Dear Happy Investor, This article contains research on the best real estate stocks at this moment. Some real estate companies currently have attractively priced stocks. The real estate industry is currently experiencing a sharp decline in prices. A justifiable price correction, or too much fear surrounding prevailing inflation and high real estate prices?

Time will tell, but the best real estate companies offer interesting value in the short term.

On to financial independence!

Table of Contents

Disclaimer: This article does not contain personalized investment advice or buying advice. Always perform a thorough fundamental analysis to determine long-term potential. Investing has risks of money loss.

Real estate stocks vs. real estate funds

Below are the best real estate stocks. First of all, a relevant nuance. By real estate stocks we mean primarily real estate companies. Think of companies that build houses, or a real estate consulting firm. Real estate companies make money by providing services and products within the world of real estate.

This is different with real estate funds and Real Estate Investment Trust (REITs). Real estate funds invest capital in real estate to generate rental income and capital gains. Typically, the return on investment is lower with such activities. In the long run, this means that real estate funds offer lower price returns. On the other hand, it distributes a large portion of its income to its stockholders. The dividend is usually higher.

The advantage of the best real estate shares is that they have the potential to give a higher price return. Of course, the reverse is also true. Therefore, a good entry moment is more important. And this you determine on the basis of financial valuation.

10x Best real estate stocks for 2022

What are the best real estate stocks for 2022? According to the Happy Investors Method, we analyze stocks based on mathematical models (factor analysis) and fundamental research on business strategy, financial health, management, et cetera. We follow this method because we want to take less risk, but still realize potentially high returns.

After all, in our journey to financial freedom, we especially don't want to lose money.

We invest in both Growth stocks (long term) and Value stocks (6 - 24 months). Value stocks typically offer lower-risk, although that is no guarantee of success. Growth stocks offer the potentially highest returns over the long term. Sometimes even x5 or x10.

Below is an overview of the best real estate stocks based on Value. We define value on the basis of mathematical models. This is a factor analysis that looks at: financial valuation + growth + profitability + momentum + EPS revisions. For this we use paid services.

These are the best real estate stocks (USA) according to our method:

- CBRE Group (CBRE)

- Jones Lang LaSalle (JLL)

- Tri Pointe Homes (TPH)

- PotlatchDeltic Corporation (PCH)

- Taylor Morrison Home (TMHC)

- Beazer Homes USA (BZH)

- Essential Properties Realty Trust (EPRT)

- Philips Edison & Company (PECO)

- National Retail Properties (NNN)

- EPR Properties (EPR).

According to our analysis based on mathematical models, these are the best real estate stocks. It is important to note that mainly USA stocks are included in the analysis. European or Asian real estate stocks such as Unibail (URW) are therefore not included. That is not to say that there are no opportunities.

These are fine real estate stocks, but we see greater opportunities in other sectors. We invest a large part of our assets according to the Insider method. They define emerging sectors with deep Value. Read our Capitalist Exploits review for more information.

Where do I buy the best real estate stocks?

You can buy the best real estate stocks through popular brokers. The real estate companies from this article are available at DEGIRO, eToro, Freeom24 or similar alternatives. Of course, buying the best real estate stocks is done on the most inexpensive broker with a large range (assortment of stocks and ETFs). Save on transaction costs. That's your first profit and also one of the few factors we have control over.

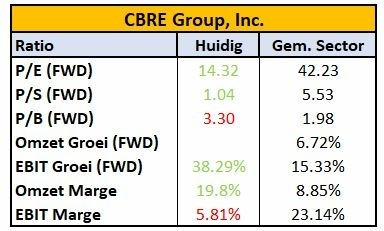

Real estate stock highlighted: CBR Group (CBRE)

CBR Group (CBRE) is among the best real estate stocks right now. It is a real estate consultancy with over 100,000 employees (!) and offices worldwide. They also offer real estate services in Europe. From advice to investing. The market capitalization is around 16 billion and the current financial valuation is favorable. The share price has recently fallen by 20%. The momentum is unfavorable. Therefore, pay close attention to the entry point. Possibly you would want to wait until a positive momentum. (Market timing is very tricky).

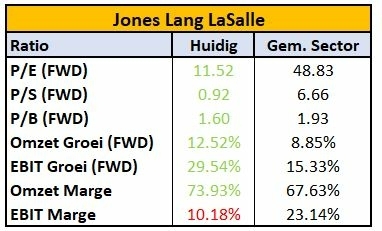

Real estate stock highlighted: Jones Lang LaSalle (JLL)

Jones Lang LaSalle (JLL) is a large real estate and investment company. They advise owners and investors in commercial real estate. For example, they also engage in Sale & Lease back. In this way, they are significantly expanding their real estate portfolio. The current market capitalization is $11 billion. JLL is currently among the best real estate stocks. It is performing excellently on multiple factors, so there appears to be Value. Moreover, its current financial valuation is on the low side.

Real estate stock highlighted: Tri Pointe Homes (TPH)

Tri Pointe Homes (TPH) is a real estate company that manufactures and installs homes. They call this a home building company. They also offer financing and insurance services. Currently, they are building new homes in 9 of the United States. In addition to TPH, there are other home building companies that have fallen sharply recently. This includes TPH, which is at -30% of its All Time High. Although the momentum is unfavorable, this best real estate stock offers serious Value.

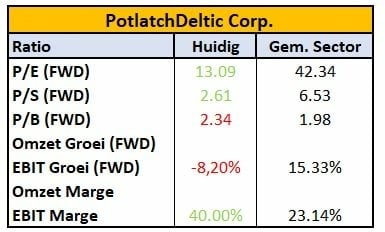

Real estate stock highlighted: PotlatchDeltic Corp. (PCH)

PotlatchDeltic Corporation (PCH) is a timber Real Estate Investment Trust (REIT). They manage forestlands to grow timber for real estate production. Consequently, we consider this company more of a commodity stock than a real estate stock. Regardless, this company can grow on both a rising real estate market and a rising timber price. However, the latter also presents a risk for long-term investors. The timber price is less controllable, and that makes it harder to assess whether PotlatchDeltic is a good investment. Despite its high score based on factor analysis, we would avoid this potentially best real estate stock.

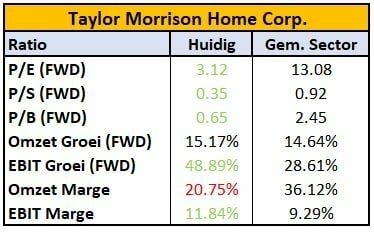

Real estate stock highlighted: Taylor Morrison Home (TMHC)

Taylor Morrison Home (TMHC), like Tri Pointe Homes, is a home building company. They produce homes on a large scale. It operates primarily within the United States. In addition, it offers financing options for home buyers. Despite its company size and revenue, its current market capitalization is only $3.2 billion. This is primarily due to its very low P/E ratio of under 5. TMHC offers unprecedented Value. Especially if the earnings forecast for next year is correct. In terms of short-term factor analysis, it definitely belongs to the best real estate stocks.

Questions or comments about these real estate companies? Let us know in the comments below!

![10x Best Real Estate Stocks [2022] Short Term Value Companies](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/best-real-estate-stocks-2560x1100.png)

![What is the best thing to invest in? Stocks to Crypto [2022]](https://media-01.imu.nl/storage/thehappyinvestors.com/4861/responsive/5849118/what-is-the-best-thing-to-invest-in-2560x1100_614_264.png)