocks.

Market Value

SPOT’s current market value is 46.5 billion. This is a relatively large company.

P/E ratio

The P/E ratio is at 0. This is because Spotify is not yet making a profit, and this is a risk.

Price/Sales

The Price/Sales ratio is 4.8. This is higher than the sector average 2.04. The expected future development is also above the sector average.

Turnover, Profit and Profit margin

Sales for the past twelve months amounted to $9.6 billion.

And the profit was -$657 million.

Y-o-Y sales growth is 15.8%. The current sector average is 0.32%

Y-o-Y earnings growth (EBIT) is N/M. The current sector average is 3.89

Gross profit margin is 25.5%. The current sector average is 50.6%

Net profit margin is -6.83%. The current industry average is 3.54

Spotify’s annual revenue growth is pretty good. It is a unique company with a strong brand name. But do we want to buy Spotify stock based on its name recognition?

Its revenue and profit margin are disappointing. Spotify is the largest within music streaming. They face serious competition. The question is whether they can ever become more profitable, or whether it will remain an endless competition. A little more on that later in the strategic analysis, but purely based on current financial results, Spotify’s performance is underwhelming.

Earnings Per Share (EPS).

EPS is -$3.80, which is not particularly favorable.

ROE, ROA & ROIC

The ROE, ROA and ROIC are at -21.27%, -2.32% and -6% respectively. These are poor results which means that SPOT is not yet achieving profitable growth with the capital invested in its business. With a growth stock, this makes sense, it just worries me that Spotify is a relatively large company with a lot of revenue. When will the tipping point come that it becomes profitable?

Shares “owned by insiders”

It is estimated that 28.30% of all shares are owned by insiders. This is a high percentage, which is usually positive because insiders are more long-term focused for future growth.

Financial Health & Risks

SPOT has a current ratio of 1.27 and quick ratio of 1.20. Although not spectacular, this is a healthy financial position at this time.

As with any stock, SPOT has risks. Some major risks include:

– No profitable growth

– Strong competition from Apple Music, Tencent and Amazon Music

– Declining demand for audio streaming (although this does not seem to be an issue)

Conclusion based on Spotify’s financial analysis

Looking purely at Spotify’s financial analysis, I get mixed feelings. On the one hand, I have an aversion to big companies that are still not making a profit. I mean, a small growth stock that achieves high annual revenue growth I can understand. But Spotify makes 9.6 billion in revenue and is still making a loss. That leaves me with the question: when will this company become profitable? (In Q1 2021 they did have a small profit). I also think the revenue and profit margin are weak, and the annual revenue growth is not special.

Purely based on the current financial results, I would not buy Spotify stock. Of course, this is too limited a conclusion, because we have not yet looked at future growth. Based on that, I can already reveal that I do not identify Spotify as an excellent investment.

Happy Investors Recommendation: Higher Return and Lower Risk? Tip: Asymmetrical Investing!

What if you could get higher stock returns while having less risk. Sounds too good to be true? It’s not if you know how to start with asymmetric investing. These are investments where the potential gain is greater than the potential loss. The only way for asymmetric investing is if you have a lot of knowledge and experience. This is for advanced professionals and is also used in the largest mutual funds with a minimum deposit of millions.

I’m not an expert in asymmetric investing, but I do know a very good party named Capitalist Exploits which I highly recommend. I’ve joined their Membership one year ago and it brings a lot of value for unique investment opportunities with commodities. I’m talking about +300% gains on Uranium, Copper, Agriculture, and 60+ buying opportunities. The Membership brought me a significant return on investment! These are true professionals. In addition, they also have a free newsletter where they share masterful tips and research on asymmetric investing with us once a week.

Want more information? read my full Capitalist Exploits Review and Experiences

To buy or not to buy Spotify shares? Strategic Analysis Spotify 2021

A financial analysis teaches us something about the current performance and valuation of the company. Of course, we also look at the past to determine whether the trend is positive or negative. But a financial analysis doesn’t tell us everything. It is important to also look at the company’s strategy. For example, the company may be working on a unique positioning that can be extremely profitable in the long run.

Below we are going to look at Spotify’s strategic analysis. Based on that, we can ask ourselves whether we want to buy Spotify stock based on its future plans.

Management

Current CEO Daniel Ek is the founder of Spotify. Co-founder Martin Lorentzon is also still employed as a director. I always find the fact that both founders are still at the helm a positive sign!

Sustainable competitive advantage

Spotify has a strong name recognition. Almost everyone in the West knows what Spotify is and what you can do on it. They are currently the largest within the audio streaming market. In my opinion, they can still improve by working on unique content. For example by connecting with international celebrities through exclusivity contracts.

I do doubt whether the competitive advantage is really sustainable. The competition is big names, including Apple. Who in turn has the advantage that the Apple Music app is automatically installed on your new iPhone. On the other hand, Spotify is the only one with 100% focus on the audio streaming market. And in doing so, the system works smoothly and customer friendly. For example, you can save playlists giving you a more personal account. This works addictively, which is beneficial for this company.

Innovation & Scalability

In terms of innovation, Spotify is focusing on new developments such as an A.I. algorithm. They are also working on new segments, with the biggest focus being on the podcast market. The podcast market is growing, and also seems to be able to give higher profit margins. And that is exactly the development this company needs to achieve sustainable profit growth!

Of course, they are also hugely scalable. The app is free to download and use. The larger the offer and the better the A.I. algorithm for personal recommendations, the more interesting it becomes to use this Social Media app.

Competition Analysis Spotify

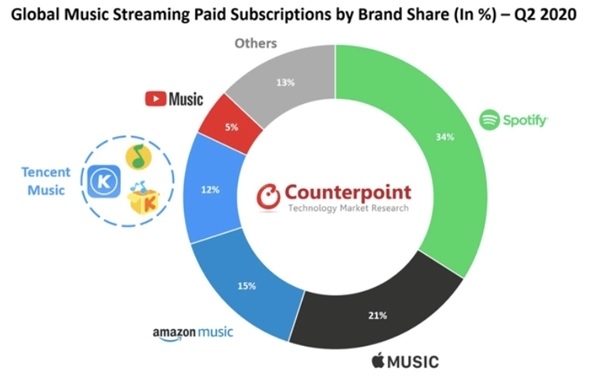

Source: Counterpoint

The above overview shows the competition at a glance. The biggest competitors are Apple Music and Amazon Music. Next comes Tencent, which is mainly active in China. These are big names, where I see Apple in particular as a formidable opponent. For example, Apple has the advantage that its app is automatically installed on iPhones. The entry barrier is thus lower, and also Apple customers are quite loyal to its services. Finally, Apple is extremely profitable, which allows them to invest huge capital in the development of this market.

A real risk in buying Spotify shares is that, because of strong competition, this company manages to secure low profit margins in the future.

Conclusion based on strategic analysis Spotify

Do we want to buy Spotify shares? From strategic analysis, Spotify is a great stock. Spotify is a unique company with a strong brand name and international reach. They specialize solely in the audio streaming market. This could be the decisive factor in the fierce competition with giants such as Apple and Amazon. And both founders are still at the helm, which is usually positive for long-term development.

Purely from a financial analysis, I would not buy Spotify shares. But looking at future developments such as the expansion into podcasts in combination with a strong strategic positioning, Spotify could be a profitable investment in the long term. It’s just that there are better investments out there right now.

Conclusion: I’m not going to buy Spotify stock. Not because it is a bad investment, but because there are better investments out there right now of unique companies with stronger future growth and more favorable financial valuation right now.

Let Money Work for You! Starting on the best investment platforms is half the battle

Are you still working hard for your money? Why don’t you consider letting the money work for you! Create passive income and attain financial freedom. Starting on the best investment platforms is half the battle. Do you want to know what the very best investment platforms are? Then click on the blue link to compare the best investment platforms now. Here you can read my independent comparison of the best online brokers for stocks, crypto, and P2P. Save money and choose the best investment platform!

![10x Best Real Estate Stocks [2022] Short Term Value Companies](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/best-real-estate-stocks-2560x1100.png)

![10 Best Stocks To Buy Now [2022] Corona To Renewable Energy](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/best-stocks-to-buy-now-2560x1100.png)